This Calculator Tells You the Size of Inflation’s Bite Into Your Household Budget

Nicole Huyer / Miles Pollard /

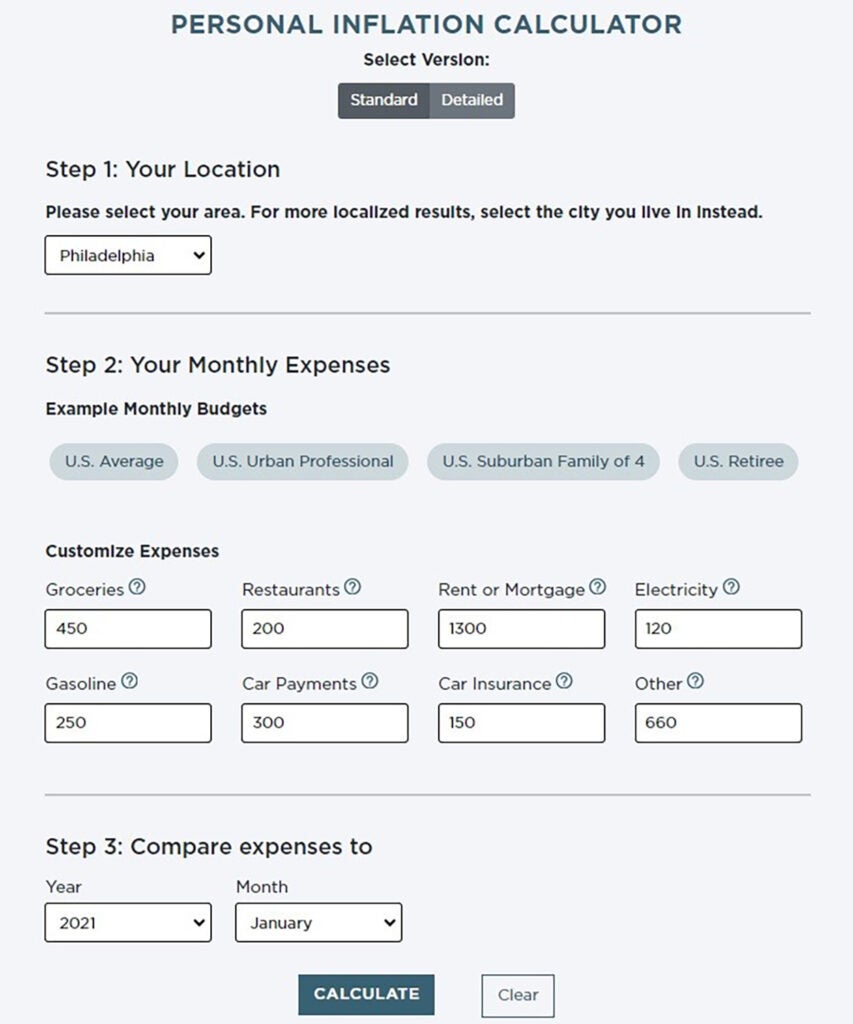

While many economic pundits point to cooling inflation, The Heritage Foundation’s new Personal Inflation Calculator showcases the cumulative effect of inflation on the average American.

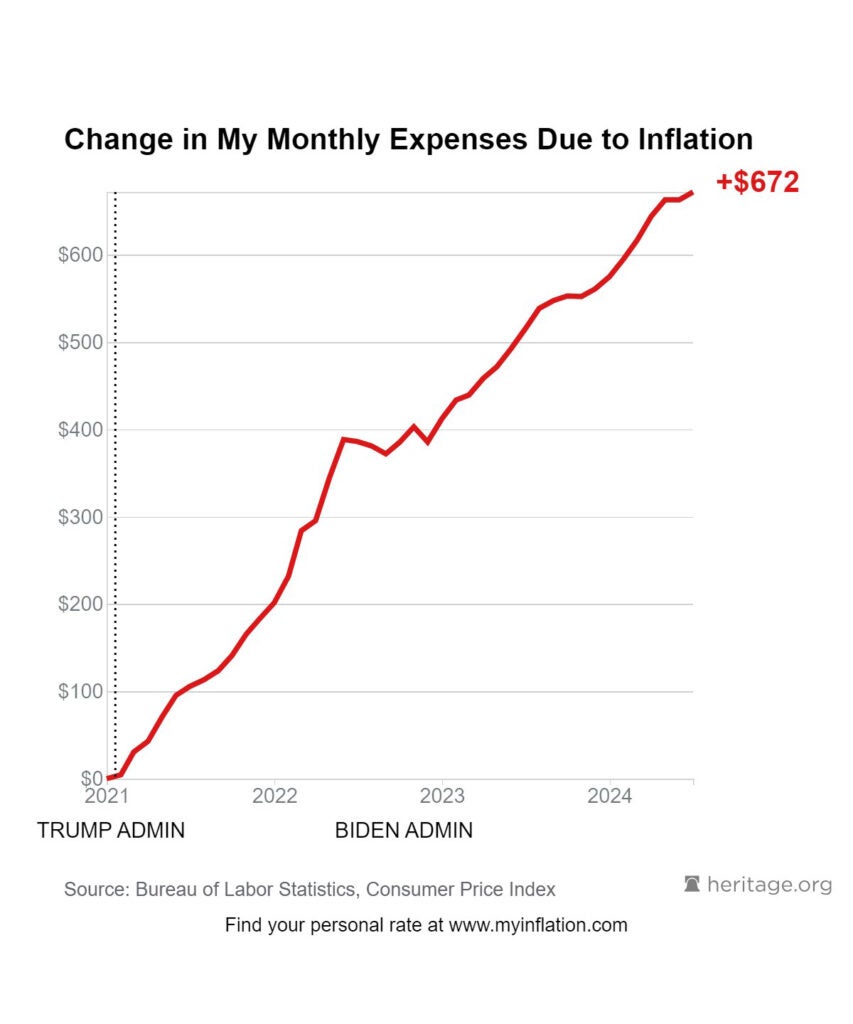

Since the Biden-Harris administration took office in January 2021, Americans have felt the pain of rising prices. The federal government’s excessive spending and borrowing habits led to record-high inflation.

Prices increased for everyone, and Americans are unable to afford the same lifestyle they enjoyed just four short years ago.

Take, for example, the fictitious Rachel in a financial vignette: Rachel is a 25-year-old marketing professional who works at the headquarters of Urban Outfitters in Philadelphia.

Rachel finds that, despite modest salary increases, she can’t enjoy the standard of living she did before inflation caused the purchasing power of her paychecks to shrink so rapidly.

Let’s assume Rachel began working in 2021 with an entry salary of $50,000 per year. By 2024, her annual salary has increased by 10% to $55,000. However, despite this pay increase, someone like Rachel still would feel financially squeezed.

The largest pain in Rachel’s budget is her rent. Like so many other recent graduates and young professionals, Rachel has a small apartment an hour away from the city where rent is significantly cheaper. Her housing costs have risen from $1,060 to $1,300 a month, a staggering 23% increase, which makes other expenses such as student loan payments more burdensome.

Despite driving a sensible 2017 Honda Civic, gas prices nearing $4 a gallon have made Rachel’s commute increasingly expensive. She now spends $250 per month on gas, 33% more than in 2021, because of her long commute. However, the largest percentage increase in Rachel’s transportation budget has been her car insurance, which surged by over 54% from 2021 to 2024.

Essential utilities such as electricity are now more burdensome—Rachel’s electric bill went up by 38%. Rachel has had to skip out on meals with friends more often as restaurant costs jumped almost 20%. She now pays 23% more for groceries, an increase from $375 to $450 per month, for staples such as eggs, bread, chicken, and fresh vegetables.

In total, Rachel now spends nearly $700 more per month for the same goods and services as she did in January 2021, when Joe Biden and Kamala Harris became president and vice president.

Though her wages increased by 10%, real cumulative inflation for Rachel rose 24% in three and a half years—and millions of Americans face a similar reality.

Housing, transportation, energy, and food prices all have gone up significantly because the Biden-Harris administration is unwilling to curb the government’s excessive spending and borrowing habits.

Why should anyone—Rachel, you, or your family—be forced to sacrifice essentials while the government maxes out a credit card in your name?

How much have you lost from the inflation tax?

Use this Personal Inflation Calculator from The Heritage Foundation to find out how much inflation has cost you and your family.