Chart of the Year: Entitlements and Interest Drive the Fiscal Crisis

Romina Boccia /

The end of 2012 was marked by lawmakers engaging in a distracting fiscal cliff debate over tax rates when the solution to the real fiscal crisis lies in an entirely different area of the budget.

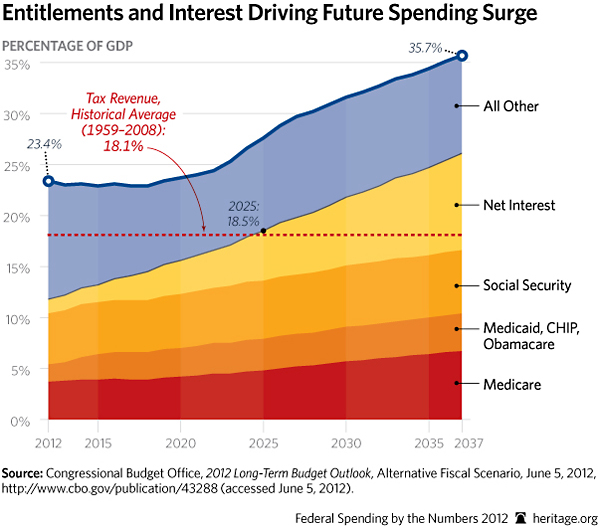

Federal spending on entitlements and interest on the debt drives the federal budget crisis. Together the three major entitlements of Social Security, Medicare, and Medicaid (including Obamacare), as well as net interest, make up more than half of all spending in the federal budget today. Their share of the budget will grow to over two-thirds of all spending in 10 years.

By 2025, the major entitlement programs and net interest together will eat up all tax revenues collected in that year. This implies that all other government spending, including for national defense, would have to be financed by borrowing.

This projection by the Congressional Budget Office assumes that historically low interest rates continue at least until 2015 and that inflation will be modest, inching up toward 2 percent of gross domestic product (GDP) by 2017. Nevertheless, spending on interest on the debt would double before the end of the decade.

Should the Federal Reserve’s continued and prolonged quantitative easing lead to more severe inflation—a risk that is very real—the dangerous scenario painted in the chart of the year could come about even sooner.

One thing is clear: Lawmakers are playing a risky game for as long as they neglect to address the structural problems in the entitlement programs that are driving the nation deeper and deeper into debt. Reform is inevitable. The only question: Will lawmakers develop the political will before the real fiscal crisis hits or will they be forced into making changes in the midst of it?