Washington Post Op-Ed: You Didn’t Pay For That (And She’s Right)

Romina Boccia /

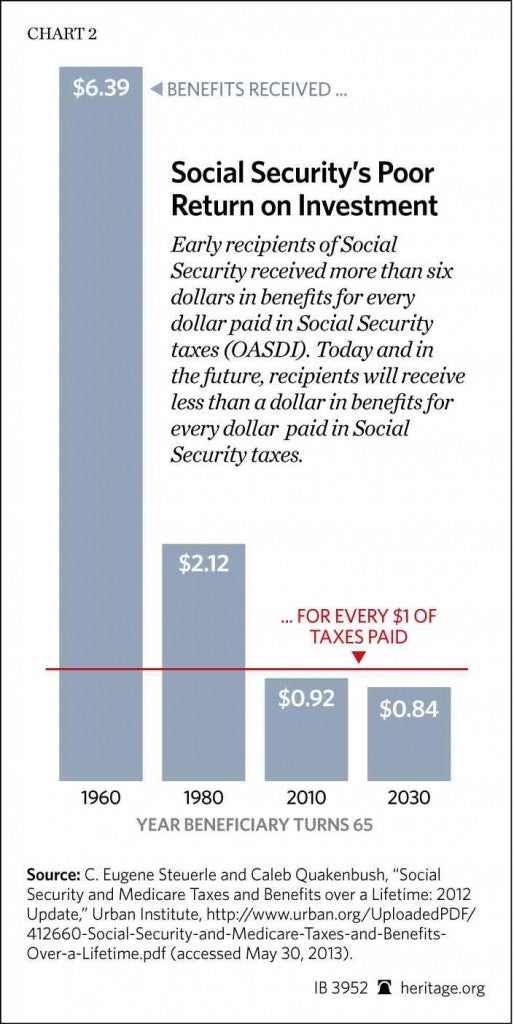

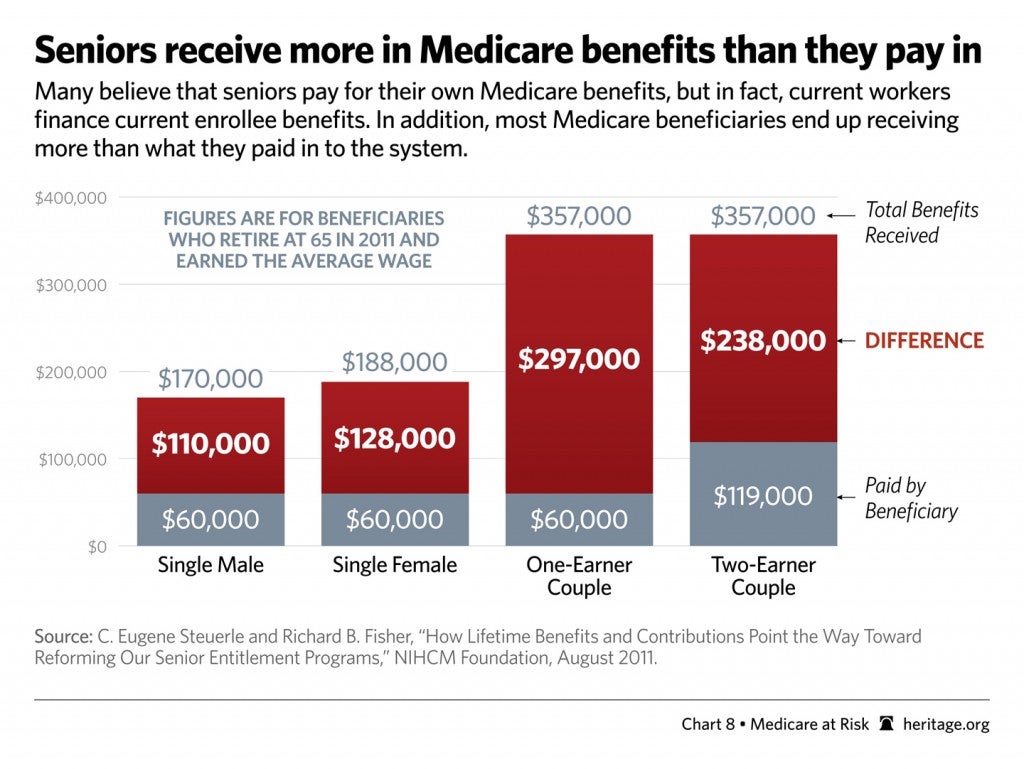

Past and current retirees receive much more in benefits from Social Security and Medicare than they paid into the systems. Absent reform, younger generations will get stuck with an unfair burden and less financial security.

One of the most common reactions to arguments in favor of entitlement reform is to claim that recipients of Social Security and Medicare benefits paid for those benefits. Such a reaction, however, discounts facts that contradict this position. On this issue, too many people believe what they want to believe.

This morning, Catherine Rampell tried to dispel this myth in the opinion section of The Washington Post:

Despite all the “we already paid for it” rhetoric popular among seniors, seniors did not pre-pay for their entitlements. If anything, they paid for their parents’ entitlements, which were more modest than the benefits today’s retirees receive. […] Earlier generations made out like bandits [from Social Security.] Medicare, on the other hand, is pretty much a steal no matter when you turned 65.

My colleague Rachel Greszler and I come to a similar conclusion using data from the Urban Institute:

In Medicare, the gap between what beneficiaries paid in compared with what they receive is even bigger.

This misunderstanding of the way Social Security and Medicare work is a huge impediment to entitlement reform. And reform is critical, as younger generations will be burdened with higher taxes and an even larger national debt—factors that will reduce their economic opportunities.

The official national debt figure now exceeds $17.5 trillion or $150,000 for every American taxpayer. But this figure excludes unfunded liabilities in Social Security and Medicare. These programs alone add $48.5 trillion to the long-term debt. More comprehensive accounting of the government’s long-term shortfall between revenues and spending by Laurence Kotlikoff, an economist at Boston University, calculates the government’s true fiscal gap to be $205 trillion.

The question before Americans is whether to recognize the nation’s fiscal realities for what they truly are, or continue to wish them away. As the people’s main representative body, Congress has an important role to play in informing the nation on the choices which it confronts and by working to implement solutions to the entitlement spending challenge.

The Heritage Foundation identified six bipartisan reforms that could kick start entitlement reform—thereby strengthening the safety net for the most vulnerable Americans, while protecting younger generations from an unsustainable and unfair fiscal burden.