Morning Bell: The IRS and Obamacare, by the Numbers

Chris Jacobs /

Chilling new details emerged yesterday about the IRS targeting scandal, as representatives from six conservative groups testified before Congress about the scrutiny and demands they faced from Obama administration bureaucrats.

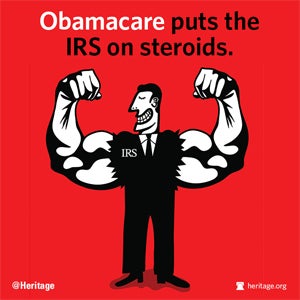

Yesterday’s testimony reminded us once again why Washington bureaucrats cannot be trusted, and why Americans should be so concerned about the new powers granted to the IRS as a result of Obamacare.

These powers are so vast, in fact, they’re difficult to put into words. So instead, we decided to give you the numbers:

18—New taxes in Obamacare, including 12 that directly violate then-Senator Barack Obama’s “firm pledge” to those making under $250,000 per year that he would not “raise any of your taxes.”

47—New provisions Obamacare charges the IRS with implementing, according to the Government Accountability Office.

$695—Tax for not buying “government-approved” health insurance the IRS will be charged with enforcing on all Americans.

1,954—Full-time bureaucrats the IRS wants to devote to Obamacare implementation and enforcement in the upcoming fiscal year.

60,000,000—Medical records the IRS has been charged with improperly seizing, raising concerns about whether the agency can handle the personal health insurance information all Americans will be required to submit to the IRS.

$439,584,000—The IRS’s request for new spending on Obamacare implementation in the upcoming fiscal year; the request did not specify how much of those funds the IRS will spend on the “Cupid shuffle.”

6,100,000,000—Man-hours Americans already devote to tax compliance, according to the National Taxpayer Advocate, a burden that will rise significantly thanks to Obamacare.

$1,000,000,000,000—New revenue raised by Obamacare in its first 10 years alone, according to the Congressional Budget Office, sums that will only rise in future decades.

If ever there were an argument as to why Obamacare should be repealed and defunded, these numbers—coupled with the IRS revelations of recent weeks—tell the tale.

>>> SHARE THIS PICTURE: Facebook | Pinterest | Tumblr

Quick Hits:

- One of the witnesses at yesterday’s IRS hearing was Kevin Kookogey, a Heritage Action Sentinel. His organization, Linchpins of Liberty, was asked to turn over the names of students whom it trains.

- Four of the most memorable moments from the IRS hearing, courtesy of The Blaze.

- President Obama’s Christmas tree tax is back, revived by House Republicans.

- The food stamp program shouldn’t be part of the farm bill, write Senator Ron Johnson (R-WI) and Heritage Action CEO Michael Needham.

- A debate over the libertarian populist agenda.

- Individual citizens can now “cosponsor” bills, thanks to an initiative from House Majority Leader Eric Cantor (R-VA).

- Senator Pat Toomey (R-PA) wants to know why HHS Secretary Kathleen Sebelius won’t use her authority to save the life of a 10-year-old child dying of cystic fibrosis.

- Must-see video: Why positively peaceful comfort clothing and the Internet sales tax don’t mix.