China Foreign Exchange Reserves: $4 Trillion and Counting

D. Gerard Gayou /

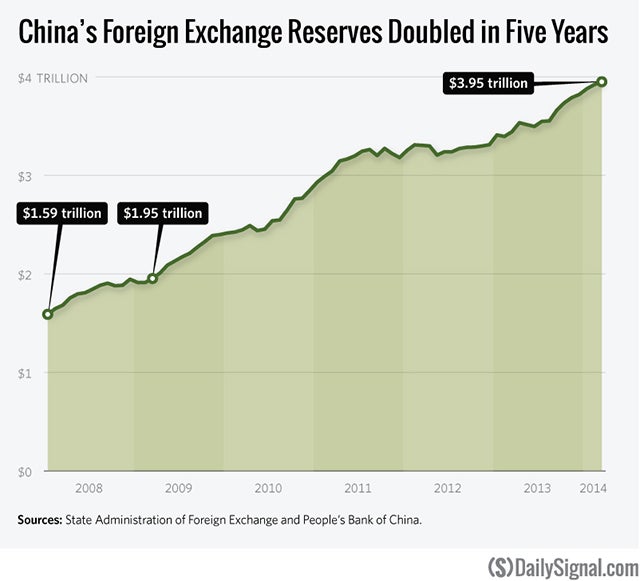

During the second quarter of this year, China’s foreign reserve holdings will top the $4 trillion mark.

Representing approximately 43 percent of China’s GDP, these enormous holdings are accumulated when China runs trade surpluses with the rest of the world (primarily the U.S.) and then intervenes by buying dollars with their domestic currency, the renminbi (RMB). While the RMB has appreciated against the dollar in recent years, the intervention has the result of keeping the RMB from appreciating further against the dollar and adds to China’s burgeoning dollar-denominated foreign exchange holdings.

It is estimated that up to 70 percent of the $4 trillion in reserves are held in dollar-denominated assets. As many of these assets are U.S. Treasury bonds, China’s substantial holding of American debt is often interpreted as significant financial leverage over the United States.

The United States does risk significant economic damage if China were to “dump” a large portion of their U.S. government debt holdings. Because interest rates and bond prices move inversely, a fall in the price of U.S. Treasuries would increase the “yield” or interest rates on U.S. government bonds. With a national debt of $17 trillion, the U.S. could face enormously higher borrowing costs to finance this debt. The higher borrowing costs, in turn, could increase annual deficits and the national debt.

A closer look, however, reveals that China’s mountain of U.S. sovereign debt is not simply a story of U.S. financial dependency on China. Rather, it is a much more complicated narrative in which a change in the status quo could result in mutual harm.

Nonetheless, the Chinese are in no practical position to assert financial influence. A dumping of U.S. Treasuries would lead to sizeable capital losses on Chinese holdings. Moreover, if the dollar were to depreciate against the RMB, China’s dollar holdings would lose even more value.

So if it’s not useful leverage, why doesn’t China simply diversify its assets? In the past few years, that is exactly what Beijing has been trying to do, but its ability to diversify is limited because of the sheer size of its reserve holdings. Many analysts argue that the enormous U.S. sovereign debt market is the only feasible sanctuary large enough for these Chinese reserves. Therefore, China has limited options.

At least for now, the financial see-saw is tilted toward Washington.

D. Gerard Gayou is currently a member of the Young Leaders Program at The Heritage Foundation. For more information on interning at Heritage, please click here.