The Top 1 Percent Pay 35 Percent of Federal Income Taxes

Michael Sargent /

The answer given by many on the left when faced with the problem du jour—deficits, inequality, etc.—is simply to raise taxes on the rich. But while “the rich don’t pay their fair share,” is an enticing narrative, it is false.

Actually looking at our federal income tax system, it’s apparent that the income tax is highly progressive: The rich already pay a greater share of the income taxes than their share of income.

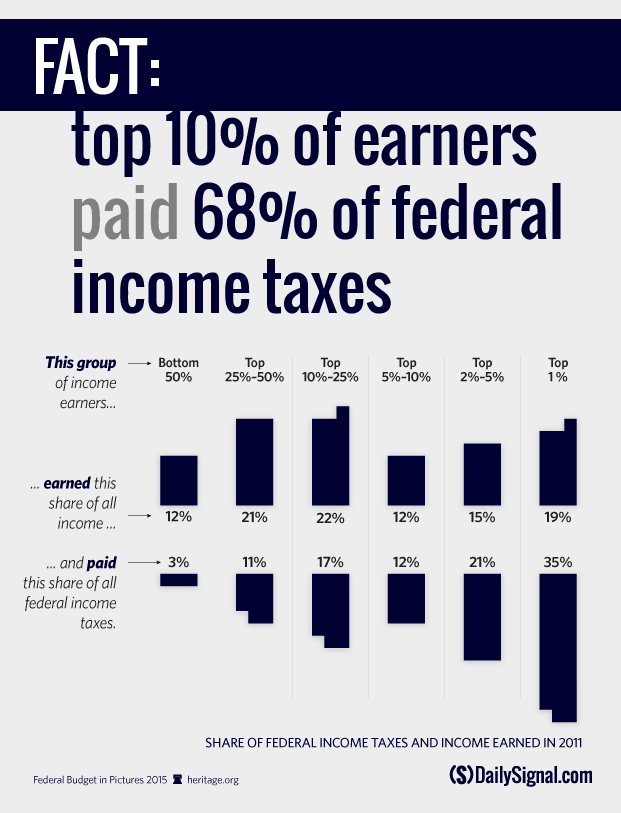

Heritage’s new report, the 2015 Federal Budget in Pictures, takes a look at who paid the most income taxes in 2011, the latest year available. The data shows that despite the rhetoric, the top 10 percent of income earners paid 68 percent of all federal income taxes while they took home 45 percent of all income.

And even though President Obama has called for a higher tax rate on high earners, the much-demonized 1 percent paid 35 percent of income taxes in comparison to earning 19 percent of the income.

And it’s not just the income tax: Other data shows that the top 20 percent of earners, on average, are the only Americans to pay net taxes when government transfers are included. So it’s correct that the rich don’t pay their fair share of income taxes: they pay more.

For more information on how federal taxes affect Americans, see the “Reduce the Tax Burden” section of Heritage’s 2015 Federal Budget in Pictures