Why One State Is Talking Tax Cuts: ‘It Is Time to Give the Taxpayers a Pay Raise’

Steve Wilson /

If Tate Reeves has his way, one of the Mississippi’s most onerous taxes may be on the chopping block.

The Republican lieutenant governor wants the state Senate to look at tax cuts this legislative session, and the corporate franchise tax might top the list, along with a cut to the state’s income tax.

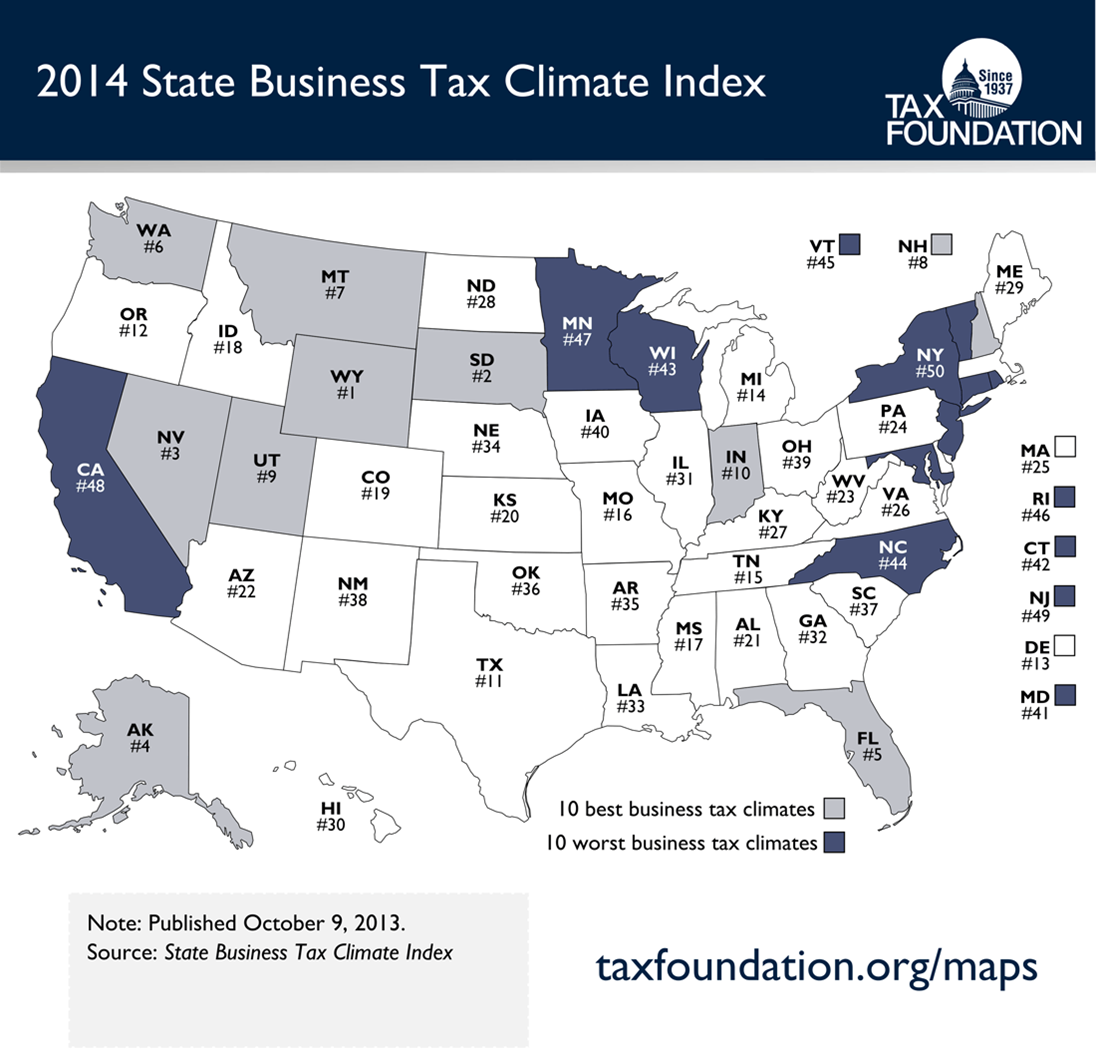

Mississippi ranks 17th on @TaxFoundation’s business tax climate index.

The franchise tax hits companies in the state for capital or property at a rate of $2.50 per $1,000 of capital or property, whichever is greater. The state’s franchise tax rate is sixth-highest in the nation and is one of the few without limits on the maximum payment.

“He is reviewing several approaches to give Mississippians tax relief, including looking at income taxes and the franchise tax,” said Laura Hipp, spokeswoman for Reeves.

Lt. Gov. Reeves believes it is time to give the taxpayers a pay raise now that the state’s fiscal house is in order with a strong rainy day fund and by only spending what government takes in from revenues.

Economist Scott Drenkard, manager of state projects for the Tax Foundation, said the tax is especially damaging to businesses in an economic downturn. According to the Tax Foundation, Mississippi is one of 18 states with a franchise tax, also known as a capital stock tax. West Virginia just phased out the tax, completing a 10-year sunset period.

“A capital stock tax has been called a tax on breathing,” Drenkard said. “You pay it every year regardless of profitability. Corporate income taxes, while they’re one of the most damaging taxes, the one benefit you can say over a corporate stock tax is that you only pay in profitable years.”

Eliminating the franchise tax could help Mississippi’s tax climate for business. It was ranked by the Tax Foundation in its most recent report as 17th best in the nation. The state’s corporate income tax has the nation’s 11th-lowest rate.