No, This Report Doesn’t Prove Income Inequality Slows Economic Growth

Salim Furth /

Monica Potts accuses conservatives of perpetrating a “big, long, 30-year conservative lie.”

“It took the worst economic crisis since the Great Depression for many economists, liberal or not, to finally say publicly what many had long argued: Inequality is bad for the economy,” Potts wrote in an article published last week in the Daily Beast.

Pott’s proof is an August 5 report by Standard and Poor’s, which she characterizes as saying, “rising inequality—gaps in both income and wealth—between the very rich and the rest of us is hurting economic growth.”

However, Potts misreads S&P and the underlying research on inequality. Furthermore, she mischaracterizes conservative ideas on the issue.

Honest scholars on the left admit that there is no decisive link between income inequality and growth.

First, let’s look at that S&P report. The S&P report that claimed a link between inequality and growth was not a new study, but rather a poorly curated review of other studies. The Manhattan Institute’s Scott Winship detailed the review’s systematic failure to report studies that disagreed with the authors’ conclusion, writing that “it describes a number of real economic problems related to growth and opportunity but fails to persuasively connect them to income inequality, assuming much of what it purports to demonstrate.” (Emphasis mine.)

But don’t take it from me or Winship. Honest scholars on the left admit that there is no decisive link between income inequality and growth. When the S&P report came out, the Washington Center for Equitable Growth – a left-wing think tank devoted to studying potential links between inequality and growth – threw cold water on it: “[The] overall findings in this academic arena are mixed. Inequality has been found to reduce growth, boost growth or have no effect at all. The varying methods used in these papers end up producing a variety of results.”

Another liberal economist, Jared Bernstein, makes clear that although he instinctively agrees with S&P’s conclusion he can’t find convincing evidence of an inequality-growth link. He concludes, “I’m quite certain there’s something to this important connection but I don’t think you see it through some of the most expected channels. Which makes it that much more interesting.”

So the S & P report simply doesn’t prove the connection between rising inequality and stale economic growth.

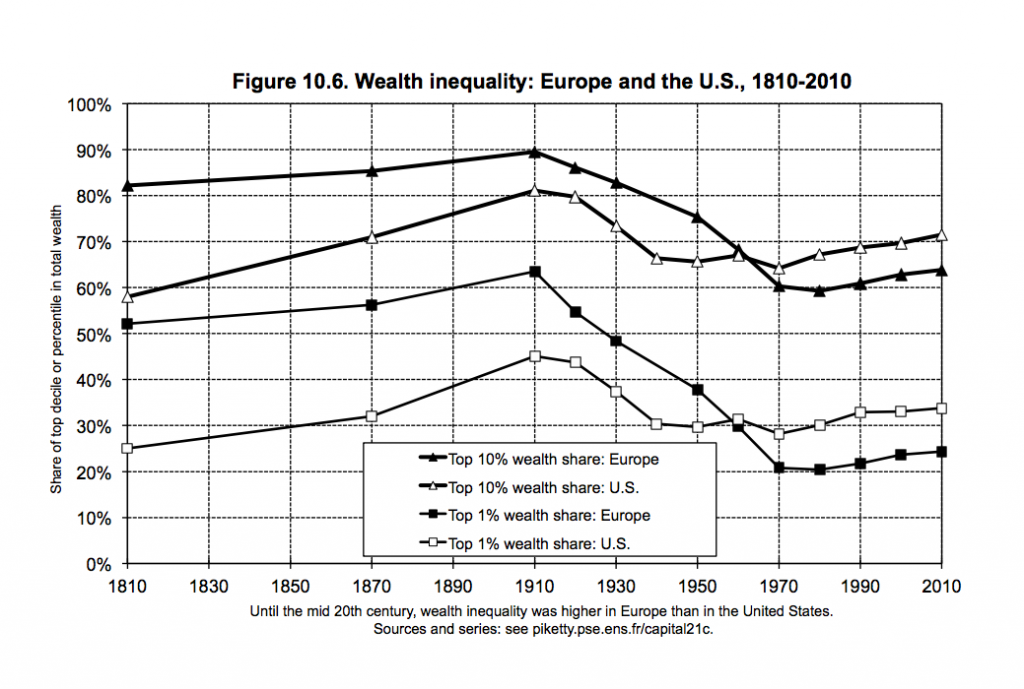

But Potts also made several other questionable claims. Some of her mistakes are minor. She states that French economics professor Thomas Piketty’s “Capital in the Twenty-First Century” shows that the “wealth gap [is] as wide as it [has] ever been.” In fact, Piketty’s own data (Figure 10.6) show that wealth is almost as broadly owned as ever, despite the rise in income inequality. Likewise, she says that real wages have been declining since the 1970s, an inaccurate claim that is repeated so often that it sounds true.

More broadly, Potts sees unbridgeable disagreement between progressives and conservatives in an area where there is actually broad agreement. Contrary to pundit caricatures, progressives understand that success always involves personal effort and conservatives reserve their greatest concern for those least able to help themselves. Potts ascribes to conservatives the idea that a culture of opportunity and work, and a disdain for handouts, are central to the American character and upward mobility. As much as we would love to own these ideas, they are widely shared – including by progressives. University of Chicago economics professor James Heckman and writer Paul Tough have performed and popularized the rigorous research showing that character traits like conscientiousness and grit are central to children’s success. Two generations ago, President Lyndon Johnson’s Department of Labor sounded the alarm that government programs were fueling dependency and encouraging the breakdown of African-American families. And it wasn’t a conservative who recently said, “I think every kid needs to get a taste of what it’s like to do that real hard work.” That was Michelle Obama.

To Potts’ chagrin, there is no contradiction between a belief that almost everyone can take care of himself or herself with hard work and the understanding that some cannot. In contrast to European social states, the U.S. welfare system has always been heavily targeted at families with young children, the elderly, and the disabled. Some welfare systems are designed to guarantee a modest lifestyle to everyone, regardless of effort. At its best, our system is designed to enable the young to prepare themselves for opportunities and prod healthy adults toward tackling whatever opportunities are available.

It wasn’t a conservative who recently said, “I think every kid needs to get a taste of what it’s like to do that real hard work.”

Potts proceeds to mischaracterize conservative economic thought as “trickle-down.” The conception of “trickle-down” economics is essentially Keynesian. It is a static view of the economy as a waterpark with a circular flow of existing money.

In practice, conservative economists build on the foundational microeconomic approach that is taught in every economics Ph.D. program. In that framework, we approach the economy as a collection of individuals, each making her own decisions in a competitive environment. The income of each individual is equal to her marginal product – the additional value created by her labor. If someone attends a failing school and lacks marketable skills, no amount of trickle-down spending is going to raise her marginal product or her wage. But if she works hard and offers value to an employer, her productivity will command a commensurate salary. (It’s more complicated than that, of course. For example, imperfect information means that wages only approximate marginal product, and capital investment indirectly raises workers’ marginal products. But this, not trickle-down, is where we start.)

The micro-first approach is why academic economists are skeptical of blanket statements about inequality. Income inequality, like income growth, is a highly complex outcome of individual decisions, market structure, and government intervention.

Ultimately, it is clear that inequality and growth are both complex outcomes of the same larger process. National income is the sum of all the individual incomes in the country. If one group is doing well and the rest of the country is doing poorly, national income growth will be in between the two, and probably close to the larger group. But that’s summation, not causation.

The real question about rising inequality (besides accurately measuring it, which is harder than it sounds) is identifying its sources. Is it globalization? If so, then the rise in domestic income inequality is linked to the startling decline in global income inequality. Is it corrupt bargaining in corporate boardrooms? If that were the case, we would expect to see the incomes of managers rise at the expense of profits, not profits and manager incomes rising together.

Happily, Potts comes around to a more agreeable tone by the end of her piece. She recognizes that conservatives care about improving the delivery of the government’s existing anti-poverty funding, mentioning Wisconsin Rep. Paul Ryan’s discussion draft on that topic. And she focuses her concern on helping those at the bottom, not dragging down those at the top. There we can agree: the real inequality problem isn’t that some people have become rich, but that not everyone in the U.S. has the opportunity to provide for themselves.