Obamacare Raises Taxes on 3 Million Middle-Class Americans

James Sherk / Ashley Shelton / Stephanie Jaczkowski /

President Obama repeatedly promised not to raise taxes on middle-class families. Yesterday, the Supreme Court ruled that he already has.

Chief Justice John Roberts upheld the President’s health care law on the grounds that the “individual mandate” is a constitutionally permissible tax increase. This violates Obama’s pledge. Middle-class families will pay the vast majority of these new taxes.

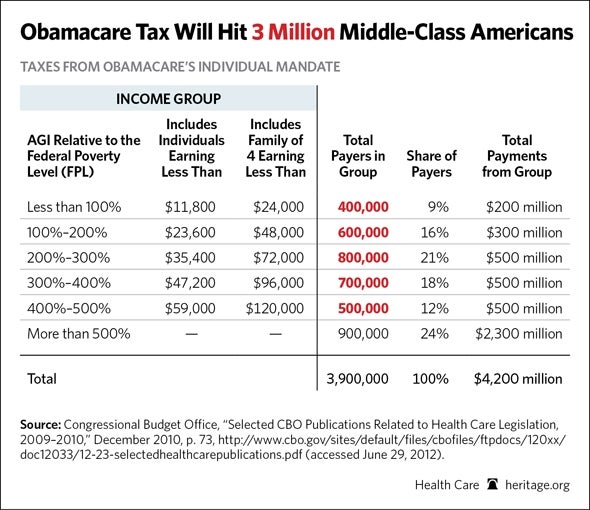

Obamacare imposes a penalty—or tax increase—on Americans who do not purchase health insurance. The Congressional Budget Office estimates that most of those paying these taxes are middle-class individuals and families making less than 500 percent of the federal poverty level: $59,000 for an individual and $120,000 for a family of four. Three million lower-income and middle-class Americans will pay an estimated $2 billion in these “mandate taxes.”

The Supreme Court’s interpretation puts the President in a peculiar situation. In 2008, he promised not to raise taxes on the middle class and accused Republican nominee John McCain of wanting to tax health benefits: “And I can make a firm pledge: under my plan, no family making less than $250,000 will see their taxes increase…not any of your taxes. My opponent can’t make that pledge.… [H]e wants to tax your health benefits.” Who could have predicted that Obama would raise taxes on millions of Americans who do not have health insurance?

Obama grossly mischaracterized his health care plan, and now American citizens will pay the price. He has both attacked individual freedom and burdened millions in the middle class.