Democrat Who Championed Ex-Im Loses Top Staffer to Key Position at Bank

Melissa Quinn /

A staffer for a Senate Democrat who championed the Export-Import Bank has joined the embattled agency to manage relationships with Congress and other government agencies.

According to the congressional watchdog LegiStorm, Erin Gulick left her post as senior adviser to Democrat Sen. Maria Cantwell of Washington to work as senior vice president for congressional and intergovernmental relations at the Export-Import Bank.

Cantwell voted to reauthorize the bank in 2012 and was one of several Democrats who led the charge to extend the bank’s charter for another five years.

A top adviser to Sen. Maria Cantwell, who championed the Export-Import Bank, has joined the agency and will manage its relationships with Congress.

The Democrat senator represents the state of Washington, where Boeing employs 81,920 workers, by far its largest state, according to company employment data. The airplane giant benefits from billions of dollars in Ex-Im financing, which provides taxpayer-backed loans and loan guarantees to foreign companies and countries in exchange for the purchase of U.S. exports.

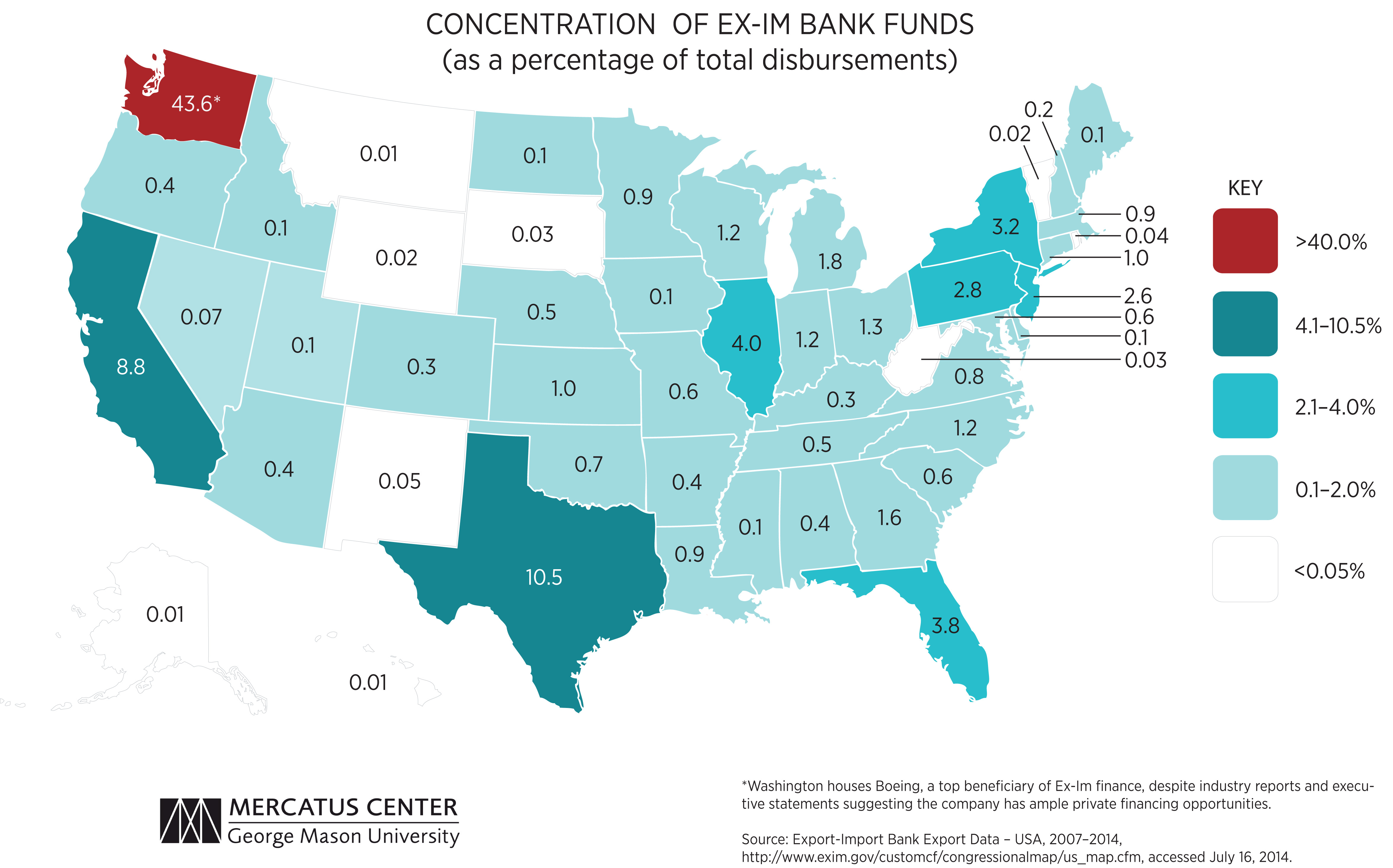

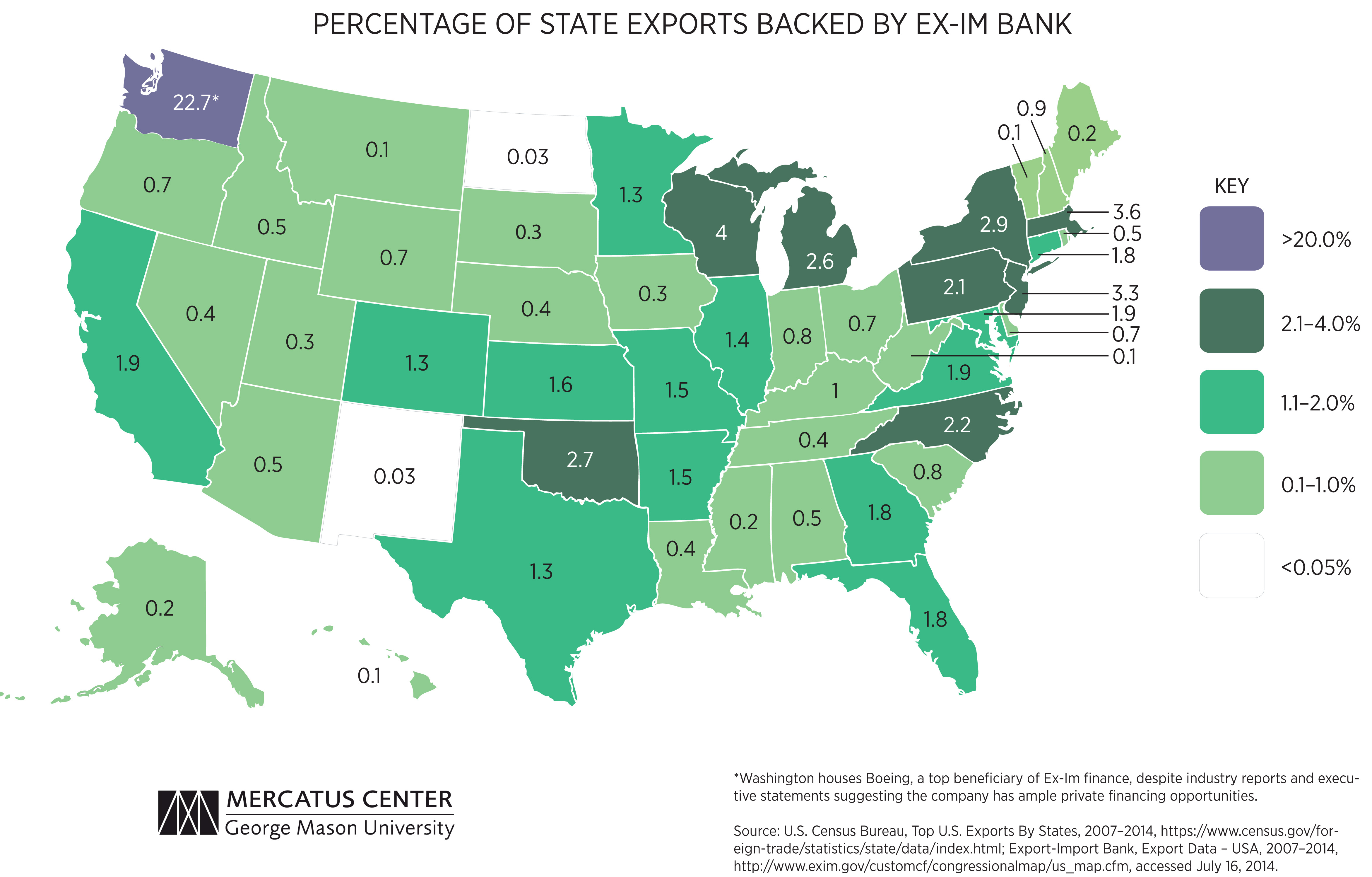

An analysis from the Mercatus Center at George Mason University found the Evergreen State benefited from 44 percent of the agency’s financing, receiving the largest concentration of Ex-Im funds. Similarly, 23 percent of Washington’s exports were backed by the embattled agency.

A press representative for Cantwell confirmed to The Daily Signal that Gulick had moved on to work for the 80-year-old agency, whose future was highly contested in Congress this year.

In an email to The Daily Signal, Dolline Hatchett, Ex-Im’s vice president for communications, said Gulick “will soon join” the bank’s staff.

>>> Politically Connected: Ties Link Embattled Government Bank, Well-Heeled Consultants

Gulick’s hiring at the bank comes in the midst of a campaign from conservative lawmakers to shutter the agency. Ex-Im’s charter was set to expire Sept. 30, but Republicans and Democrats reached a deal to reauthorize the bank until June 30, 2015.

Conservative lawmakers are optimistic Ex-Im’s short-term reauthorization will provide ample time for members of Congress to learn more about the bank and thus make an educated decision about its future.

>>> Main House Foe of Export-Import Bank ‘Swallows Hard’ at 9-Month Reprieve

“When we have that good public policy discussion, not just in June but over the next [nine] months, we’re going to win the hearts and minds of folks,” Rep. Rob Woodall, R-Ga., said at last month’s Conversations with Conservatives.

Woodall said he was confident there would be enough votes in June to end the bank for good.

Opponents of the agency, led by House Financial Services Chairman Jeb Hensarling, R-Texas, believe it furthers corporate welfare and cronyism. Proponents, including Cantwell, say it helps small businesses compete in the global market and creates jobs in the United States.

Sen. Joe Manchin, D-W.Va., introduced a measure to reauthorize the bank for five years in the Senate in July.