How U.S. Taxpayers Subsidize Fossil Fuels in Russia, Saudi Arabia While Being Penalized at Home

Kevin Mooney /

Americans have to pay more for electricity and compete for fewer jobs because of President Obama’s regulatory curbs on fossil fuels at home, even as their tax dollars support expansion of those same energy sources abroad.

The Obama administration last month rolled out its most recent brake on fossil fuels, a 645-page proposed rule to achieve a 30 percent cut in carbon dioxide emissions from power sources by 2030 compared to 2005 levels.

At the same time, the administration pressed for reauthorization this fall of the U.S. Export-Import Bank, a federal agency that offers billions of taxpayer dollars for development of fossil fuels in Russia, Saudi Arabia, Turkey, Mexico and other countries.

In effect, Heritage Foundation policy analyst Diane Katz says, the Obama administration is “imposing a hefty energy tax on Americans” while “subsidizing fossil-fuel projects in foreign countries.”

In examples The Daily Signal plucked from the Export-Import Bank’s annual reports in the past three years, the federal agency:

- Authorized $633.6 million for U.S. exports to four new fossil-fuel power plants, with an estimated aggregate amount of carbon dioxide (CO2) emissions totaling about 5.87 million metric tons a year. Of that, 3.67 million metric tons will be produced at natural gas-fired plants in Spain, Russia, and Israel, and 2.2 million metric tons will be produced by a coal-fired plant related to a copper-mining project in Mongolia. The bank provided $494.5 million for exports to the project in Mongolia and $32.3 million in “engineering services” for a petroleum refinery in Russia (2013 report, page 26).

- Financed $736 million in export sales to three other new fossil-fuel power plants, two in Turkey and one in Saudi Arabia. The bank estimated the aggregate amount of CO2 emissions would total about 11.3million metric tons a year — 2.1 million metric tons from two gas-fueled, combined-cycle plants in Turkey and 9.2 million metric tons from a similar plant in Saudi Arabia (2012 report, page 26).

- Provided $5 billion for a petrochemical project in Saudi Arabia, described as “engineering and equipment for Sadara Petrochemical Complex” (2012 report, page 9).

- Provided more than $4.5 billion to support mining projects, including $1.2 billion for oil and gas exploration and development projects by Mexico’s national oil company, Pemex (2012 report, page 18).

A design featured on the Sadara-Dow and Aramco Launch Chemical Project Facebook page. (Photo: Facebook)

‘Political Hypocrisy of a High Order’

The Export-Import Bank provides taxpayer-backed loans, loan guarantees, capital, and credit insurance to foreign firms and countries to stimulate purchase of U.S. exports.

When President Obama signed a bill in May 2012 extending the 80-year-old agency’s charter through this Sept. 30, he told an audience of business owners gathered at the White House that the bank would open new avenues for their products overseas:

By reauthorizing support for the Export-Import Bank, we’re helping thousands of businesses sell more of their products and services overseas. And in the process, we’re helping them create jobs here at home.

>>> Related: Export-Import Bank Didn’t Make 2012 Reforms Ordered by Congress

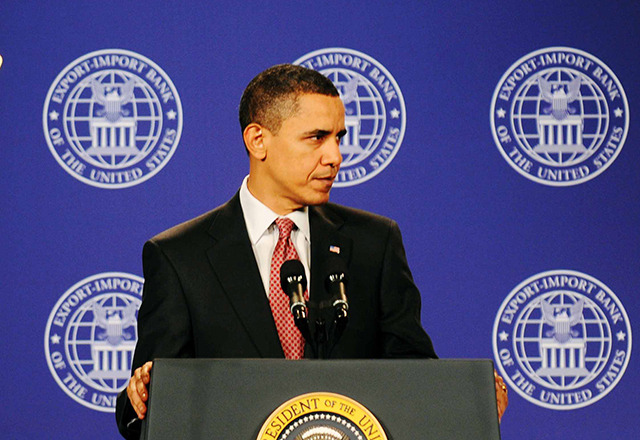

President Obama remarks at an Export-Import Bank Annual Conference. (Photo: Yacouba Tanou/Maxppp/ZUMAPRESS.com)

But some of those products and services will go toward developing the same energy sources that in the U.S. are being hit with a regulatory crackdown by the White House. The intent is to eliminate use of traditional energy sources under the rationale of averting “the catastrophic impacts of climate change” described in the president’s “Climate Change Action Plan.”

“This is political hypocrisy of a high order,” says Katz, a regulatory policy analyst at Heritage who has written extensively about the Ex-Im Bank:

The Obama administration effectively is imposing a hefty energy tax on Americans at the very same time it is subsidizing fossil-fuel projects in foreign countries. Both are lousy policy.

The $5 billion in direct loans for Saudi Arabia’s state-owned oil company last week drew the distinction of being named “Egregious Ex-Im Bank Deal of the Day” by the House Financial Services Committee.

A general view shows the Saudi Aramco oil facility in Dammam city. (Photo: Hassan Ammar/AFP/Getty Images)

Rep. Jeb Hensarling, R-Texas, the committee’s chairman, is the leader of a push by conservative lawmakers to deprive Ex-Im of reauthorization when its charter expires Sept. 30. The Heritage Foundation’s lobbying arm, Heritage Action for America, is part of a coalition organized by Americans for Prosperity to argue that Ex-Im’s time is past.

The Daily Signal invited Ex-Im officials to respond to critics for this report and to account for its support in foreign countries of the same kind of fossil-fuel development that the Obama administration restrains in the United States. Despite repeated phone calls and emails, the bank declined to comment.

Higher Electricity Prices, Fewer Jobs

President Franklin Roosevelt created what was then the Export-Import Bank of Washington through an executive order in February 1934. The idea, according to the order, was to “remove obstacles to the free flow of interstate and foreign commerce,” and to boost job creation in the U.S.

Two of today’s biggest supporters of preserving Ex-Im, the U.S. Chamber of Commerce and the National Association of Manufacturers, continue to sound these themes – even while expressing concern about the effect of administration policy on domestic jobs and energy prices. However, critics argue, the bank’s subsidies long have distorted the allocation of labor and capital by imposing political calculations in place of economic decisions.

>>> Commentary: What Obama Has Wrong on Climate Change

Under rules proposed by the Environmental Protection Agency, states and power companies must reduce emissions of carbon dioxide by a whopping 30 percent. States must obtain EPA approval of implementation plans that will impose higher energy costs on American families and businesses. The agency’s “flexible” options include expanding renewable energy sources such as wind and solar, implementing energy-efficiency mandates and regulations, and switching from coal to natural gas.

As noted by Heritage Foundation economist Nick Loris, who researches energy and environmental issues, the costs would reverberate across the economy. The phase-out of coal between 2015 and 2023 alone would eliminate 600,000 jobs, computer models show, and the annual income of a family of four would drop more than $1,200 a year.

The U.S. Chamber of Commerce, although a major backer of the Ex-Im Bank, has been a critic of the domestic energy policies to which the bank isn’t bound. A chamber report said the EPA rules would mean $290 billion more in electricity bills by 2030:

Higher electricity prices [will] ripple through the economy and reduce discretionary income, which affects consumer behavior, forcing them to delay or forego some purchases or lower their household savings rates.

Mixed Messages

Ex-Im’s FY 2013 Annual Report shows the bank was not hesitant to offer support for cheap, affordable energy products that the Obama administration is working to restrict in the U.S.

Ex-Im “approved a total of 67 loans, guarantees and working capital guarantees and approximately 77 new and renewed export-credit insurance policies to finance U.S. exports related to foreign energy development, production and transmission,” the annual report says, adding:

These activities include electric-power generation and transmission, coal mining, oil-and-gas-field exploration and development, production, pipelines and refineries.

Since 2001, Ex–Im has provided $14.8 billion in financial commitments for oil and gas exploration, field development, pipelines, distribution, and refining. A fact sheet from Ex-Im trumpets: “United States equipment and services for the petroleum industry are sought after by the world’s leading companies because of their quality and reliability.”

The bank’s annual report for 2011 noted that it had:

- Financed the sale of $1.7 billion in goods and services to five new fossil-fuel power plants. The bank estimated the aggregate amount of CO2 emissions would total about 63.9 million metric tons a year; of that, 56.3 million tons would be from two coal-fired plants projects and 7.7 million tons from three gas-fueled, combined-cycle plants (page 20).

- Approved a $2.84 billion direct loan and loan guarantee for a refinery project in Colombia for Refinería de Cartagena S.A. (Reficar), a subsidiary of Ecopetrol S.A., the national oil and gas company. The financing was “part of a $5 billion refinery and upgrade project in Cartagena, from which Reficar will supply petroleum products to the domestic and export markets” (page 9).

>>> Commentary: Why We Must Get Rid of the Export-Import Bank

However, back home, the administration’s package of EPA rules aimed at staunching global warming or climate change is just the latest in a series of costly regulations aimed at curtailing use of fossil fuels in the United States, Katz and other policy analysts familiar with the changes say.

Alpha Natural Resources, for example, announced it will shut down eight coal mines and eliminate 1,200 jobs as a result of what the company’s CEO called “a regulatory environment that’s aggressively aimed at constraining the use of coal.”

President Obama’s EPA regulations forced 300 American coal-fired power plants to close down. (Photo: Newscom)

Citing environmental concerns, the White House persists in delaying construction of the Keystone XL Pipeline, which would transport oil from Canada to refineries in south Texas. The administration effectively has banned offshore drilling for the next seven years.

Data compiled by the Western Energy Alliance shows federal leasing for oil and gas exploration on land has dried up as well. The end result of the Obama administration’s energy policies at home and abroad is a “lose-lose” for taxpayers, Chris Prandoni, director of energy and environment policy at Americans for Tax Reform, told The Daily Signal. Prandoni says:

While President Obama’s EPA was writing regulations that forced 300 American coal-fired power plants to close down, his Export-Import Bank conceded the importance of coal by financing overseas coal development. This lose-lose for the American taxpayer is particularly painful: Our electricity rates will increase as we pay countries to burn what we no longer can.

‘Blind Eye to Sweetheart Loans’

The administration continues to build its case for new regulations around the “politically fashionable” concept of human-induced global warming, but that theory remains “scientifically unproven,” says Bonner Cohen, senior fellow with the National Center for Public Policy Research. This “war on coal,” he said, “is part of a larger war on affordable energy.”

The policy research center compiled a list of the Top 10 Reasons Washington Should Not Impose New Global Warming Laws or Regulations. Figuring prominently on the list is the disparity between climate models and actual scientific observations that show there has been no appreciable global warming since the Clinton administration.

>>> Commentary: Environmentalists Call U.S. Workers ‘Collateral Damage’

“Under the guise of combating ‘climate change,’ the administration practices crony capitalism and allocates ever-more regulatory power onto itself,” Cohen says, adding:

But when it comes to the Ex-Im Bank, it provides taxpayer-backed loans to foreign customers of well-heeled U.S. behemoths, such as Boeing, Caterpillar, and General Electric. And its allegiance to Washington’s powerful administrative agencies leads it to turn a blind eye to the Ex-Im Bank’s sweetheart loans, even if they finance fossil-fuel-related projects the administration would have the world believe endanger the planet.

- Ken McIntyre, news director of The Daily Signal, contributed to this report.