Average Federal Spending Per Household Nearly $30K

Spencer Woody /

Did you know that the National Institutes of Health spent $374,000 to find out if a puppet show would convince preschoolers to eat more vegetables? Or that the Department of Agriculture gave $50,000 to a business that packs and sells alpaca manure?

Your tax dollars paid for it–and much more. In 2014, federal spending per household was $28,826.

Here are some more key facts from “Federal Spending by the Numbers 2014,” a new Heritage report.

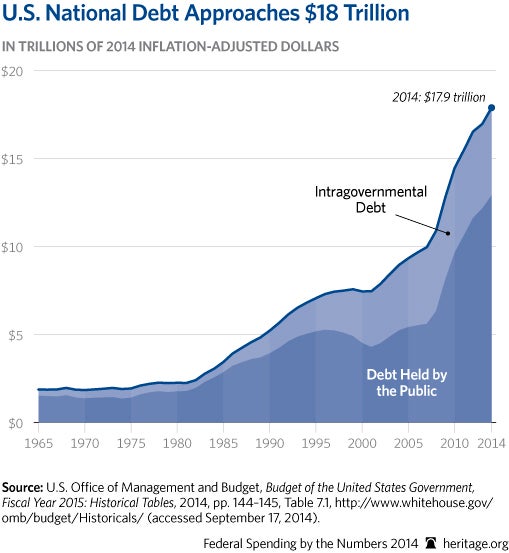

1. Even with the temporary drop in deficits and the Budget Control Act, federal spending and the national debt are projected to increase drastically. The current national debt tops $18 trillion, which is more than 100 percent of the national Gross Domestic Product. Without reforming federal spending, especially on Medicare, Medicaid and Social Security, the rising debt threatens Americans with higher taxes and fewer economic opportunities through less growth. At some point, investors may even lose confidence in the federal government’s ability to service the debt.

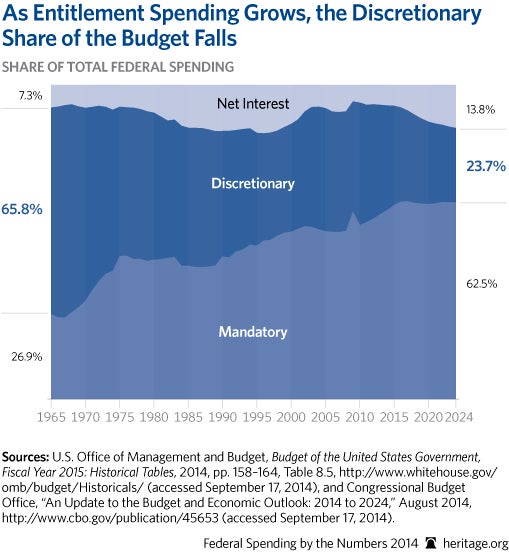

2. Federal Spending drives the debt, specifically entitlement spending on Medicare, Medicaid and Social Security and on means-tested welfare. Entitlement programs are considered mandatory spending, meaning they are set to grow on auto-pilot, unchecked by Congress each year. As spending on entitlement and welfare programs squeezes funding for national priorities, it raises concerns that Congress is not adequately funding America’s national defense because entitlements get the first call on federal revenues.

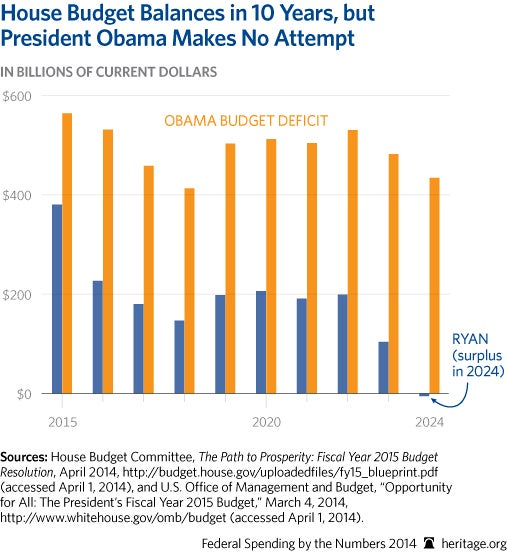

3. Putting the budget on a path to balance is not an easy task politically, but reining in federal spending is a must to enable economic opportunity and growth for younger and future generations. As government spending and debt grows, it crowds out private investment, which translates to fewer jobs and lower wages for Americans. President Obama fails to realize this: Under his budget plan, both spending and the debt are projected to increase, despite a trillion-dollar tax increase. On the other hand, the House’s budget plan created by Rep. Paul Ryan, R-Wisc., balances after 10 years thanks to health care entitlement and welfare reform and elimination of wasteful and duplicated programs.

There is plenty of wasteful spending to cut from the budget, as demonstrated in the 51 examples of government waste that are part of this year’s report.

Just as growth in federal spending and in the scope of the federal government often resulted from small, incremental increases, reining back the federal government starts with small steps. Congress and its constituents should keep this report and its lessons close at hand when considering the budget and other spending requests.