Debt Limit and Tax Reform: Both Important, But On Their Own

J.D. Foster /

Press reports link the coming debt limit debate with the building effort for tax reform. The debt limit and tax reform are both important, but the connection ends there, as it should. Suggestions that some sort of fast-track procedure for tax reform might be the conservative “ask” in exchange for a debt limit increase are way off base.

The debt limit debate is precipitated by ongoing massive deficit spending and the calendar. Tax reform, meanwhile, is precipitated by the need to compensate for President Obama’s economic policies’ failure to launch a robust recovery and to correct a tax system increasingly inconsistent with the dictates of a globally competitive economy.

For the first time in a long time, however, tax reformers have good reason for optimism. Ways and Means Committee Chairman Dave Camp (R–MI) and retiring Senate Finance Committee Chairman Max Baucus (D–MT) are working diligently to harness the rising bipartisan interest in tax reform. Even President Obama has joined the debate, at least in principle, and all have focused on reducing the corporate income tax rate and otherwise making the tax code simpler, more transparent, and more conducive to economic growth. All good, but there is as yet only the outlines of broad consensus, and much, much work left to do, a message given greater weight by the recent release of a 568-page tome on tax reform by the Joint Tax Committee.

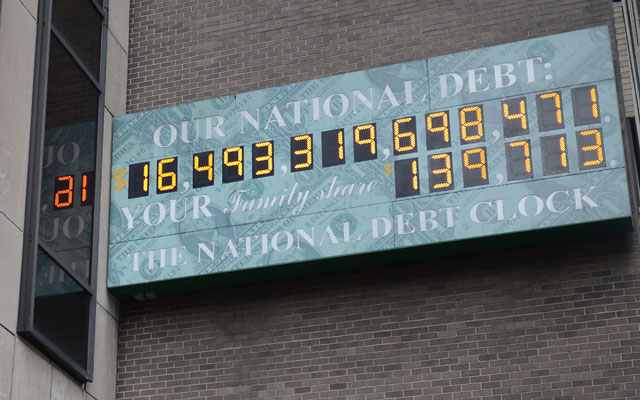

On May 19, the debt limit will be reached. For the first time in history such a precise forecast is possible because for the first time in history the debt limit was raised not in terms of a dollar figure but in terms of a calendar date. An interesting experiment, the sole benefits of this approach seems to be in making the precise forecast and making it easier for Members of Congress to vote for it—a calendar date is not nearly as scary as a figure in units of trillions of dollars.

After May 19 the Treasury will then turn to its usual toolbox of extraordinary measures, now believed sufficient to carry the government certainly through July and quite possibly into the fall. Whatever the time frame, another debate is unfolding as to whether and how to raise the debt limit, by how much, and on what terms.

It is in this context that the debt limit and tax reform have been linked. That link should be broken and never repaired.

The House of Representatives, in passing the Ryan budget, memorialized its commitment to balancing the budget within 10 years. Simple as it sounds, achieving that consensus was a major accomplishment, and achieving the result will be a major undertaking. The debt limit debate provides the next venue for taking concrete steps to reduce spending consistent with the commitment.

Whatever conditions attach to legislation to raise the debt limit, the effect of those conditions should be to reduce spending immediately and permanently. Legislative procedures to expedite tax reform legislation at some future date, while certainly meritorious and important, do neither.

Congress should debate the debt limit. Congress should aggressively pursue pro-growth tax reform. Congress should do each separate from the other.