How to Make Social Security Work Better for Women

Romina Boccia /

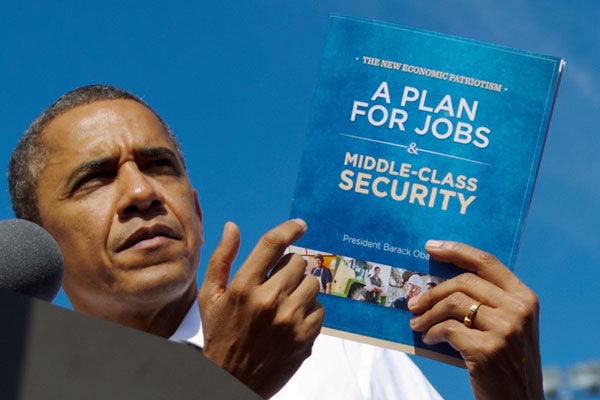

President Obama’s recycled economic plan sorely lacks the much-needed reforms to make Social Security work better for women.

The program needs to do a better job dealing with the circumstances women face in retirement. More women than men rely on Social Security as their sole source of income, and yet their benefits are lower on average. Social Security is failing especially non-married women, who face some of the highest poverty rates in retirement. The program is in dire need of structural reforms.

Among retired workers, women received $300 less than men in Social Security benefits in 2010, collecting only $1,023 in monthly benefits on average. Women are more likely than men to lack all of the necessary 35 years of payroll tax contributions to qualify for full benefits, as many take time off from the workforce to care for children and elderly parents. And those who don’t have a full work history are even worse off. Many seniors receive benefits below the federal poverty level.

Women are particularly at risk. Non-married women are almost twice as likely to retire in poverty, with 15.5 percent being poor, compared to the average among all Social Security recipients of 8.9 percent. Retiring in poverty is hardly a way for women to “retire with dignity and the respect that they’ve earned,” as the President says in his new booklet. And yet the President has no agenda to improve their situation or to reform Social Security at large.

Social Security’s growing and permanent deficits are threatening an across-the-board 25 percent benefit cut in 20 years. The President won’t even acknowledge Social Security’s financial problems and instead stated during the first presidential debate that the program was “structurally sound.” This coming benefit cut would affect women—whose benefits are already lower than men’s—the most.

The Heritage Foundation has a plan to strengthen Social Security for all seniors, including women, assuring them protection from poverty in retirement. Under Saving the American Dream, Social Security would gradually transition to a flat benefit of about $1,200 that provides predictability and economic security for all. This benefit is higher than the average benefit women receive today and would always be above the poverty level.

The Heritage plan would also make Social Security a properly financed, true insurance program. By limiting benefits to those who actually need them, the Heritage plan would avert the looming cut to Social Security’s benefits for all recipients, and it would do so without burdening younger generations with higher taxes.

Retiring in poverty is far from retiring with dignity and respect. The President has not put forth a plan to reform Social Security so that all seniors, including women, may find economic security in retirement.