Is It True That Low Gas Prices Hurt the Economy?

Kelsey Bolar /

Low prices at the pump are good for consumers, but are they hurting the American economy?

Though oil prices fell below $50 per barrel as of Monday, Jack Gerard, CEO of the American Petroleum Institute, the largest U.S. lobbying arm for the oil and natural gas industry, expressed little concern.

Speaking at the annual “State of American Energy” event yesterday in Washington, D.C., Gerard said, “While there may be volatility in the short term … longer-term we [the oil industry] contribute stability to the price and to the global marketplace.”

Some experts say low gas prices hurt the economy, as seen through tumbling stock markets, which had their worst start to a year since 2008.

What’s going on with gas?

The price decline in oil is partly because of lower demand. “Decreased demand can spook investors because it signals less economic activity,” said Nick Loris, The Heritage Foundation’s expert in energy policy.

The drop in oil prices is causing production companies to scale back on investment — earning less profit.

>>> Commentary: Even If OPEC Decided to Cut Oil Production, It Wouldn’t Be a Huge Deal. Here’s Why.

Some analysts argue that in the current economic landscape — in a sudden era of low oil prices — the nation should be wary of embarking on new projects such as the Keystone XL pipeline.

In an interview with CNBC, Moody’s Analytics energy economist Chris Lafakis said the project is not feasible with current prices below $50 per barrel.

“In order for new drilling projects to be capitalized and economical, the price of oil would need to be around $85 to $90,” he said. Federal analysts and other left-leaning economics have echoed Lafakis’ sentiment.

But Gerard had a different take.

Drill, baby drill

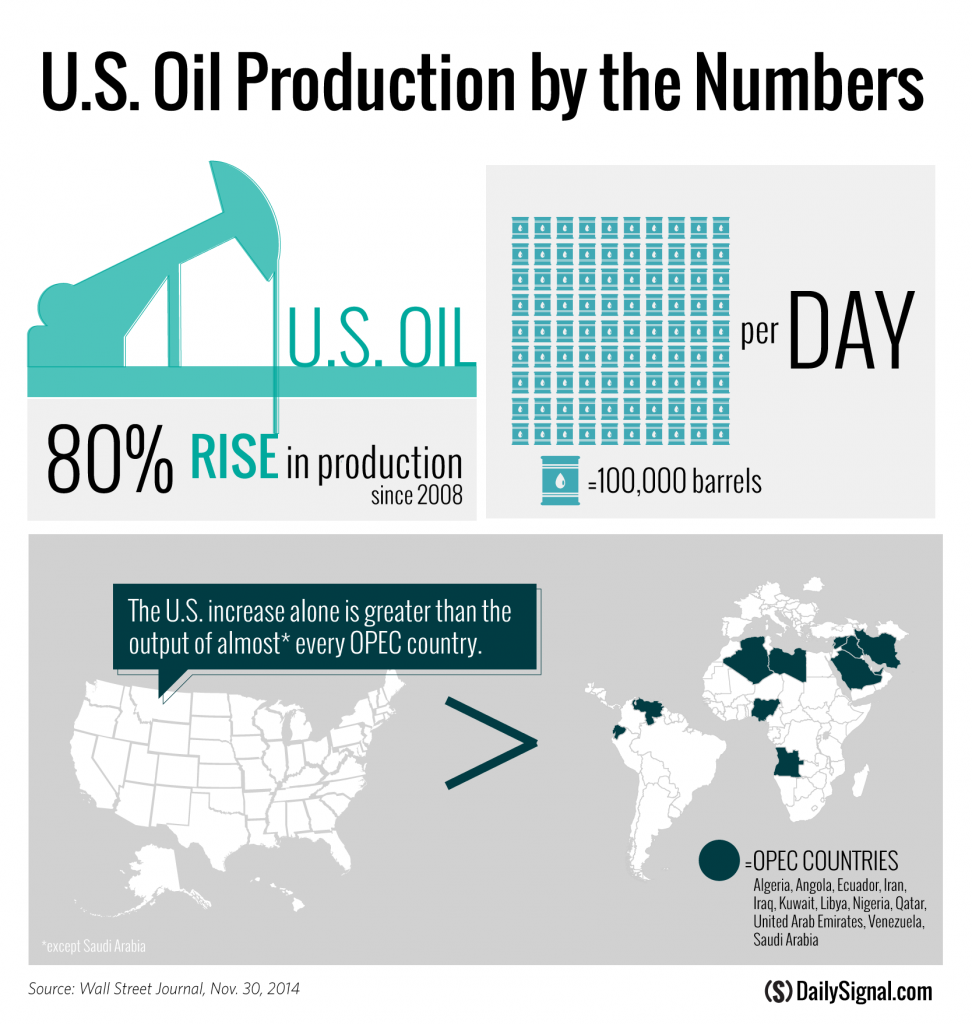

He said one of the main reasons consumers have benefitted from low gas prices is because of the additional “three to four million barrels of oil” American producers have put into the marketplace. Without that production, he predicted the price of crude oil globally would likely be more than $150 per barrel.

Gerard said:

The more supply brought to the global marketplace continues to put downward pressure on the price of crude oil. … If you want to benefit the American consumer in the form of lower gasoline prices, the more supply you put into that marketplace, the better off you’ll be.

So Gerard hopes the Keystone XL pipeline will move forward in Congress this year, despite the White House’s announcement that President Obama would veto the current bill, which is supported by more than 60 U.S. senators.

>>> On Day One of New Congress, Obama Vows to Veto Keystone XL Pipeline

The price is right?

Gerard wouldn’t identify a sweet spot for gas prices that could appease both the markets and consumers.

When asked by a reporter whether there exists a price point where the pipeline is no longer economically feasible, he said, “I can’t predict what the price would be.”

Ultimately, “the markets should make that decision—not government,” Gerard said.

He said one thing is clear: Building the Keystone Pipeline would have implications that reverberate on a “global scale.”

Embarking on the project would “indicate to friend and foe alike around the world that we are going to be a dominant energy player around the world particularly in the oil and gas space,” Gerard said.

And that, he believes, will bring more stability to consumers, investors and national security.

“We are becoming the No. 1 producer. We are taking our future under our own control, under our own initiative.”