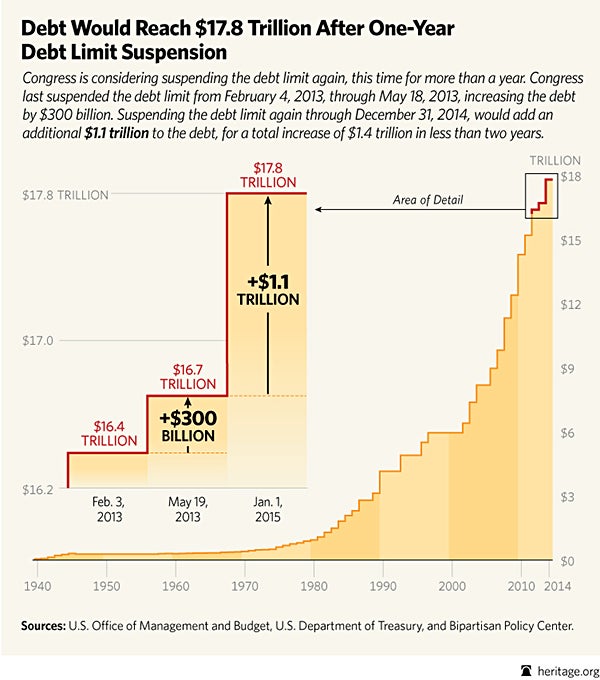

Plan to Suspend Debt Limit Means Debt Would Rise to $17.8 Trillion

Romina Boccia /

Treasury Secretary Jack Lew announced a new debt ceiling deadline today, urging congressional lawmakers and the President to come to an agreement concerning the nation’s borrowing authority by October 17. Republicans are proposing a $1.1 trillion increase in the debt limit by suspending the cap through December 2014. The big question is: Will lawmakers take control of the key drivers of soaring spending and debt as part of an increase?

Recent news reports suggest the answer is largely no. According to Bloomberg:

The House Republican plan would suspend the debt cap until Dec. 31, 2014, according to a proposal distributed by party leaders to Republican members and obtained by Bloomberg News. House Republicans said it is a plan that would save at least $256 billion from budget revisions and changes to entitlement programs.

The $256 billion in savings, especially if some of the savings come from important changes to mandatory programs, is a start. But in the big picture, the proposal is woefully inadequate. Republicans have all but given up on the Boehner rule, requiring a dollar in cuts or reforms for a dollar increase in the debt limit. They are already $300 billion behind, and this latest proposal would put them $1.1 trillion deeper in the hole.

Congress and the President last suspended the debt ceiling from February 4, 2013, through May 18, 2013, adding $300 billion to the national debt in less than four months. Their only request was that the Senate produce a budget for the first time in four years, which it did. No savings were accomplished. Suspending the debt limit through December 31, 2014, would add an approximate $1.1 trillion to the debt, for a total increase in the debt ceiling of $1.4 trillion in less than two years.

A lot is at stake this fall. Recent projections by the Congressional Budget Office (CBO) show that publicly held debt, which makes up 60 percent of the debt subject to the limit, could reach 100 percent of gross domestic product as soon as 2028. At such high levels, debt poses serious risks for economic growth. As Heritage economist Salim Furth explains:

The CBO’s sobering numbers should motivate Congress to pass serious entitlement reform now—while it can still be done through gradual reforms and not Greek-style austerity.

Congress should implement spending cuts and entitlement reforms before—or as part of—an increase in the debt ceiling. Lawmakers still have time to put forth a plan that puts the budget on a path to balance and avoids a debt crisis today and in the future. The clock is ticking.