Social Security: Runs Permanent Deficits, Benefit Cuts Loom

Romina Boccia /

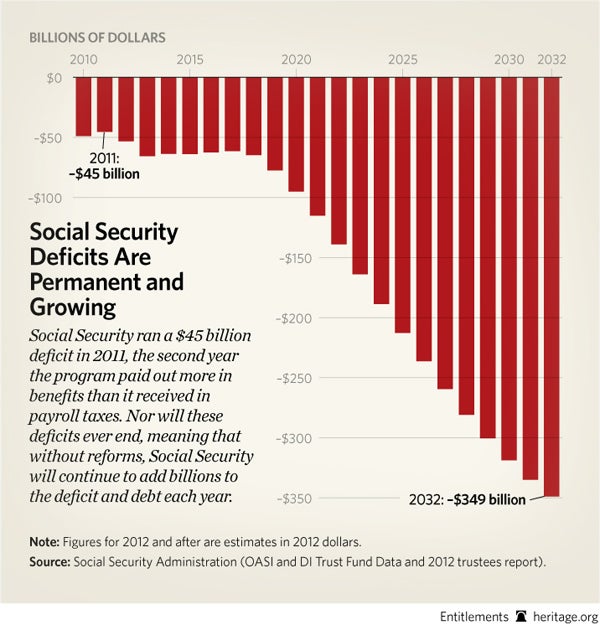

Social Security paid out more to retirees and other beneficiaries than it collected in tax revenue in 2011. This is the second straight year the program is running deficits, as highlighted in a recent Congressional Budget Office (CBO) report.

Social Security’s finances will only get worse without reform, as the program will run growing deficits into perpetuity.

CBO is the second reputable, nonpartisan organization to point out this year that Social Security has promised more in benefits than it can afford to pay. Social Security’s growing financial woes were already reported on in April in the Social Security Trustees report. As Heritage retirement expert David John reported:

The April 23 report shows that all people who receive Social Security benefits face about a 25 percent benefit cut as soon as 2033.… In 2011, Social Security spent $45 billion more in benefits than it took in from its payroll tax. This deficit is in addition to a $49 billion gap in 2010 and an expected average annual gap of about $66 billion between 2012 and 2018. These deficits will quickly balloon to alarming proportions. After adjusting for inflation, annual deficits will reach $95 billion in 2020 and $318.7 billion in 2030 before the trust fund runs out in 2033.

CBO now repeats this story in its report 2012 Long-Term Projections for Social Security. According to CBO, the program’s outlays exceeded tax revenue by 4 percent last year, and these deficits will only increase. CBO projects Social Security’s deficits will average 10 percent over the next decade and then rise to exceed 20 percent by 2030 as more baby boomers retire.

These deficits are adding to the nation’s debt today. Andrew G. Biggs of the American Enterprise Institute (and former principal deputy commissioner of the Social Security Administration) explains that:

on a unified budget basis, when Social Security’s financial position worsens the budget deficit grows. Social Security today contributes about $53 billion to the budget deficit—$165 billion if we include the temporary payroll tax cut designed to stimulate the economy—rising to $100 billion by 2020 and never looking back.

While CBO’s and the trustees’ numbers differ somewhat, the important take-away is the same: Social Security’s finances are in dire need of reform if the program is to provide seniors protection from poverty in retirement and do so in an affordable and sustainable manner.

Some of these reforms should be no-brainers, such as raising the Social Security retirement age gradually and indexing it to life expectancy to reflect Americans’ ability to live longer lives. Other changes are bolder, such as slowly moving to a flat Social Security benefit that keeps seniors out of poverty and making income adjustments to Social Security to target benefits to those who need them most.

In the current system, some seniors who worked the necessary 35 years receive benefits below the poverty line. Meanwhile, millionaires’ children receive benefits on top of their parents’ lucrative wealth portfolios. Such a system is sorely broken and in need of a serious overhaul.

The Heritage Foundation’s plan, Saving the American Dream, strengthens Social Security as a protection against senior poverty in an affordable and sustainable way.