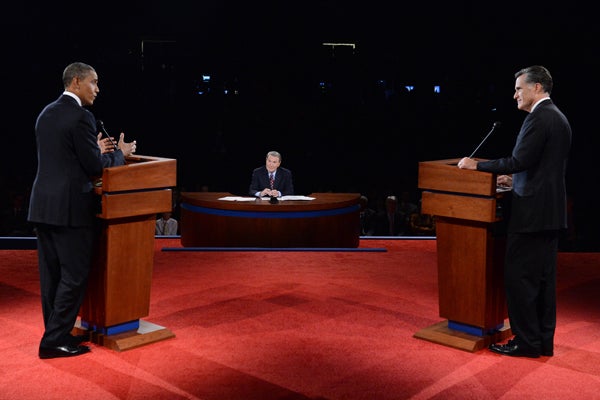

First Presidential Debate 2012: Top 10 True/False Quiz

Romina Boccia /

During last night’s presidential debate, claims were flying fast and furious. Some of these claims were true, others false. Here are the top 10—see which ones you can guess as either true or false.

1. Governor Mitt Romney’s tax plan would burden the middle class.

President Obama: “[I]ndependent studies looking at this said the only way to meet Governor Romney’s pledge of not reducing the deficit or—or—or not adding to the deficit is by burdening middle-class families.”

False. This incorrect assertion was spread by a biased report from the Tax Policy Center. Romney’s plan can make pro-growth changes to the tax code and doesn’t have to raise taxes on the middle class.

2. Obamacare raises taxes and cuts Medicare.

Former Governor Romney: “You’ve raised [taxes] by $1 trillion under Obamacare [and] cut Medicare by $716 billion.”

True. Over the coming decade, Obamacare’s taxes will reach $1 trillion, including new taxes on workers’ wages and capital income, as well as taxes on insurers and manufacturers of medical products. Obamacare also cuts Medicare by $716 billion from 2013 to 2022 and uses the savings to pay for other provisions in Obamacare, not to help shore up Medicare’s finances. Many of Obamacare’s 18 new or increased taxes and penalties would fall directly on the middle class—like the ever-controversial individual mandate tax, which is primarily paid by middle- and low-income Americans, as reported by the Congressional Budget Office.

3. Seniors would receive vouchers under Medicare reform.

Obama: “The idea, which was originally presented by Congressman Ryan, your running mate, is that we would give a voucher to seniors and they could go out in the private marketplace and buy their own health insurance.”

False. There is no premium support proposal that would issue seniors a voucher. The Ryan proposal, like all major premium support models, is a defined-contribution system that would provide direct payment from the government to a health plan of a person’s choice, including traditional Medicare. Health plans would have to meet government standards, including benefit standards of the traditional Medicare program, plus new and much-needed protections against the costs of catastrophic illness. Moreover, Congressman Ryan is not the first to propose premium support; its origins are bipartisan and date back to the 1990s.

4. Romney would cut taxes by $5 trillion.

Obama: “Governor Romney’s central economic plan calls for a $5 trillion tax cut.”

False. Governor Romney’s tax plan doesn’t cut taxes. His plan is revenue neutral.

5. Dodd–Frank promises to bail out “too-big-to-fail” firms.

Romney: “Dodd–Frank was passed. And it includes within it a number of provisions that I think has some unintended consequences that are harmful to the economy. One is it designates a number of banks as too big to fail, and they’re effectively guaranteed by the federal government.”

True. Dodd–Frank contains language that would make future bailouts of “too big to fail” firms inevitable, but it does nothing of consequence to reduce systemic risk.

6. The oil industry receives $4 billion in corporate welfare that other businesses don’t get.

Obama: “The oil industry gets $4 billion a year in corporate welfare. Basically, they get deductions that those small businesses that Governor Romney refers to, they don’t get.”

False. A large part of that $4 billion figure comes from a broadly available tax provision and expensing options. These are neither subsidies nor corporate welfare. The tax deduction, under Internal Revenue Code Section 199, goes to all domestic manufacturing. Producers of clothing, roads, electricity, water, renewable energy projects, and many other things produced in the United States are eligible for the manufacturer’s tax deduction—including Hollywood movies.

7. Natural gas production is up in spite of Obama’s policies, not because of them.

Romney: “[T]he President pointed out correctly that production of oil and gas in the U.S. is up. But not due to his policies. In spite of his policies. Mr. President, all of the increase in natural gas and oil has happened on private land, not on government land.”

True. Much of the increased oil and gas production is on private lands, over which the Administration has no control. According to a recent report from the Energy Information Administration, energy production decreased 13 percent on federal lands in fiscal year (FY) 2011 compared to FY 2010.

8. Businesses can take a deduction for moving jobs overseas.

Obama: “I also want to close those loopholes that are giving incentives for companies that are shipping jobs overseas.”

False. President Obama falsely claimed businesses can take a deduction for moving jobs overseas. No such deduction exists. Moreover, President Obama demonstrates a fundamental misunderstanding of how the global economy works by suggesting that companies investing overseas destroy jobs at home. A U.S. business investing abroad is good for the U.S. economy because it makes the company more competitive at home and abroad in selling products into global markets, which often creates more jobs for Americans.

9. America’s corporate tax rate is uncompetitive.

Obama: “When it comes to our tax code, Governor Romney and I both agree that our corporate tax rate is too high, so I want to lower it, particularly for manufacturing, taking it down to 25 percent.”

True. At over 39 percent, the U.S. has the highest corporate tax rate among industrialized nations. The average of all industrialized countries in the Organization for Economic Co-operation and Development (OECD), including the U.S. rate, is about 25 percent. To regain standing compared to competing nations, Congress should lower the rate so it is on par with the current OECD average. Despite this, President Obama has proposed to raise taxes on those firms with multinational operations. This would not insource jobs, but outsource ownership of U.S. firms.

10. Social Security is structurally sound.

Obama: “Social Security is structurally sound. It’s going to have to be tweaked, [but] the basic structure is sound.”

False. Social Security is running permanent and growing deficits, threatening a 25 percent cut in Social Security benefits in 21 years. The Congressional Budget Office (CBO) recently confirmed that Social Security has been running deficits of about 4 percent for two years in a row and that these will only get worse over time. CBO projects that Social Security’s deficits will average 10 percent over the next decade and then exceed 20 percent by 2030 as more baby boomers retire.