Top 10 Heritage Charts of 2012

Ericka Andersen /

If you’ve read our work, you probably know we love charts. Our signature products — the Index of Economic Freedom and Federal Budget in Pictures — include some amazing informational graphics. We also showcase our charts weekly on The Foundry and in many of our research papers. Today we bring you 10 of the most popular from 2012.

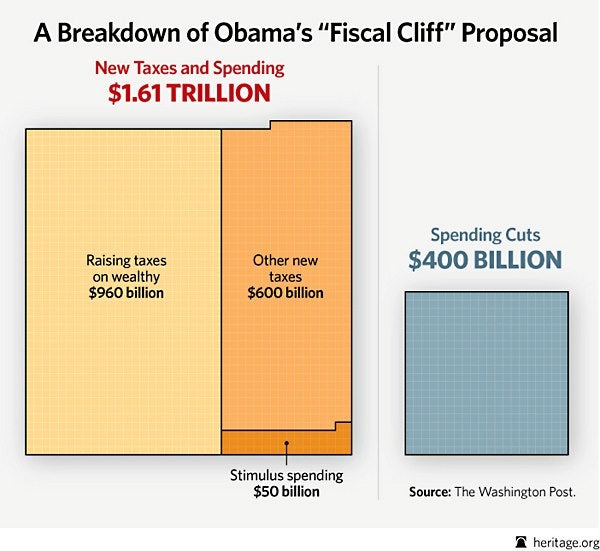

1. One of the biggest issues of 2012 was the fiscal cliff. It wasn’t always easy to understand, so we broke it down for you. This chart shows President Obama’s tax-heavy proposal.

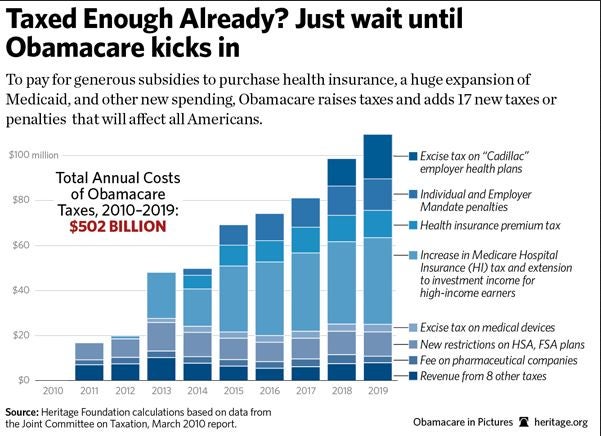

2. There are 18 tax hikes included in Obamacare to pay for the President’s takeover of the healthcare industry. We published a chart detailing each of these tax hikes along with a timetable of when the tax takes effect.

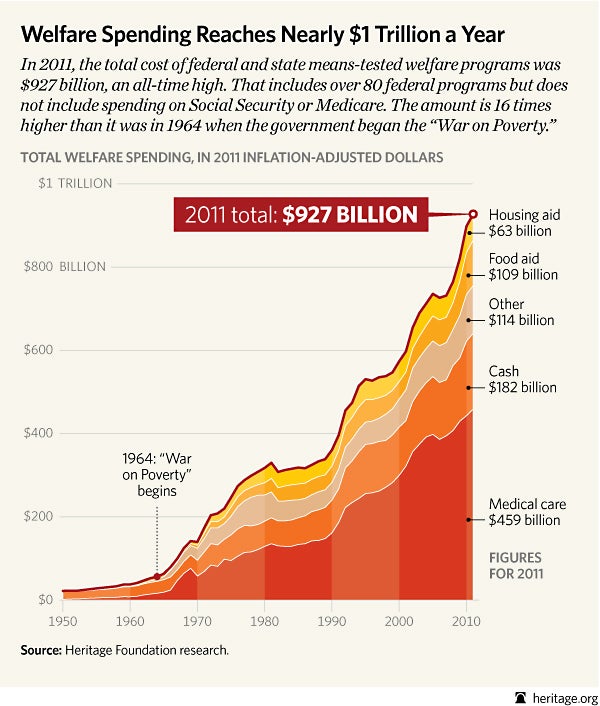

3. In 2011, the total cost of federal and state means-tested welfare programs was $927 billion, an all-time high. That includes more than 80 federal programs but does not include spending on Social Security or Medicare. The amount is 16 times higher than it was in 1964 when the government began the “War on Poverty.”

4. To pay for generous subsidies to purchase health insurance, a huge expansion of Medicaid, and other new spending, Obamacare raises taxes and adds new taxes or penalties that will affect all Americans.

5. Slashing America’s defense budget by a half-trillion dollars will jeopardize the military’s ability to defend the nation. Let’s cut entitlement spending — not pull the rug from beneath our soldiers.

6. Spending on Medicare, Medicaid, Social Security, and the Obamacare subsidies will soar as 78 million baby boomers retire and health care costs climb. Total spending on federal health care programs will more than double. Future generations will be left with an untenable debt burden.

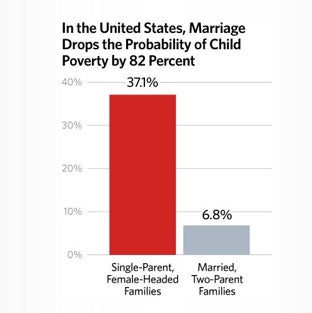

7. The collapse of marriage, along with a dramatic rise in births to single women, is the most important cause of childhood poverty—but government policy doesn’t reflect that reality.

8. This year’s Index of Dependence on Government presented startling findings about the sharp increase of Americans who rely on the federal government for housing, food, income, student aid or other assistance.

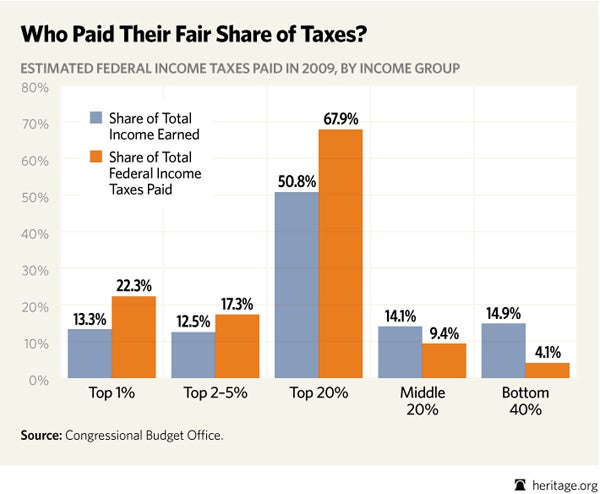

9. People were very interested to know who pays their fair share of taxes. When President Obama and his supporters complain that the rich are not paying their fair share of taxes, and Warren Buffett suggests another tax to ensure that they start paying more, someone should show them this chart. If the argument is that America must ensure that the rich pay, it must just be rhetoric—because they are already paying.

10. In the United States today, the entitlement culture is rampant. Dependence on government for things like food, housing, income, student aid and more — is higher than it’s ever been.