Priced Out of the American Dream: A Would-Be Homebuyer’s View From Wisconsin

Andrew Weiss /

EAU CLAIRE, Wis.—Craig Ervin, a skilled welder from my hometown of Eau Claire, is forced to rent.

“I always wanted my own place, but I don’t even bother looking anymore. Gets my hopes up, then I see the prices. It’s just depressing how expensive it’s gotten,” he said.

Like many Wisconsinites, Ervin is wondering how different policymakers would bring down the cost of living.

Ervin is the epitome of a hardworking American who did everything right, but still finds his paycheck stretched thin. He graduated from Chippewa Valley Technical College, where he learned to interpret complex blueprints and weld piping systems to precise specifications.

Ervin would love to buy a house, but buying one costs nearly $1,000 more per month than it would have four years ago.

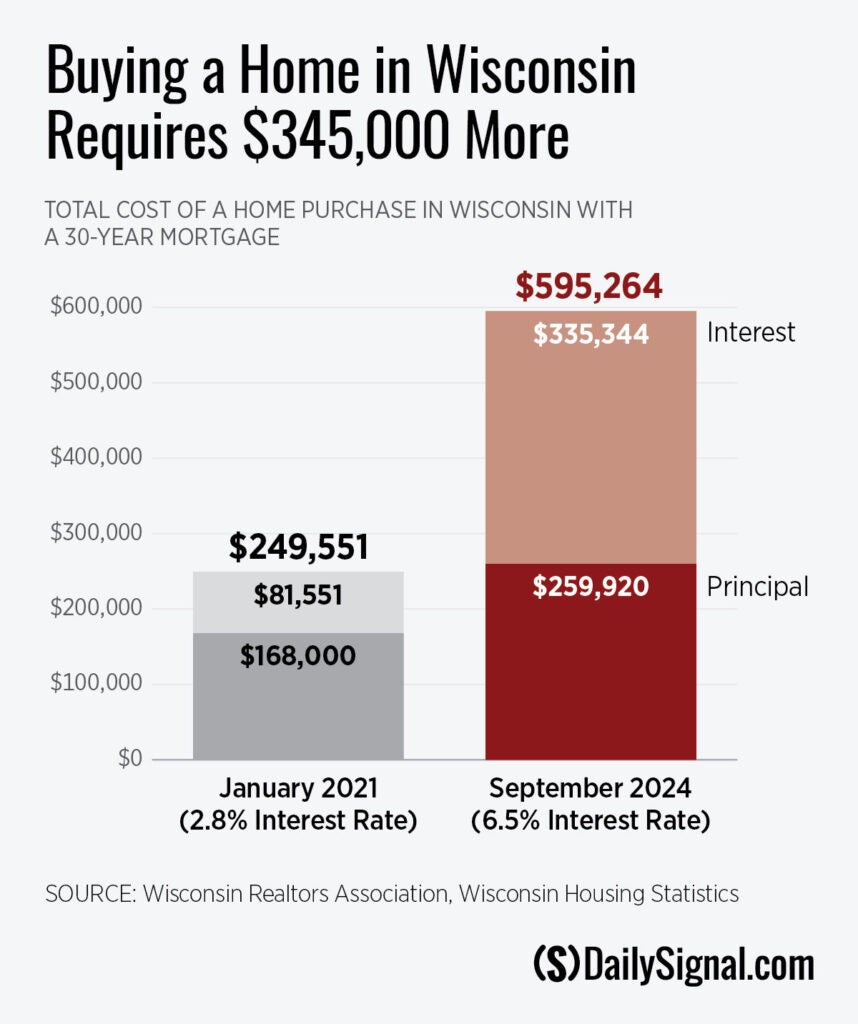

In fact, Wisconsin homebuyers now face a quarter-million-dollar increase in interest payments over the life of a 30-year mortgage. The median selling price for a home in Wisconsin has increased from $210,000 to $324,900 since January 2021.

In addition, interest rates are more than double what they were, increasing from under 3% to nearly 7% today.

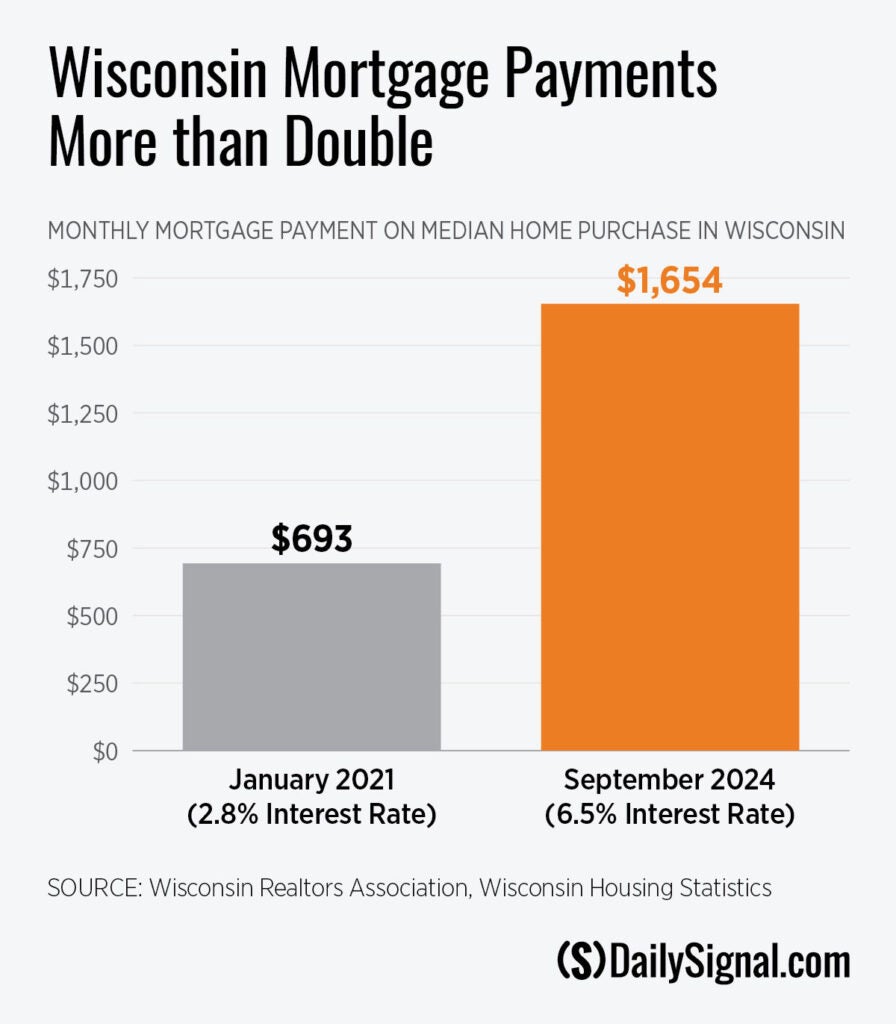

With a 20% down payment, the principal and interest on a mortgage for the median-priced home in Wisconsin in January 2021 cost $693 per month. Buying the same house today costs $1,654 per month, a 138% increase.

At the same time, the median 20% down payment has increased by $23,000.

Effectively, Ervin’s potential mortgage costs $345,000 more than it would have.

Vice President Kamala Harris says inflation is a result of corporate price-gouging. So, to fix inflation, she is proposing a ban on gouging. Such price-setting measures will do nothing to ease interest rates.

Basic economic principles and recent history consistently show that when governments impose price ceilings, shortages follow. Look no further than the 1970s, when government-mandated caps on gasoline prices led to the most severe fuel shortage in our nation’s history.

The same principle applies to construction materials and rent-control policies, which result in reduced housing availability and quality.

The supply of existing homes for sale is shrinking, too. Many homeowners aren’t selling their properties because it would mean giving up their low 2% to 3% interest rates for much higher rates.

This also puts pressure on the rental market because renters who would otherwise purchase a home stay in the rental market. The housing market will remain frozen as long as interest rates remain high.

Here’s what’s really happening: Inflation is caused by massive government overspending.

When the government borrows and spends trillions of dollars, it floods the economy with money. This surge in money outpaces the production of goods and services, causing the dollars in our pockets to lose value relative to things we buy (otherwise known as inflation). To combat this, the Federal Reserve raises interest rates, making borrowing more expensive for banks, businesses, and everyday Americans like Ervin.

A would-be Harris administration would continue this spending trend, offering $25,000 for down payments to first-time homebuyers. However, injecting more demand into an already overheated market will likely not achieve the intended outcome.

Rather than making housing more affordable, that policy would drive up home prices substantially, while also increasing the budget deficit.

When the government spends money, it needs to be paid for eventually. The public pays either directly through taxes or indirectly though inflation.

The COVID-19 pandemic spending financed by trillions in borrowed dollars has led to the recent inflation, imposing a hidden tax that silently erodes the purchasing power of Ervin’s and every other American’s hard-earned money.

To return to an America where the reward for hard work is affordable living, the government needs to stop its reckless spending. Harris’ plan to ban inflation won’t fix the underlying problem of government spending, but it will cause housing and food shortages.

Hardworking Americans such as Ervin are the backbone of our country’s industrial might. Housing is out of reach for many Americans, and Washington’s reckless spending has tangible effects on the lives of hardworking people in Wisconsin and every other state.

Ervin isn’t asking for handouts. He simply wants Washington to step back so his hard work can once again be enough to achieve the American dream.