5 Charts to Explain the 2016 IRS Tax Brackets and Other Changes

Rachel Greszler / John Fleming /

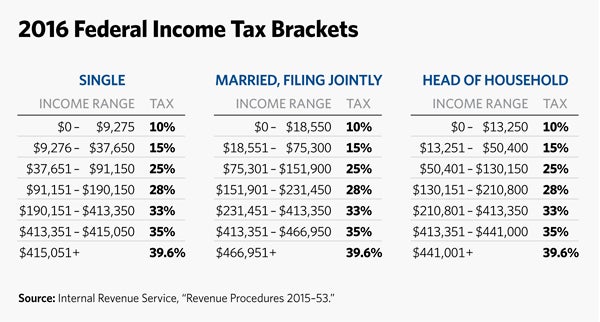

The 2016 tax brackets just announced by the Internal Revenue Service don’t include dramatic changes, largely because of low inflation last year.

The brackets will rise about 0.5 percent, the IRS said, meaning a $50 increase for single filers in the lowest tax bracket up to a $2,100 increase for married filers in the highest tax bracket.

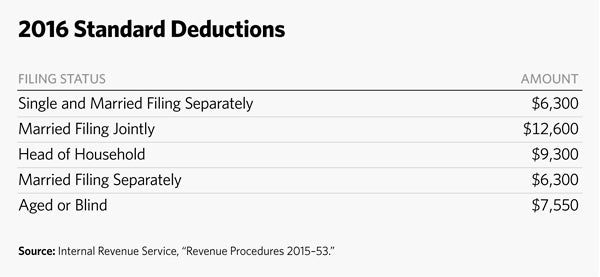

The standard deduction for 2016 income will stay the same, with the exception of filers who are heads of household. They will receive a $50 boost, to $9,300. The deduction for singles and “married filing separately” will be $6,300. The deduction for married filers will be $12,600.

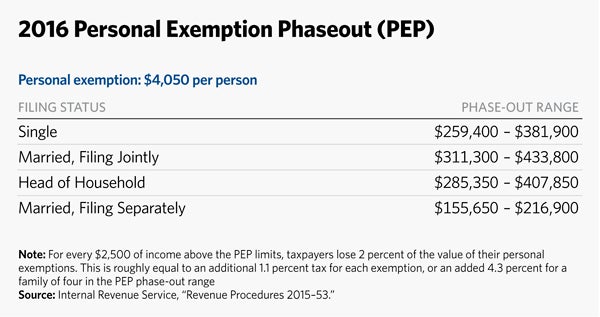

The personal exemption will rise by $50 in 2016, to $4,050. Since 2013, the personal exemption phaseout—or PEP—has reduced or eliminated personal exemptions for higher-income taxpayers.

For every $2,500 of income above the PEP limits, taxpayers lose 2 percent of the value of their personal exemptions. This is roughly equal to an additional 1.1 percent tax for each exemption, or an added 4.3 percent for a family of four subject to the phaseout.

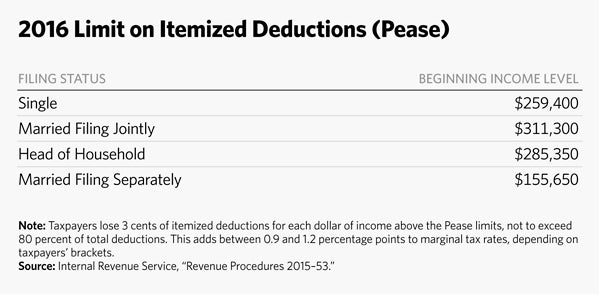

Since the IRS in 2013 reinstated the limitation on itemized deductions—or “Pease,” after the late Rep. Donald J. Pease, R-Ohio— taxpayers lose 3 cents of itemized deductions for each dollar of income above the Pease limits (beginning at the same level as PEP), not to exceed 80 percent of total deductions.

This translates into an extra 0.9 percent to 1.2 percent tax, depending on the taxpayer’s marginal bracket.

The Alternative Minimum Tax begins at income levels of $53,900 for singles and $83,800 for married couples. The initial tax rate is 26 percent and rises to 28 percent at an income level of $186,300 for both single and married taxpayers. The corresponding income levels for “married filing separately” taxpayers are $41,900 and $93,150.

The initial AMT exemption amounts—$53,900 for singles, $83,800 for married couples, and $41,900 for “married filing separately”—begin to phase out at respective income levels of $119,700, $159,700 and $79,850. The 25 percent phaseout increases the 26 percent rate to 32.5 percent and the 28 percent rate to 35 percent.

The exclusion for public transportation benefits remains unchanged at $130 per month, while the qualified parking exclusion will rise by $5 to $255.

The annual gift tax exclusion also is unchanged at $14,000 per person, while the estate tax exemption will rise from $5.43 million to $5.45 million.

As this overview—which only scratches the surface of tax law and annual changes—makes clear, the tax code remains overly complicated. This complexity makes it hard for individuals and businesses to plan, and can result in unexpected payments when taxpayers lose deductions or become subject to the AMT.

To dig deeper, consult The Heritage Foundation’s Tax Reform Primer, which explains the problems with our existing system, principles for tax reform, and four ways to achieve a fairer, simpler, and more efficient tax system.