More States Putting Parents in Charge With Education Savings Accounts

Jonathan Butcher /

Sarah Greenbank didn’t think she would be able to send her daughter, Ashlee, to anything but an Arizona public school.

She didn’t think a private school could help Ashlee’s speech delay and moderate learning needs, or that she could find affordable educational therapy outside of public school services.

“I concluded that even if I found a private Christian school that was willing to accept my daughter and I was able to cover tuition, Ashlee would be unable to continue receiving therapy because the cost would be a financial impossibility,” Greenbank said in an interview earlier this summer.

Thankfully for Ashlee, Arizona has offered families like the Greenbanks the chance to use education savings accounts to help children with special needs since 2011.

And earlier this year, lawmakers expanded the accounts to give every child enrolled in a public school the chance to apply for an account by the 2020-2021 school year.

With an account, the state deposits a portion of a child’s funds from the state funding formula into a private bank account that parents use to buy educational products and services for their children.

Parents remove their child from a district school and can hire personal tutors for their student, find classes online, and pay private school tuition and educational therapists, to name a few possible uses—simultaneously, if they choose.

In most states that offer the accounts, families can even save money left in a child’s account from year to year.

Greenbank uses an account for Ashlee and says, “We have been completely satisfied with our experience thus far.” Ashlee receives one-on-one services in a school Greenbank chose specifically based on Ashlee’s needs.

Today, Ashlee’s two siblings are also using an account.

“It is hard to remember what it was like before the [education savings account] program helped us create a place where Ashlee could thrive,” Greenbank says.

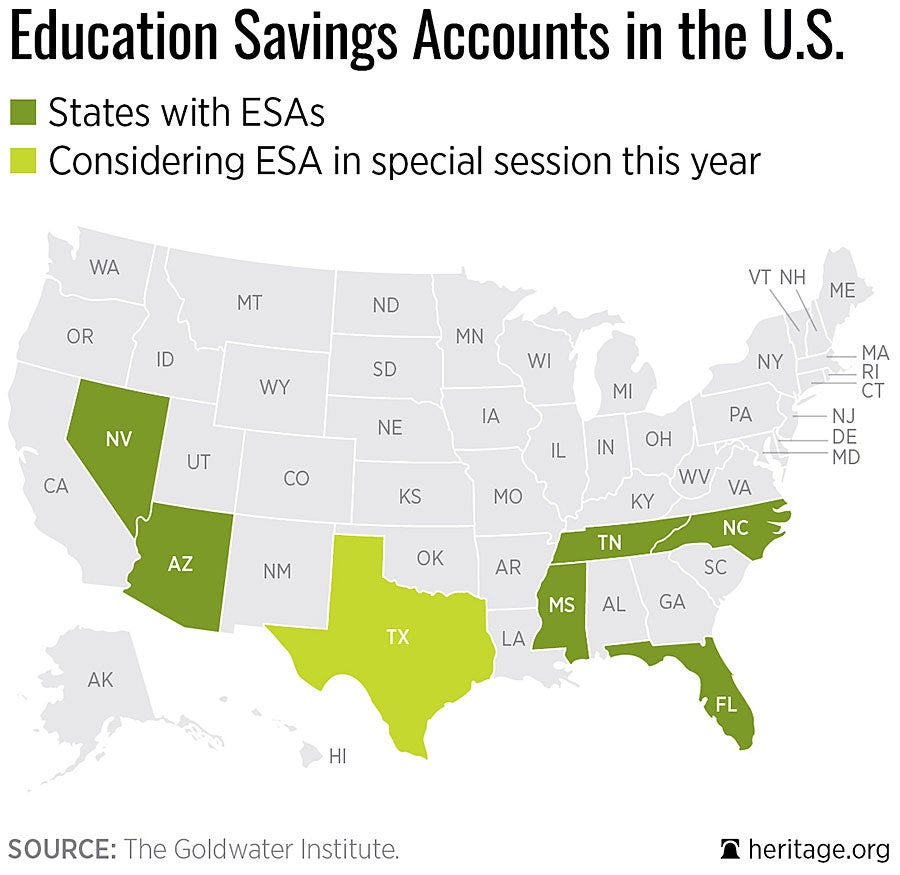

As of this writing, lawmakers in six states have enacted education savings accounts: Arizona, Florida, Mississippi, Tennessee, Nevada, and North Carolina. In 2017, Arizona and Florida lawmakers expanded their accounts to more students, while North Carolina created a new program.

- Arizona

In 2017-2018, children in grades K-1, 6, and 9 can apply; in 2018-2019, students in grades K-2, 6-7, and 9-10 will be eligible; in 2019-2020, students in K-3, 6-8, 9-11 can apply; and all 1.1 million students are eligible in 2020-2021 though the program is capped at 5,500 new applicants each year.

Arizona Gov. Doug Ducey signed SB 1431 in April, which expands student eligibility for the nation’s oldest education savings accounts by three grade levels each year until 2020-2021, when all public school students will be eligible to apply.

- Florida

Lawmakers also appropriated more than $103 million for scholarships, which will allow approximately 10,000 children to use a Gardiner Scholarship next year. Currently, 7,600 Florida students are using these scholarships.

Florida’s accounts (called “Gardiner Scholarships”) have been available to children with severe special needs since 2014. This year, lawmakers gave access to more children with such diagnoses, such as those who are deaf or visually impaired.

- North Carolina

The size of each award may vary, but analysts expect room for approximately 300 accounts in the 2018-2019 school year.

In the 2017 budget, state lawmakers created a new account program for children meeting specific criteria, including students with special needs, children in military families, and children in foster care.

As for Greenbank and her daughter Ashlee, Greenbank says, “The inability for her to find her ‘place’ in the public school system … prompted my search for a school choice option that would work for us.”

Every child should have such an option and the chance at a quality education and the American dream. And with these accounts, parents can customize their child’s education to give them opportunities to succeed.