Look Closer: Tax Increases, Not Spending Cuts, Are the Harmful Austerity

Salim Furth /

Proponents of government spending want to use the recent history of Europe as evidence that spending cuts are harmful, but their arguments lose traction when one looks closely at the data.

Proponents of government spending want to use the recent history of Europe as evidence that spending cuts are harmful, but their arguments lose traction when one looks closely at the data.

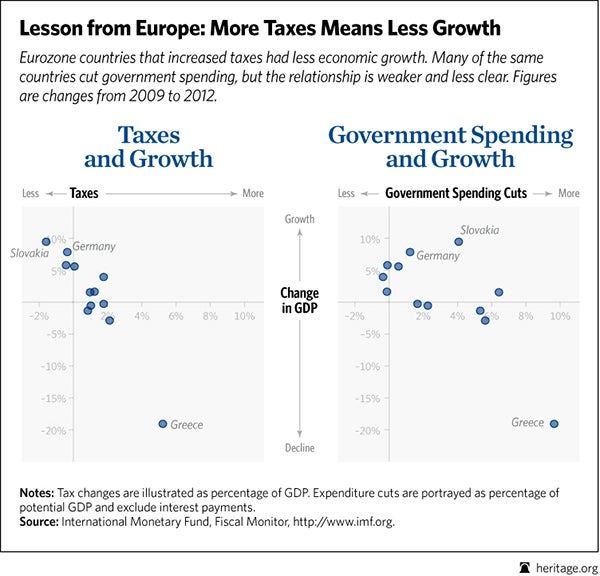

One example comes from Paul Krugman, who used the International Monetary Fund’s Fiscal Monitor data to argue that “austerity has large negative impacts.” But he could have made a more valuable observation: Tax increases have large negative impacts, spending cuts not as much.

That lesson is visible in the charts: A dollar increase in tax revenue lowers gross domestic product (GDP) by $2.10 over the same time period, while a dollar of spending cuts only lowers it 80 cents. (Those are short-run effects, and in the long run, economists expect that the private sector picks up any slack left by the government.) Greece has a lot of influence on these estimates, and without Greece the revenue effect falls to $1.30 and the spending effect to 40 cents.

Spending cuts are baked into GDP, so those estimates imply that the private sector is basically unharmed by spending cuts. Taxing more in order to cut deficits, on the other hand, is an exercise in futility: Historically, the tax increases hurt the economy so much that the increases utterly fail to lower the deficit.

A more recent generalization about austerity comes from Ezra Klein, who tweeted that “austerity destroyed Europe’s economy.” The problem? His graph shows an estimate of only aggregate demand growth, not austerity or fiscal policy.

Looking at the data on austerity we can see that generalizing about Europe obscures more than it reveals. Klein obviously believes that the U.S. and Japan were substantially less austere than the eurozone. But looking at two different measures of austerity, we can see that is not the case.

In structural deficit reduction from 2009 to 2012, the U.S. is in the middle of the eurozone countries—slightly more “austere” than Germany, the largest eurozone economy. In the Fiscal Monitor estimate of discretionary deficit reduction policy, the U.S. is more austere than all but four eurozone countries. Japan, by contrast, has moved toward larger deficits, bigger government, and higher taxes.

How have those policies worked out? Germany’s GDP grew 8 percent from 2009 to 2012, the U.S.’s grew just over 6 percent, and Japan’s grew just under 6 percent. Maybe tax-and-spend is not such a great strategy for Japan after all.

Finally, which country in the eurozone had the strongest growth record from 2009 to 2012? Slovakia, which surged 9.5 percent. According to the Fiscal Monitor, Slovakia cut taxes by 1.59 percent of GDP and cut spending by 4.07 percent of GDP.

(Wonkish notes: Krugman used GDP growth from 2008 to 2012, so his growth “effect” starts a year before the cause. Krugman also excluded eurozone countries Slovakia and Slovenia from his graph and regression without explanation. The Fiscal Monitor table that Krugman cites does not include a “total austerity” series—Krugman and I had to add up the spending cuts and revenue increases to get “total austerity.” I dropped changes in interest payments from the spending side, since they are not driven by fiscal policy. None of these analytical choices makes a substantial difference in the regression results. Finally, these spending cuts include the expiration or termination of temporary stimulus spending.)