How This Small Business Succeeded Without Government Financing From Export-Import Bank

Melissa Quinn /

Supporters of the embattled Export-Import Bank argue the bank helps small businesses move into global markets and remain competitive. But a California-based company is speaking out about how the agency provided its competitors with an unfair advantage.

“The winners should prevail by playing the game better than others, not by forcing taxpayers to give them an advantage,” Garett Churchill, owner of Fluxeon Inc., told The Daily Signal. “The winners should be judged by the success they have, and that’s not achieved on the backs of his fellow countrymen.”

Fluxeon, which employs just two people, sells induction heaters and supplies to businesses and individuals across the United States and internationally. The company maintains an online store and ships to countries, including Spain, Great Britain, Australia and Mexico.

Fluxeon sells induction heaters like the Roy 1500, which is designed to heat metals without contact. (Photo: Fluxeon)

Fluxeon’s competitors include companies like Induction Innovations, which was the beneficiary of Ex-Im insurance policies but later ended its relationship with the bank.

“The winners should prevail by playing the game better than others, not by forcing taxpayers to give them an advantage,” said Garett Churchill, owner of Fluxeon.

Despite Ex-Im’s push to work with small businesses, Fluxeon hasn’t received any financing through from the bank, and Churchill—who called its benefits “questionable”—believes the bank offers little to businesses that actually need it.

“Similar to the Small Business Administration, they seem to exist to help businesses with financing who don’t need help,” Churchill said. “In other words, you still have to put yourself in jeopardy with personal collateral. What’s the point of a government entity that’s supposed to help you, but asks in return that you risk your life?”

>>> The Debate Over the Export-Import Bank, Explained in 90 Seconds

Churchill contended that while it’s possible Ex-Im can help businesses break into international markets, it eliminates true small businesses as potential customers.

“Unless the company is big enough to afford costly legal services needed to ensure the deal is properly penned and followed faithfully, that competitor stands to lose a lot,” Churchill said. “But the main point is no small business like ours can truly afford that, and by ‘small,’ most of us are thinking something in the 10 employee range, not the 500 that the government uses.”

>>> Hillary Clinton Announces Support for Export-Import Bank Reauthorization

Fluxeon has done business overseas, and though they have passed on opportunities to secure financing from Ex-Im, Churchill said that it’s relatively simple for small businesses to do international business with no financial risk.

That includes only accepting prepaid orders and securing private financing for large orders. Ex-Im opponents often argue businesses can obtain the same financing the bank offers through the private sector.

The Small Business Argument

Many Ex-Im supporters tout the benefits Ex-Im provides to small businesses. Additionally, the bank’s backers say that getting rid of the bank will hurt companies benefiting from its financing, including Ex-Im’s top three beneficiaries: Boeing, General Electric and Caterpillar.

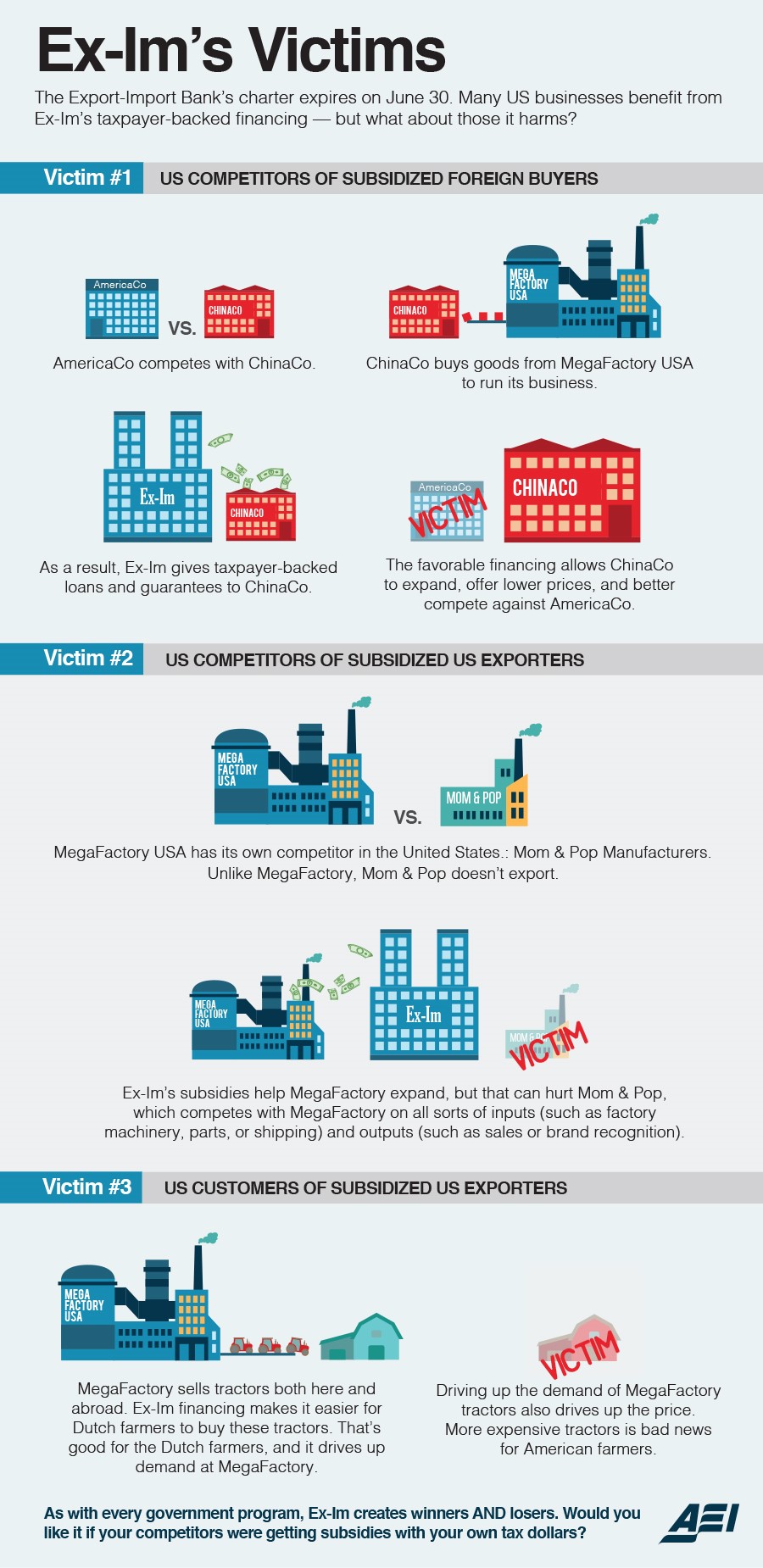

Despite the help Ex-Im financing provides to businesses, Tim Carney, a columnist at the Washington Examiner and visiting fellow at the American Enterprise Institute, pointed out that while beneficiaries are “easy to spot … Ex-Im’s victims, while just as real, are harder to spot.”

In addition to Carney, Ex-Im’s opponents argue the bank creates an uneven playing field for its beneficiaries, which often receive financing with better terms and at lower rates than others do in the private sector.

“One of the two firms is basically getting an edge in terms of financing costs from the federal government and getting a significant advantage over another firm that competes with it,” Veronique de Rugy, senior fellow at George Mason University’s Mercatus Center, told The Daily Signal. “By getting special terms and financing, it creates a very unlevel playing field.”

De Rugy also noted that the government shouldn’t be in the business of providing capital to firms, should they fail to secure financing in the private sector.

“We shouldn’t make a mistake and assume that some firms are turned down and mistake it for a bug,” she said. “It’s a feature of the capital market.”

According to a Mercatus Center report authored by de Rugy, California received just 8.8 percent of Ex-Im’s disbursements, and 1.9 percent of the state’s exports are backed by the bank.

Overall, Ex-Im supports just 2 percent of exports.

“For every small business in California that receives export subsidies there are nearly 700 small business exporters doing without,” Dan Holler, spokesman for Heritage Action for America, told The Daily Signal. “This is just another example of the bank picking winners and losers.”

Bank opponents point to such statistics as a reason the agency shouldn’t be reauthorized, as the agency supports few exports. Additionally, the bank’s larger beneficiaries—GE, Boeing and Caterpillar—can secure financing through their own financing arms.

“It’s just a doubling down on the unlevel playing field,” de Rugy said.