House Budget Panel Republicans Deliver Plan to Tackle $33T Debt

David Ditch /

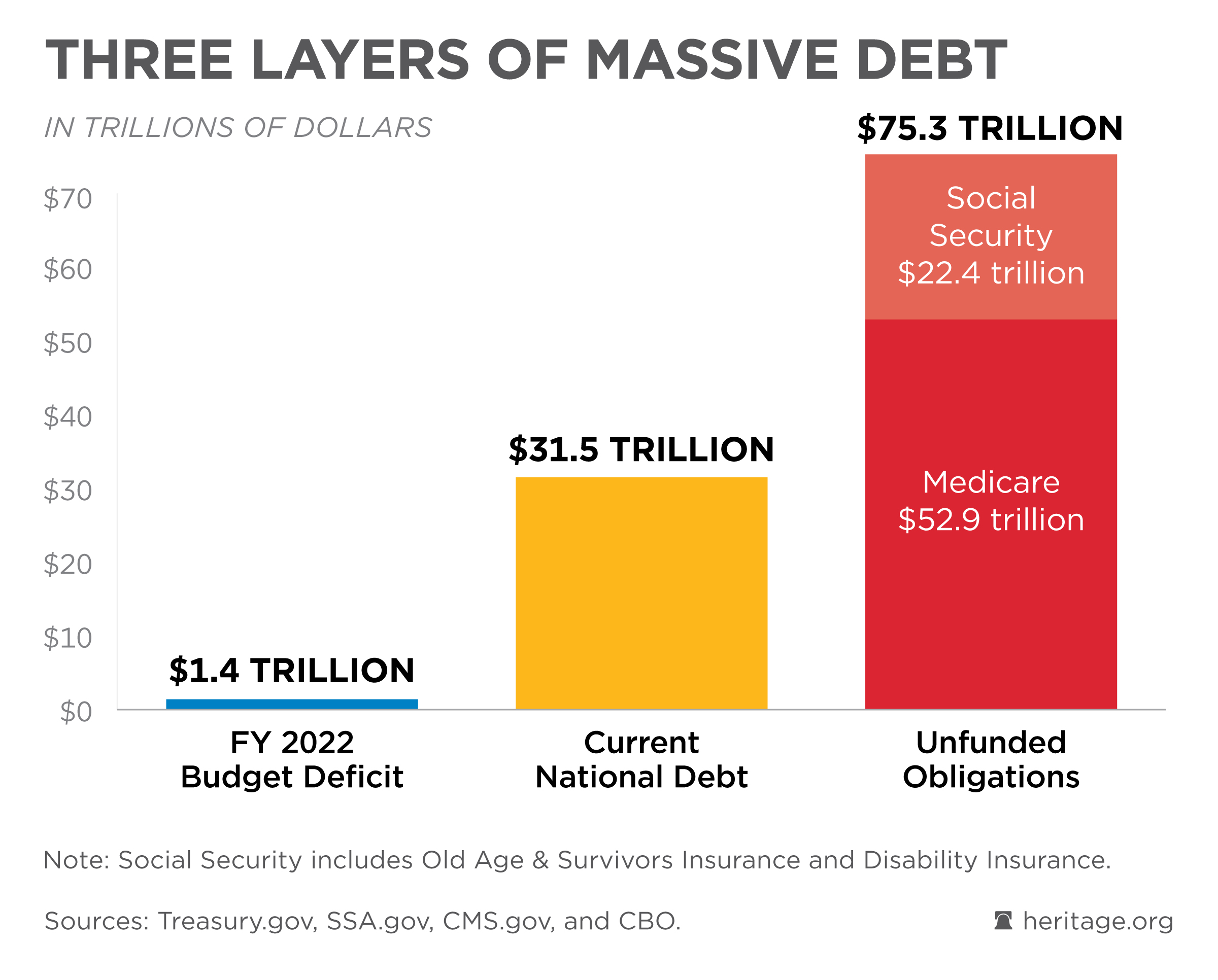

The federal government reached an ominous milestone Sept. 15 as the gross national debt exceeded $33 trillion—or more than $57,000 per household.

The debt increased by $1.5 trillion in just 15 weeks due to rising spending and declining revenue.

That’s understandably concerning, especially at a time of rising interest rates and elevated inflation. Higher interest rates on a growing debt have caused a hard spike in federal interest payments, eating into the budget and dragging on the economy.

However, the worst may be yet to come. Imbalances in major benefit programs, such as Social Security and Medicare, mean that the federal government faces unfunded liabilities of more than $75 trillion.

With senators ignoring this reality by planning to spend billions of additional dollars on boondoggles, and the Biden administration all but lighting tax dollars on fire to appease climate activists, it seems that few in Washington are interested in fiscal sanity.

>>>Related: “The Road to Inflation: How an Unprecedented Federal Spending Spree Created Economic Turmoil”

Fortunately, the House Budget Committee has released a budget that could help turn things around.

Led by Chairman Jodey Arrington, R-Texas, the committee’s new “Reverse the Curse” plan offers many things for Americans to cheer. It:

- Ambitiously seeks a balanced budget within a decade.

- Eliminates or overhauls dozens of wasteful and unnecessary federal programs, and proposes efficiency reforms for Medicare.

- Builds from the House-passed Limit, Save, Grow Act, which creates spending caps.

- Significantly reduces projected interest payments on the national debt by quickly reducing annual deficits.

- Stops the IRS hiring spree in its tracks.

- Retains pro-growth tax rates.

This is a strong contrast to the year’s irresponsible budget from President Joe Biden, which included:

- Runaway spending that would hit $10 trillion in 2033 alone.

- $4.7 trillion in tax hikes.

- Debt growing faster than the economy, even with the tax hikes, meaning the Biden budget is unsustainable on its own terms.

- Big increases for leftist institutions, such as the federal Department of Education, while ignoring the crisis on the border.

Another important factor in the House Budget Committee’s plan is facilitating stronger economic growth.

Restraining the regulatory state and cutting red tape would encourage more private investment, driving new jobs and innovations. That would help draw people from welfare programs and into the workforce, further reducing spending.

Also, growing the economy reduces the relative burden of existing debt.

In contrast, Biden’s Big Government plan would keep the economy mired in taxes, political slush funds, and an unleashed regulatory state that seeks to strangle America’s energy sector.

Arrington’s plan has tremendous potential. However, the Budget Committee faces many limitations.

First, Senate Democrats and the Biden administration are united in opposition to a policy agenda that reduces Washington’s stranglehold over the country. As such, most of the important work will likely have to wait until at least 2025.

Second, while the budget plan is an important collection of policy principles, the Budget Committee has a relatively small jurisdiction. Most of the work must be done by authorizing committees, which are often more comfortable with handouts and bureaucracies than with seeking bold reforms.

Accordingly, to truly “reverse the curse” and put the budget plan into action, the American public needs to make it clear that they will no longer tolerate Washington’s swampy status quo.

The last time that Congress made meaningful spending cuts was in the wake of the tea party movement, which not only sent many energetic conservatives to the House and Senate, but also pressured centrist members to do the right thing.

A similar (and more sustained) reckoning is needed to accomplish the ambitious plan laid out by the House Budget Committee.

It won’t be easy to steer the federal government to an affordable future, but the alternative of runaway debt, interest payments, and inflationary pressures would mean nothing less than the death of the American dream.

Have an opinion about this article? To sound off, please email [email protected] and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.