Two More Government-Funded Co-Ops Created Under Obamacare To Close

Melissa Quinn /

Two more nonprofit insurance companies created under Obamacare announced Friday they would be closing their doors at the end of 2015, leaving more than 93,000 consumers left to find new insurance next year.

Health Republic Insurance of Oregon announced Friday afternoon it would not be offering plans to consumers either on Obamacare’s health insurance exchange or off the exchange in 2016. Colorado’s co-op, Colorado HealthOP, also said Friday that it, too, would be winding down operations.

The companies are two of the 23 original co-ops, or consumer oriented and operated plans, backed by $2.4 billion in start-up and solvency loans. Health Republic Insurance of Oregon received $60.6 million in taxpayer-backed loans, and Colorado HealthOP received $72.3 million.

The co-ops’ decisions to cease operations came just days after two others, Kentucky Health Cooperative and Tennessee Community Health Alliance, said they would be closing their doors.

In announcing their decisions not to continue offering plans to consumers next year, the four co-ops—Health Republic Insurance of Oregon, Colorado Health OP, Kentucky Health Cooperative and Tennessee Community Health Alliance—cited a recent announcement from the Obama administration regarding risk corridor payments.

The risk corridor program is intended to provide stability to the health insurance market. Insurance companies requested risk-corridor payments from the program earlier this year, but this week, the government announced it would pay insurance companies 12.6 percent of their requested amounts.

For many of the co-ops, the news that they would receive far less than expected delivered a blow to balance sheets.

>>> Why 6 Government-Funded Insurance Companies Created Under Obamacare Collapsed

“The government’s refusal to honor its risk corridor obligations represents a negative financial impact of over $20 million,” Dawn Bonder, president of Health Republic Insurance of Oregon, said in a statement. “This has placed us in a difficult financial position that could jeopardize our members and partners. As a result, we believe the most ethical step is for Health Republic to refrain from entering the market in 2016 and begin an orderly wind down of business.”

In a message to customers, Colorado HealthOP Chief Executive Officer Julia Hutchins also pointed to the risk corridor program as a significant player in the co-op’s closure and criticized the state Department of Insurance.

“The [Department of Insurance] has let local and national politics hurt Coloradans’ access to low-cost healthcare options and assessed Colorado taxpayers with significant avoidable costs,” she said.

Over the last 10 months, CoOportunity Health in Iowa, Louisiana Health Cooperative, Nevada Health Cooperative and Health Republic Insurance of New York also announced their closures.

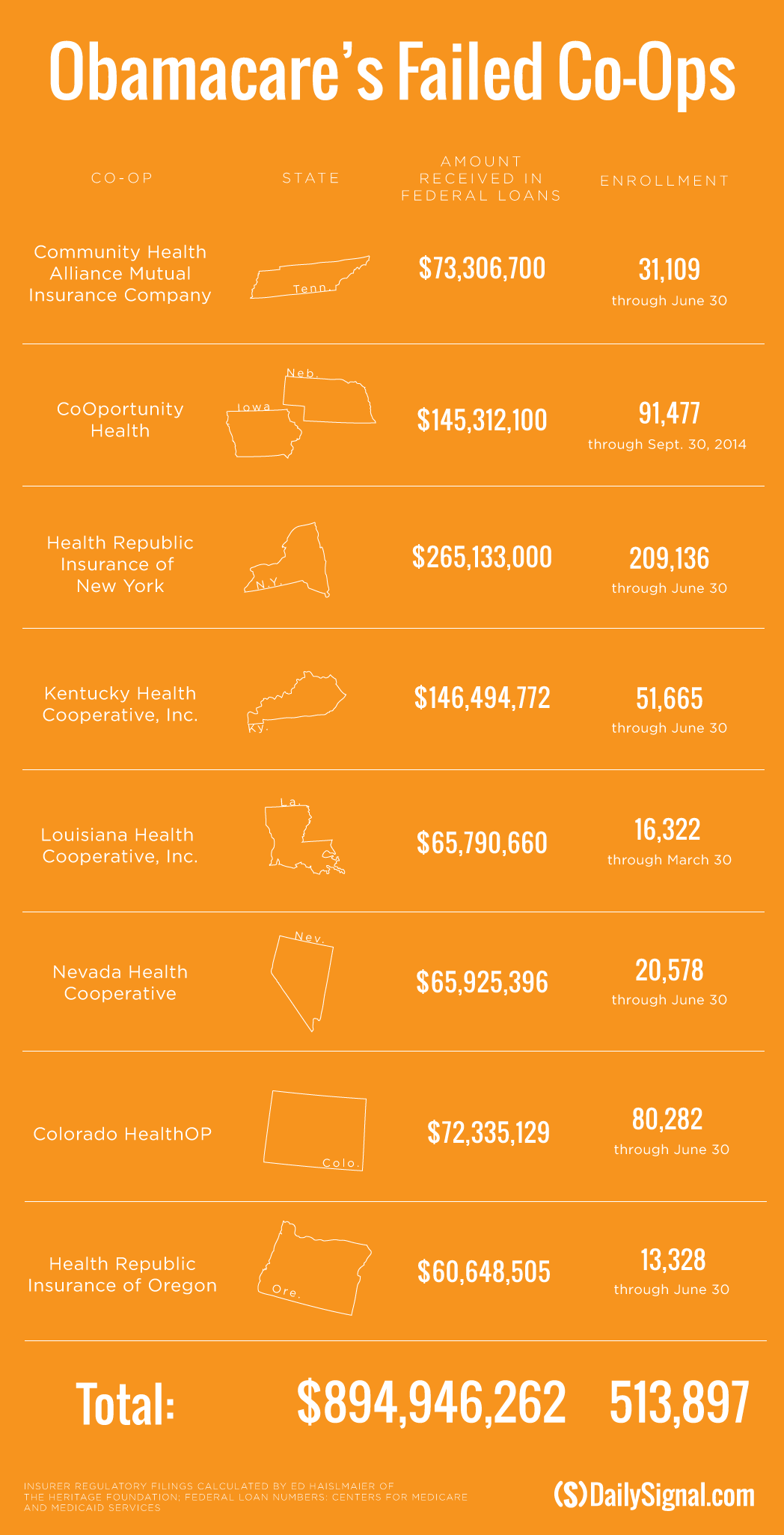

Collectively, the eight co-ops that have collapsed received $894.9 million from the government and enrolled more than 500,000 Americans.

Of the 23 co-ops that were created under Obamacare, just 15 remain.

The co-ops, or consumer oriented and operated plans, were designed to foster competition in markets where few insurance companies provided coverage. To assist the co-ops in launching and meeting state solvency requirements, the Centers for Medicare and Medicaid Services disbursed $2.4 billion in start-up and solvency loans.

An analysis conducted by The Daily Signal in February, as well as an audit of the co-ops conducted by the Department of Health and Human Services Inspector General in July, found that in 2014, 22 of the 23 co-ops lost money.

Additionally, 13 of the 23 co-ops enrolled fewer consumers than they projected.

As a result, the Centers for Medicare and Medicaid Services placed four co-ops on enhanced oversight. Two more received warnings for low enrollment.