Morning Bell: How Taxmageddon Will Impact You

Amy Payne /

“I’ve said that this is a make-or-break moment for the middle class, and I believe it,” President Obama told an Ohio crowd yesterday. Indeed it is—because in a sluggish economy, American taxpayers are about to be clobbered by the largest tax increase in history.

Starting January 1, 2013, Americans will face a $494 billion tax increase, the highest ever in one year. According to The Washington Post, congressional aides started calling it “Taxmageddon“—a chilling reference fit for an apocalyptic nightmare. Federal Reserve Chairman Ben Bernanke has warned that it will be a “massive fiscal cliff” for the economy.

How will this affect you? Heritage has a new Taxmageddon page that shows the impact of these tax hikes on individuals. It includes an interactive map where you can click on your state to see what the average tax increase will be, based on the average income of taxpayers in your state.

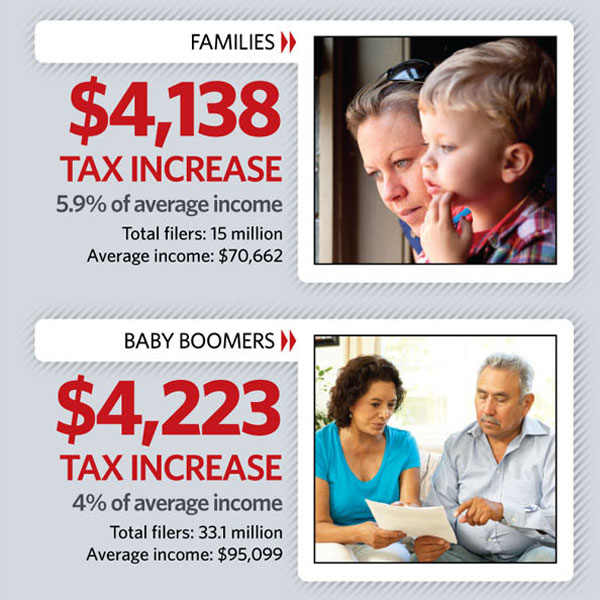

Heritage research shows that families will see an average tax increase of $4,138. Baby boomers’ average increase will be $4,223, and low-income taxpayers can expect a $1,207 increase. Millennials will be hit with an average hike of $1,099, and retirees $857. Check out the infographic to see where you fall.

Taxmageddon falls primarily on middle- and low-income Americans. That’s because, contrary to the President’s rhetoric about “the wealthiest Americans,” 60 percent of the Bush tax cuts went to middle- and low-income taxpayers. The expiration of the patch on the Alternative Minimum Tax (AMT) will cause these taxpayers to pay a tax that was never supposed to hit them, and the expiration of the payroll tax cut is a tax hike almost exclusively on middle- and low-income families.

This is only the direct impact on individual taxpayers. Americans at all income levels will feel the pain of Taxmageddon, because it will slow job creation and wage growth. At 8.2 percent unemployment, it’s the last thing the economy needs.

Where are these tax increases coming from? Under current law, tax policies in seven different categories will expire, and just five of the 18 new tax hikes from Obamacare will begin.

About a third of Taxmageddon’s increase comes from the expiration of the 2001 and 2003 Bush tax cuts. These cuts are best known for reducing marginal income tax rates, but they also reduced the marriage penalty, increased the Child Tax Credit and the adoption credit, and increased tax breaks for education costs and dependent care costs.

What is the President doing to prevent this? Congress and President Obama have developed a penchant for waiting until the very last minute to act on pressing tax legislation. In 2010, they waited until late December to extend the expiring Bush tax cuts for two years. At the end of 2011, they waited again until late December to extend the expiring payroll tax holiday. This is a bad habit.

The threat of Taxmageddon is clouding jobs and family finances now. Businesses, families, and investors are uncertain about the future. They need to know as soon as possible that this massive tax increase will not hit them on New Year’s Day 2013.

But yesterday, Obama told the crowd he was their economic savior: “I have approved fewer regulations in the first three years of my presidency than my Republican predecessor did in his.” He also warned that Republicans want to raise taxes on the middle class, adding, “This is not spin. This is not my opinion. These are facts.”

The fact is that during his first three years in office, the Obama Administration unleashed 106 new major regulations that increased regulatory burdens by more than $46 billion annually, five times the amount imposed by the George W. Bush Administration during its first three years. Hundreds more costly new regulations are in the pipeline, many of which stem from the Dodd–Frank financial regulation and Obamacare. Conveniently, of course, many of Obamacare’s main provisions—including tax increases—don’t kick in until 2014.

And as for the threat of raising taxes on the middle class, the President needs look no further than the laws that are already in place. If he really wants to prevent a cataclysmic tax increase on working Americans, preventing Taxmageddon is the answer. These are facts.

Quick Hits

- The EPA is set to release a new air quality standard today—the Administration “had sought to delay the politically fraught rule until after the election, but was forced to act by a court order,” according to the AP.

- In advance of Sunday’s election in Greece, bankers, governments, and investors are starting to prepare for a worst-case scenario that could involve theU.S., the AP reports.

- Now that “don’t ask, don’t tell” has been repealed, the Pentagon is planning the first gay pride event for the military.

- Egypt is in chaos approaching Saturday’s presidential runoff election. A court ruling yesterday dissolved its parliament, and the military has authorization to arrest civilians in the event of public protests.

- Online chat today at noon Eastern: Reagan’s Impact on Foreign Policy. Heritage’s Marion Smith will take your questions about the impact of Reagan’s “Tear down this wall” speech and its implications for foreign policy today.