Congressmen: Internet Sales Tax Is Attack on Small Business, Consumers

T. Elliot Gaiser /

Conservative members of Congress are adding their voices to a rising chorus of bipartisan opposition to the Internet sales tax.

At last week’s Conversations with Conservatives, a monthly event co-hosted by The Heritage Foundation, Representative Raul Labrador (R-ID) said the Marketplace Fairness Act allows large retail businesses to impose new taxes on small businesses.

“A lot of the large retailers already have the nexus, they already have these different packing facilities,” said Labrador. “They’re realizing their products have to be taxed, so now they want to impose upon small business the same burden that’s being imposed on them.”

Representative Tim Huelskamp (R-KS) agreed. “I served in the state legislature for 14 years and this was a real burden to business,” he said. “It’s not a burden to the larger retailers that would like to impose this.”

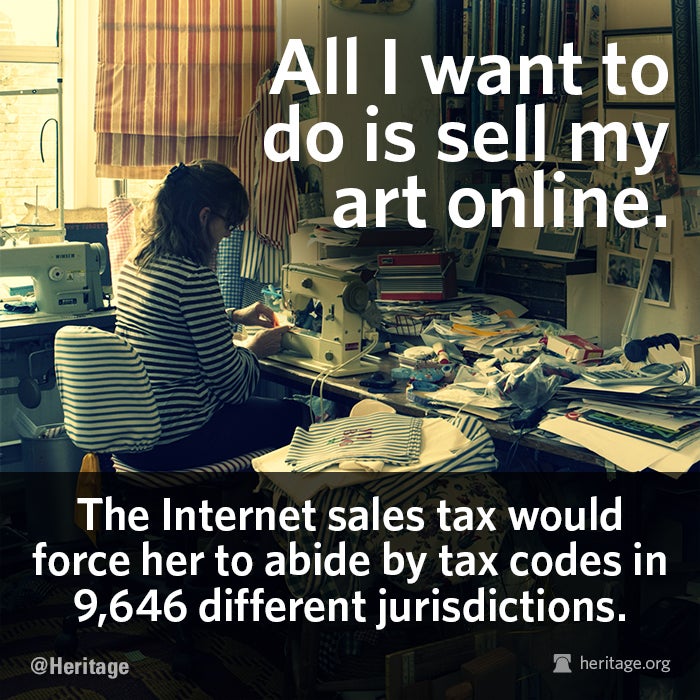

Contrary to proponents of the bill who say the Internet sales tax would level the playing field between online and brick-and-mortar stores, Representative Mick Mulvaney (R-SC) said it would impose unprecedented burdens on online consumers and businesses.

“When I ran a restaurant, and you’d come into my restaurant, I had to collect sales tax from you, and I’d never ask you where you are from,” he said. “We’re fighting over whether or not we’re going to make small businesses find out where you’re from and then have that small business collect the tax and send it to California if that’s where you’re from.”

“We don’t do that with retail,” said Mulvaney.

Representative Ron DeSantis (R-FL) said the Internet sales tax was an attempt to use the federal government to bail out state officials from the political costs of enforcing use tax laws. “If you buy something online, you’re supposed to pay a use tax. But they don’t enforce the law, and I think the reason they don’t enforce the law is because if they started to enforce the law the people who did that would get voted out of office,” he said.

“I think they want the federal government to relieve them of the burden of enforcing the law against their own citizens,” said DeSantis. “In that sense it’s almost like a bailout of state and local officials.”

Mulvaney said this is why he supports an alternative, where online businesses pay the sales tax only in the state where they operate – just like brick-and-mortar retailers.

“There’s an existing model with retail right now which is simply you collect where you perform the service or sell the good, and then you remit where you are,” he said. “That is a much simpler system that does not bring constitutional issues up, that does not bring jurisdictional questions up.”

Ultimately, the Marketplace Fairness Act would harm competition through bigger government, said Labrador.

“I get concerned that what we do here in Congress is that we allow big government to allow big business to impose requirements on everybody else and it becomes less competitive instead of more competitive,” Labrador said.