How Much Federal Income Tax Do the Rich Pay?

Preston Brashers /

Politicians on the Left portray the rich in America as a bunch of freeloaders who don’t pay their fair share of taxes.

These politicians suggest that many of society’s problems could be solved if only the rich would be less greedy and hand over more of their money to the government to spend.

There are three problems with this argument.

First, many of society’s problems are caused by the government spending too much—inflation is a prime example.

Second, the argument ignores the greed of the politicians who want to spend other people’s money.

Third—and this is the crux of the matter—the rich already pay a disproportionate share of federal taxes.

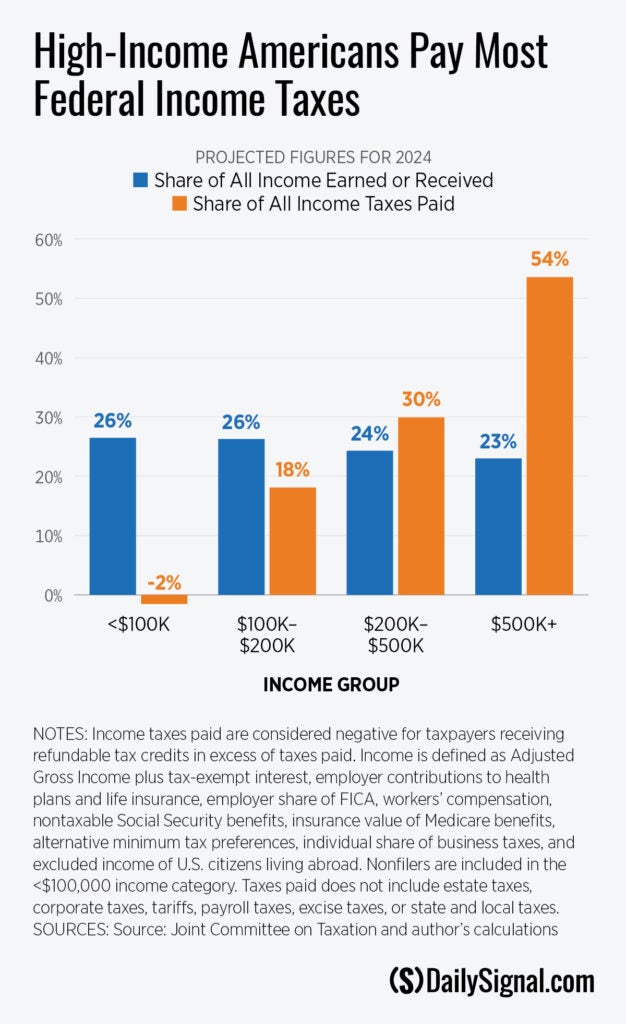

Here are the numbers, according to the government forecasters at the Joint Committee on Taxation.

In 2024, about 1 out of 180 American taxpayers will make $1 million or more of total income, based on a broad definition of income used by the forecasters.

Altogether, these million-dollar earners will earn about 15% of the nation’s income next year. But they will pay 39% of all federal income taxes.

The million-dollar earners will pay an average federal income tax rate that is 3.5 times higher than the other 99.4% of Americans.

Politicians also peddle the claim that millionaires and billionaires pay a lower tax rate than schoolteachers, nurses, firefighters, sanitation workers, or whatever group they’re pandering to on that particular day.

President Joe Biden has even suggested that millionaires pay not only a lower rate, but “less in taxes” than these other Americans.

That couldn’t be further from the truth.

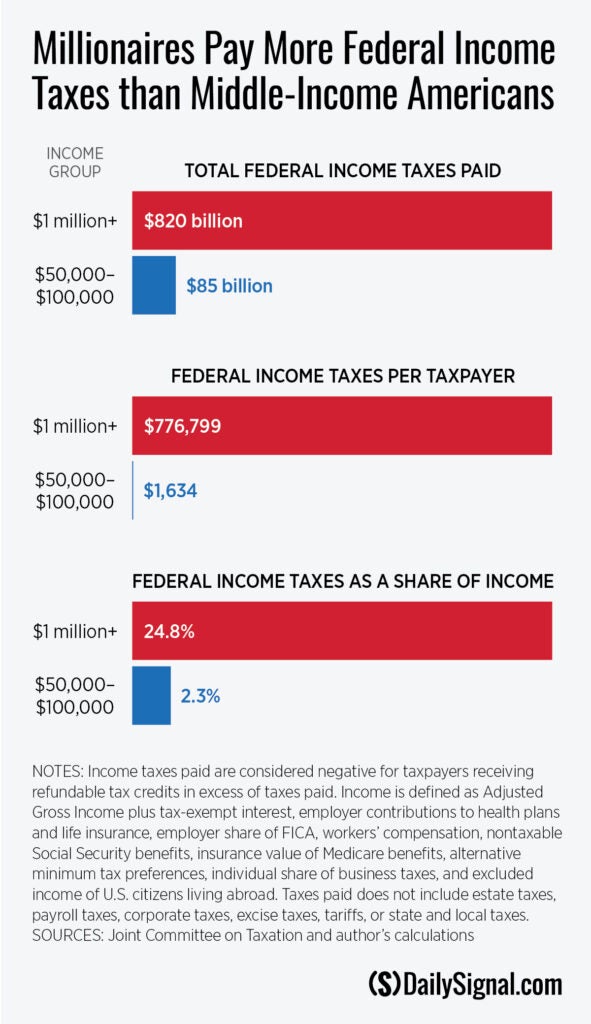

Based on the government forecasters’ estimates, those earning a million dollars or more in 2024 will pay an average of about $776,800 in federal income taxes, about 475 times as much as the average American taking home between $50,000 and $100,000.

As a percentage of income, it’s somewhat more even. But still, for every dollar of income, the millionaire category will fork over more than 10 times as much in federal income taxes as their middle-income compatriots.

However you look at it, the rich directly pay a huge share of federal income taxes.

But for politicians who routinely propose trillion-dollar increases in federal spending, the higher priority seems to be convincing voters that somebody else can and should pay for their spending sprees. After all, if every household paid an equal share of taxes, each household would be on the hook for more than $7,500 in additional taxes for each trillion dollars of new federal spending.

The “pay your fair share” malarkey is a diversion meant to distract Americans from seeing just how big of a share the federal government is taking out of the economy.

America’s economic malaise isn’t a consequence of the rich being allowed to keep too much of the money they earn, it’s a consequence of the federal government draining massive amounts of resources out of the private economy by spending about $7 trillion a year—more than $50,000 per American household.

America’s economic troubles are multiplied by the federal government’s regulating businesses to death and by the Federal Reserve’s inflating away the purchasing power of each dollar by printing more and more money to buy up federal debt.

The inflation that comes with a bloated federal government is a hidden tax that hits all Americans, but that doesn’t show up in tax distribution charts.

And that brings us to another Biden claim: that those making less than $400,000 won’t pay a penny more in federal taxes under his policies.

In fact, Biden has implemented and proposed numerous tax increases that would directly hit middle-income Americans. But none of them has hit as hard as the hidden and indirect tax known as inflation that followed Biden’s runaway spending.

And this is a critical point. Tax distribution charts show that the rich pay a disproportionate amount of federal taxes, but they don’t show how much of the economic fallout of excess taxes and spending ultimately lands on the middle class.

When excess federal spending and taxes drive up businesses’ costs and force business owners to raise their prices, nurses and schoolteachers must pay more for their groceries, rent, and gas.

When high taxes lead a manufacturer to eliminate bonuses, cut benefits, or move jobs overseas, workers pay the price.

When high taxes discourage entrepreneurship and stifle innovation, firefighters, sanitation workers, and everyone else who would have benefited from better, more affordable products suffer.

These downstream effects on the middle class don’t show up in tax distribution charts, but they’re no less real than the taxes that come out of Americans’ paychecks.

If the solution to what ails the middle class was more government and high taxes on high-income Americans, then Americans would be sitting pretty right now.

But if that’s not working for everyday Americans—and there’s every indication that it’s not—maybe it’s time to make the federal government tighten its belt for a change.