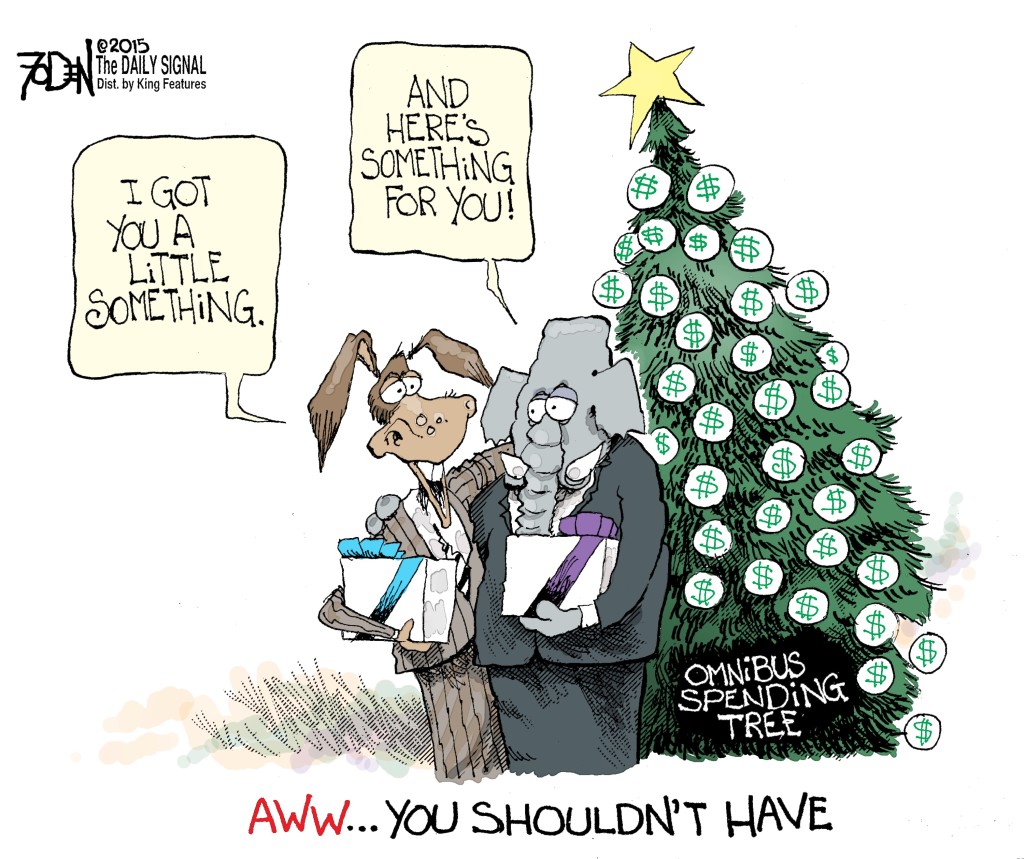

Cartoon: An Omnibus Chistmas

Glenn Foden /

Several Heritage Foundation researchers gave their reaction to the spending bill that was announced this week:

Early Wednesday morning, the House Rules Committee posted text for the Consolidated Appropriations Act of the 2016 fiscal year (FY). This $1.1 trillion spending package, known as the omnibus, shows Washington at its worst.

Lawmakers are being asked to sign off on 2,200 pages (with an additional 1,000 pages of explanatory materials), at the 11th hour, without having had sufficient time to analyze its contents.

The House plans to begin consideration of the bill on Friday morning, with final votes expected to come Friday afternoon before the House leaves town until Jan. 5. Exact timing of when the Senate will vote on the bill is unclear, but lawmakers are expected to wrap up consideration quickly and begin their vacation, perhaps as early as Friday night. In the meantime, another short-term continuing resolution will be necessary to avoid a government shutdown at midnight.

The omnibus spending package, along with the tax extenders package, is full of provisions that were negotiated behind closed doors.

Heritage experts have combed through the bill’s numerous provisions and have provided their analysis on several key issues below:

- Higher Spending

- War Account as Slush Fund

- Even Higher Spending With Gimmicks

- Sanctuary Cities Spared

- No Additional Assurances on Vetting Refugees

- Risk Corridor Bailouts Avoided

- Planned Parenthood Affiliates Still Funded

- Failure to Protect Conscience Rights

- More Bad Than Good on Energy Provisions

- Failure on WOTUS (EPA Water Rule)

- Funding Barred for Unrelated Dietary Guidelines

- Repeals Mandatory Country of Origin Labeling

- Small Steps on School Lunch Funding

- Congress Is at It Again With Tax Extenders

- Obamacare’s Taxes

Once again, Congress has missed a critical opportunity to abide by the Budget Control Act spending caps and will not rein in wasteful and excessive spending.

Base spending for the omnibus comes in at $1.066 trillion, the level agreed upon in the Bipartisan Budget Act of 2015. The defense and non-defense subcategories are at the agreed upon levels as well.

Overall, FY2016 base discretionary spending in the omnibus is $50 billion higher than the original Budget Control Act of 2011 (BCA) levels.

The Bipartisan Budget Act set a maximum amount of discretionary spending, not a spending goal that had to be obtained. Since its enactment in 2011, the Budget Control Act caps set by the law have been exceeded each year.

With the Bipartisan Budget Act’s revised FY2017 spending level already set to bust the caps and be above the FY2018 cap, unless Congress starts making the tough spending decisions and abiding by the Budget Control Act, we are poised to continue this trend in the future.

Funding for Overseas Contingency Operations (OCO) is also at the $73.7 billion level agreed upon in the Bipartisan Budget Act, with defense receiving $58.8 billion and non-defense receiving $14.9 billion in FY 2016. The Bipartisan Budget Act increased Overseas Contingency Operations funding by $16 billion for each of the next two years.

The $8 billion designated for non-defense is likely to be used to cover base budget needs of the State Department rather than for continuing war efforts, once again using Overseas Contingency Operations money as a slush fund to increase non-defense discretionary spending up to the president’s requested level while defense remains underfunded.

Even Higher Spending With Gimmicks

On top of the base discretionary funding and Overseas Contingency Operations funding agreed upon in the Bipartisan Budget Act, the omnibus also includes other above-the-cap spending for purposes such as disaster and emergency declarations and program integrity initiatives.

The bill includes $7.1 billion in disaster spending, which funds responses to presidential declarations for natural disasters such as hurricanes, tornadoes, and wildfires, among other purposes.

The omnibus also provides $1.5 billion for program integrity initiatives that aim to combat Medicaid waste, fraud, and abuse. An additional $698 million is also appropriated to the Department of the Interior for emergency declarations. While some of these may be worthwhile and necessary purposes, these expenses (which recur almost every year) should be accounted for in the base budget. Funds in excess of the discretionary cap should be appropriated only when a true emergency or unforeseen disaster occurs. They should not be used as another gimmick to circumvent the spending caps.

The omnibus also relies on Changes in Mandatory Programs (CHIMPs) to bust through the (already inflated) spending caps. These are changes to mandatory spending and entitlements that affect current-year budget authority and are treated as changes in discretionary spending for the purpose of scoring appropriations bills.

Sometimes these are real savings and may be used as an acceptable offset, but most of the time they are simply a way to increase discretionary spending in the current year with no real savings ever being realized.

The FY2016 Conference Budget Resolution took a first step in reining in CHIMPs spending by limiting the total amount that could be used as an offset over the each of the next four years. However, the agreement still allows for over $19 billion in additional spending this fiscal year. This is purely additional discretionary spending over the agreed upon budget caps. Moving forward, the use of CHIMPs should be eliminated completely.

—Justin Bogie, senior policy analyst, Roe Institute for Economic Policy Studies

The omnibus does not restrict Department of Homeland Security or Department of Justice grants to cities that resist the enforcement of federal immigration law, also known as sanctuary cities. Federalism gives local governments some latitude in choosing to oppose or not assist the federal government in enforcing immigration law, but the federal government does not have to reward or pay for the results of such policies.

No Additional Assurances on Vetting Refugees

The omnibus also does not request additional assurances, intelligence assessments, or risk-based plans for the refugee process. If Congress is genuinely concerned about the vetting of refugees, then it should have requested additional information with which to oversee such vetting programs.

Similarly, while the bill makes small improvements to the Visa Waiver Program (VWP), it also adds largely unhelpful and even counterproductive restrictions to the program by denying Visa Waiver Program to individuals who have travelled to Iraq, Syria, or other countries. Importantly, it also does not expand the program in order to reap additional security benefits.

—David Inserra, policy analyst for homeland security and cybersecurity, Allison Center for Foreign and National Security Policy

Risk Corridor Bailouts Avoided

The bill also continues a provision to prohibit the Center for Medicare and Medicaid Program Management funds from being used to make payments under Obamacare’s risk corridor program. This will prohibit the administration from using undedicated funds to bail out unprofitable qualified health insurance plans in the individual and small group markets.

Planned Parenthood Affiliates Still Funded

The trillion-dollar budget deal would continue to allow hundreds of millions of dollars in taxpayer funds, from both discretionary funding under Title X and from Medicaid reimbursements, to flow to Planned Parenthood Federation of America affiliates—despite recent disturbing videos showing Planned Parenthood officials haggling over the price of body parts of aborted babies.

No federal funds should be going to Planned Parenthood Federation of America or any of its affiliates or health centers. Disqualifying Planned Parenthood affiliates from receiving Title X family planning grants, Medicaid reimbursements, and other federal grants and contracts should not reduce the overall funding for women’s health care. The funds currently flowing to Planned Parenthood affiliates should be redirected to health centers that offer comprehensive health care without entanglement in abortion on demand. Members of Congress had the opportunity with the year-end funding bill to end both mandatory and discretionary federal funding of Planned Parenthood and end taxpayer entanglement with the largest abortion provider in the country, but they failed to do so.

Failure to Protect Conscience Rights

While long-standing pro-life riders are included in the omnibus, a much-needed policy to address serious conscience violations is missing from the spending bill.

In August 2014, the Department of Managed Health Care in California mandated that almost every health plan in the state include coverage of elective abortions, including those plans offered by religious organizations, religious schools, and even churches. The Weldon Amendment prohibits federal, state, and local governments that receive certain federal funds from discriminating against health care entities, including health care plans, that do not “provide, pay for, provide coverage of or refer for abortions.” While that policy has been included in appropriations bills since 2004 (including the current omnibus), enforcement of the conscience policy is left to the discretion of officials in the Department of Health and Human Services, which has a poor track record of moving quickly (if at all) on complaints. The Obama administration has so far effectively ignored requests to HHS for help obtaining relief from California’s mandate.

In response to this urgent problem, Congress should provide victims of discrimination the ability to defend their freedom of conscience in court, not leave them to wait on bureaucrats in the Obama administration. The Abortion Non-Discrimination Act would do just that. The act is currently part of the Health Care Conscience Rights Act, H.R. 940, a bill that would address other conscience issues in Obamacare.

—Sarah Torre, policy analyst, DeVos Center for Religion and Civil Society

More Bad Than Good on Energy Provisions

If you were to put a jelly bean for each energy provision on a two-sided scale, one side being good free-market provisions and the other being corrupt energy provisions, the bad side of the scale would be hitting the floor.

The good provision is a very good provision, indeed. Lifting the crude oil export ban would generate more jobs for Americans, supply the United States and the world with more affordable energy, and provide important geopolitical benefits for Washington and its allies.

But the numerous bad provisions waste taxpayer money and provide targeted tax credits to politically connected companies. They include:

- A five-year extension of the wind production tax credit (PTC). The wind PTC, which has been around since 1982, artificially propped up an industry, advanced special interests, and allocated labor and capital away from more competitive uses in the marketplace.

- A five-year extension of the solar investment tax credit (ITC), which companies can now take when they begin construction rather than when they start producing power. Solar companies would be better off in the long run without the ITC. They would understand their true price point to be competitive in the short and long run.

- A ramp up in Department of Energy spending for renewables, energy efficiency provisions, fossil fuels, and nuclear. The Department of Energy has ballooned by subsidizing and forcing energy technologies into the marketplace. The private sector has demonstrated countless times that it is far better equipped than government to allocate resources and develop commercially viable technologies.

- A handout for the oil industry. The legislation would provide a targeted tax credit for small, independent refiners and allow independents to exempt 75 percent of transportation costs when calculating their Section 199 manufacturing deductions. This is nothing more than obvious compensation for lifting the ban on crude oil exports. Further, the energy tax provisions in the omnibus speak to the need for the federal government to stop using the tax code to pick winners and losers for all energy sources and technologies.

- A three-year extension of the Land and Water Conservation Fund. The massive amount of land owned and managed by the U.S. government has resulted in land mismanagement, stifled opportunities for recreation and resource production, and poor environmental stewardship. Reauthorizing the LWCF is a recipe for prolonging mediocre and often poor federal control of America’s land. Permanently eliminating the LWCF is recognition that improved economic growth and environmental quality are born not out of Washington, but in the states.

Absent from the text are provisions that would block the Obama administration’s climate change regulations, regulations that will drive up energy costs no climate benefit. Instead, the federal government has hundreds of millions of dollars to dole out internationally through the Climate Investment Fund and Strategic Climate Fund. Notably missing from the omnibus spending bill is a provision prohibiting spending on the Green Climate Fund.

This is no compromise, but instead a large extension of government intrusion in energy markets where it does not need to be.

—Nick Loris, Herbert and Joyce Morgan fellow, Roe Institute for Economic Policy Studies

Failure on WOTUS (EPA Water Rule)

The omnibus bill fails to prohibit funding for the Environmental Protection Agency’s and Army Corps’ controversial “waters of the United States” rule, which would greatly expand the types of waters that could be covered under the Clean Water Act, from certain man-made ditches to so-called waters that are actually dry land most of the time.

In addition to this rule being an attack on both property rights and the states’ role in protecting the environment, the Government Accountability Office (GAO) just ruled that the EPA broke the law in developing it.

The policy problems and the agency overreach should have been more than enough to block funding for the rule. Both the House and the Senate have already passed different bills that would repeal the rule (the same bill still needs to be passed by both chambers). Attorneys general and agencies from at least 31 states are suing the federal government regarding the rule. Even environmental groups are suing.

If it somehow wasn’t a no-brainer to block funding for the water rule before, then it certainly should have been after the GAO’s opinion. The GAO found that the EPA violated the law when developing the rule by trying to inappropriately gin up support for the rule through improper lobbying activities and covert propaganda. Their illegal actions, according to GAO, were focused not just on the regulatory process, but also on encouraging opposition to legislation that would have blocked efforts to undermine the rule. The legislative process itself, and the work of many members of Congress, was itself being undermined by EPA’s actions. Yet Congress still allowed the rule to go forward. If Congress won’t use the power of the purse to block this rule, when will it ever use the power of the purse to block any rule?

Funding Barred for Unrelated Dietary Guidelines

Every five years, the Department of Agriculture and the Department of Health and Human Services issue dietary guidelines to advise the public on healthy eating. The Dietary Guidelines Advisory Committee (DGAC) submitted its scientific report, which helps to inform the final guidelines, in February. Throughout the Dietary Guidelines Advisory Committee process, there has been a focus on non-dietary issues such as sustainability, climate change, and other environmental factors.

The omnibus bill does prohibit funding for guidelines that are not limited to nutritional and dietary information (Division A, Sec. 734). It would also direct the Secretary of Agriculture to work with the National Academy of Medicine to study the Dietary Guidelines process (Division A, Sec. 735). The problem, though, is that any new Dietary Guidelines, even if claimed to be based on nutritional and dietary factors alone, will have no legitimacy, because the process was dominated by environmental concerns, not dietary concerns.

Repeals Mandatory Country of Origin Labeling

The mandatory country of origin labeling (COOL) requirements for certain meat products has been the subject of significant controversy. Both Canada and Mexico have correctly alleged that COOL has a discriminatory effect on their livestock exports to the United States, violating trade obligations. COOL is merely a non-tariff trade barrier, having nothing to do with health or safety, which is supposed to provide consumers information.

Yet the government doesn’t need to impose such a requirement if consumers value such information; the market will respond accordingly. As it turns out, consumers don’t value this information. The World Trade Organization (WTO) has repeatedly agreed with Canada and Mexico. After just receiving WTO authorization, Canada and Mexico are about to impose over a billion dollars in retaliatory tariffs on the United States. The omnibus bill would repeal COOL before this costly retaliation is imposed on a wide range of industries (Division A, Sec. 759).

—Daren Bakst, research fellow in agricultural policy, Roe Institute for Economic Policy Studies

Small Steps on School Lunch Funding

The omnibus continues funding for the USDA’s new school lunch standards, which were implemented as part of the Healthy and Hunger Free Kids Act of 2010.

However, these standards have been burdensome to schools and should not be funded. For example, a January 2014 report by the GAO shows that since the implementation of the new standards, participation in the school lunch program has declined, there has been an increase in food waste among students, and some schools have dropped out of the program at least partially due to the new standards.

The new standards have also imposed greater costs on schools, such that some have even have had to draw from their education funds to cover them.

The omnibus takes small steps in the right direction by 1) allowing states to exempt schools from the whole grain requirement if a state can “demonstrate hardship, including financial hardship, in procuring specific whole grain products which are acceptable to the students and compliant with the whole grain-rich requirements,” and by 2) prohibiting funds to go toward rules that would require a reduction in sodium in school meals until scientific research can establish that such a decrease is beneficial to children.

The decision of what children eat is best left to parents, not bureaucrats in Washington. Congress should prohibit any funding from going toward these costly and heavy-handed standards.

—Rachel Sheffield, policy analyst, DeVos Center for Religion and Civil Society; and Daren Bakst, research fellow in agricultural policy, Roe Institute for Economic Policy Studies

Congress Is at It Again With Tax Extenders

The tax extenders are a yearly exercise that Congress is long overdue to end. Lawmakers should go through the various policies in the package, extend those that are sound policy, and eliminate those that are not, all in a revenue-neutral manner. Once again, Congress did not follow this sensible approach.

To its credit, Congress made several policies permanent. Importantly, it made the Research and Development Credit, section 179 expensing for small businesses, and the exemption from subpart F income of active financing income permanent. These are all necessary policies, given the dilapidated state of the tax system. It will be a relief in future years that they are no longer set to expire.

The price of these permanent extensions was steep. Congress also made permanent the stimulus’ expansions of the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Credit. These permanent expansions increase spending by nearly $160 billion over the next 10 years. Congress should have offset this spending with spending cuts in other areas.

The bill also extends bonus depreciation, better called 50 percent expensing, for five years. It would have been better had Congress made it permanent, too, but a five-year extension is better than a two-year continuance.

Disappointingly, Congress also included a five-year extension of other policies that are not sound, including the New Markets Tax Credit and the Work Opportunity Credit. These policies are examples of Congress using the tax code to pick winners and losers. They should have been among the first extenders to be permanently excised instead of receiving an expanded extension.

The rest of the extenders get the at-this-point standard two-year extension. Since the extenders were expired for 2015, the two-year bill extends them retroactively for 2015 and through 2016. Congress will be back at this game either in the lame duck session at the end of 2016 or sometime in 2017.

A two-year moratorium on Obamacare’s medical device tax, for 2016 and 2017, is also included in the tax bill. It is a bad tax, but suspending it should not be confused with repealing Obamacare.

Strangely, the omnibus spending bill includes a two-year delay of the beginning of the Cadillac tax on high-cost health insurance plans from 2018 to 2020, as well as the delay of the tax on health insurers, and an extension of various alternative energy credits, including the production tax credit. The policies should not have been extended, especially since Congress did not adopt equivalent Obamacare spending cuts.

Delaying the start of the Cadillac tax was the wrong approach, especially since Congress did not adopt equivalent Obamacare spending cuts. Congress should instead use it as a pivot to capping the tax exclusion of employer-provided health insurance.

Even though it is long past time for Congress to end its practice of dealing with the extenders semiannually, it did make certain important policies permanent. That will make the extenders easier to deal with next time and lowers the revenue baseline for tax reform. These are steps in the right direction after years of standing still.

Curtis Dubay, research fellow for tax and economic policy, Roe Institute for Economic Policy Studies