Morning Bell: Chinese Investment in the U.S. Shatters Records

Derek Scissors / Amy Payne /

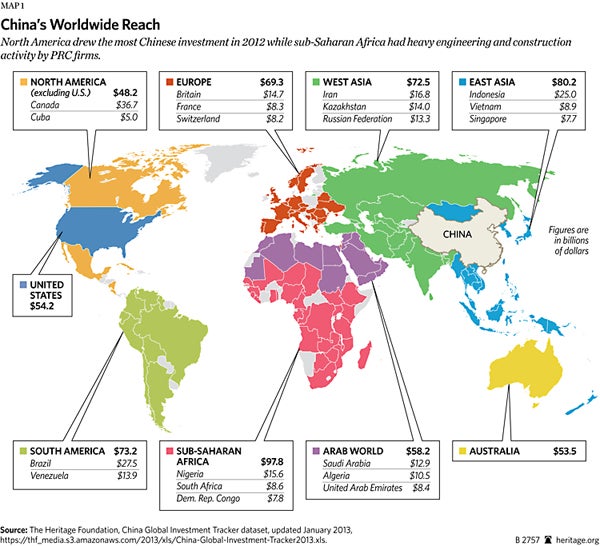

China set a record with its investments around the world in 2012. And in the United States, China shattered its previous investment record.

Before people start panicking, it’s important to know: This is not a bad thing.

First, let’s put it in perspective. Chinese investment is still very, very small as compared to the size of the U.S. economy. At the national level, the stock of investment is barely $50 billion—which sounds large, but is negligible compared to a stock of American wealth of more than $60 trillion.

No one’s “taking over” anything. In fact, more Chinese investment is a good thing. It creates jobs; it benefits companies, and it should be welcomed. It also gives us more leverage to push for a more open Chinese market, which continues to be a major problem.

Globally, the U.S. can compete and win with China in terms of economic influence, but we have to be willing to play. We have to be willing to expand our trade and investment in both directions.

The Heritage Foundation offers the only public dataset of Chinese outward investment, tracking the country’s investments of $100 million or more since 2005. Using our interactive map, you can see where the flow of investment is going—by country and by sectors, including technology, transportation, agriculture, real estate, metals, etc.

>> Use the China Global Investment Tracker’s Interactive Map

Energy continues to attract the most Chinese money, while North America became the most popular destination for Chinese firms in 2012. Australia also remains a top destination for Chinese investment.

Protecting America

Now, while additional investment that supports American jobs is welcome, we have to be smart. We need to make sure that Chinese companies doing business here don’t undermine competition, because they get so much support from their government. If our laws are adequate to do this, we should not hesitate to enforce them. If they need to be modified, that process will take some time, so we should start now.

There are protections in place for U.S. interests, and if these need strengthening, then the U.S. government should address those needs. America already has a structure in place to:

- Safeguard technology: The Committee on Foreign Investment in the United States (CFIUS) is tasked with keeping foreign entities from acquiring technology that could harm American interests. It should continue to investigate and bar any transactions it finds harmful.

- Ensure that Chinese firms behave differently here than at home: The Securities and Exchange Commission is currently responding to a failure to disclose financial information by some Chinese firms that sell stock here. This kind of action must continue. Chinese entities operating in the U.S. or selling stock here must follow American law or be forced to depart.

Chinese investment in the U.S. is no reason to get nervous. It boosts our economy and should prompt us to secure top-flight trade and investment agreements across the Pacific and around the world.

It’s also important to note that this trend won’t last forever. North America has jumped to the forefront of Chinese business activity, but this development is likely to be temporary: The pattern over time is for Chinese enterprises to move as a group from region to region. The U.S. should take this opportunity both to welcome Chinese investment and to respond to it according to our laws and values.

Quick Hits:

- Yesterday, President Obama signed a law that will give him and future Presidents and their spouses armed Secret Service protection for life.

- “Vice President Joseph Biden will deliver his recommendations for comprehensive gun violence legislation on Tuesday,” reports The Huffington Post.

- You have apps on your phone—what about apps for your car?

- What’s in store for the next Treasury Secretary? National Journal has some expectations.

- Join us today at noon ET for a Google+ Hangout to talk about the money for Hurricane Sandy relief—or whatever else Congress is throwing into the bill.