How will you fare if the GOP tax plan is enacted?

Well, on net, most Americans will see a significant tax cut under the proposed plans from Republican lawmakers, including virtually all lower- and middle-income workers and a majority of upper-income earners.

Both the House and Senate versions of the Tax Cuts and Jobs Act would, on average, provide immediate tax cuts across all income groups, according to analysis from Congress’ Joint Committee on Taxation.

This analysis does not, however, show how those tax cuts would vary based on factors such as total income, type of income, number of children, and itemized deductions.

While the plans lack a pro-growth cut to the top marginal tax rate (the Senate plan slightly lowers the top rate, but the House keeps the top rate and adds a higher bubble rate), both bills achieve significant reductions in business tax rates. This will help make America more competitive with the rest of the world, and will result in more and better jobs as well as higher incomes for all Americans.

To get a better idea of how some workers, families, and small businesses would fare under the proposed tax reform, The Heritage Foundation has estimated the tax bills of a range of taxpayers under current tax law, the House’s Tax Cuts and Jobs Act, and the Senate’s modified mark of that bill.

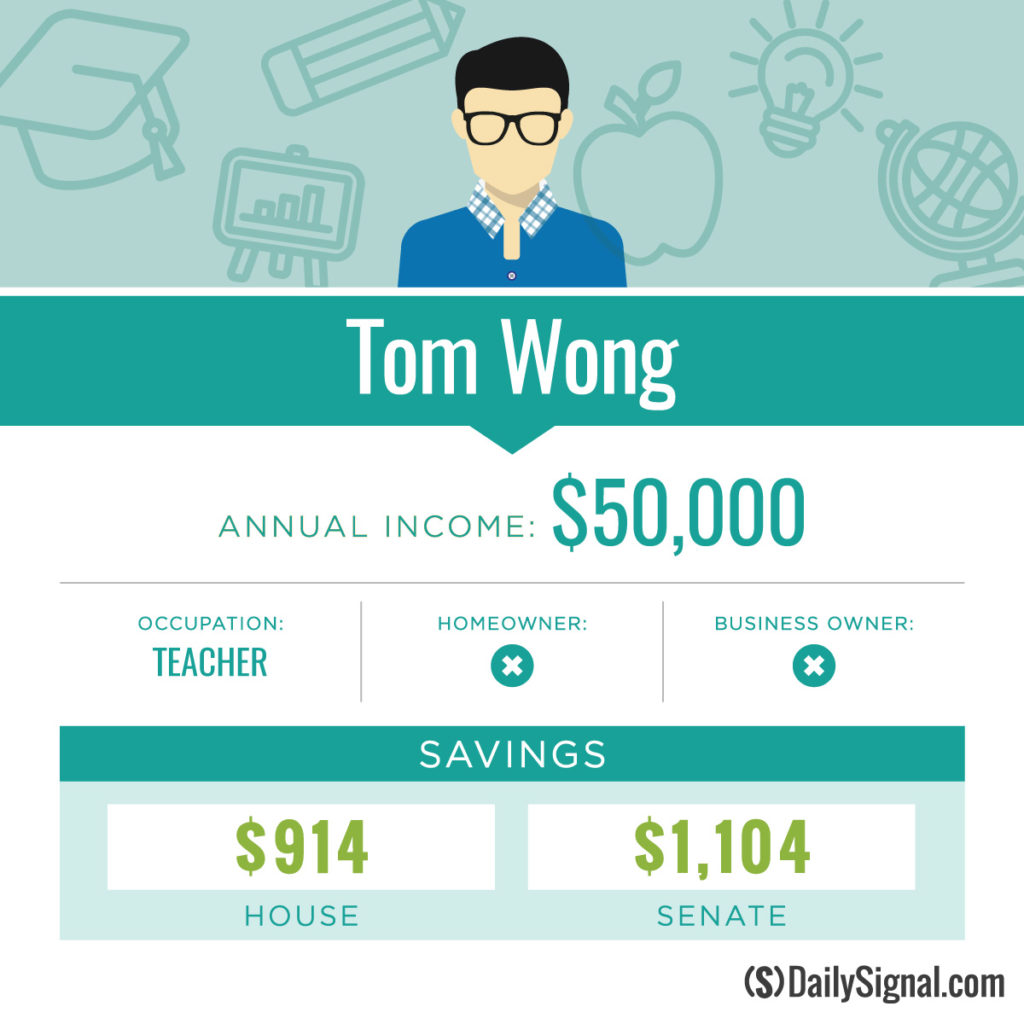

Tom Wong: Single teacher with median earnings of $50,000 per year. Under the current tax code, Tom pays $5,474 each year in federal income taxes. His tax bill would decline by $914, or 17 percent, (to $4,560) under the House’s plan and by $1,104, or 20 percent, (to $4,370) under the Senate’s plan.

These tax cuts come primarily from a higher standard deduction of $12,000 and from lower marginal tax rates. Currently, Tom’s marginal tax rate is 25 percent. But under both the House and Senate plans, his tax rate would become 12 percent.

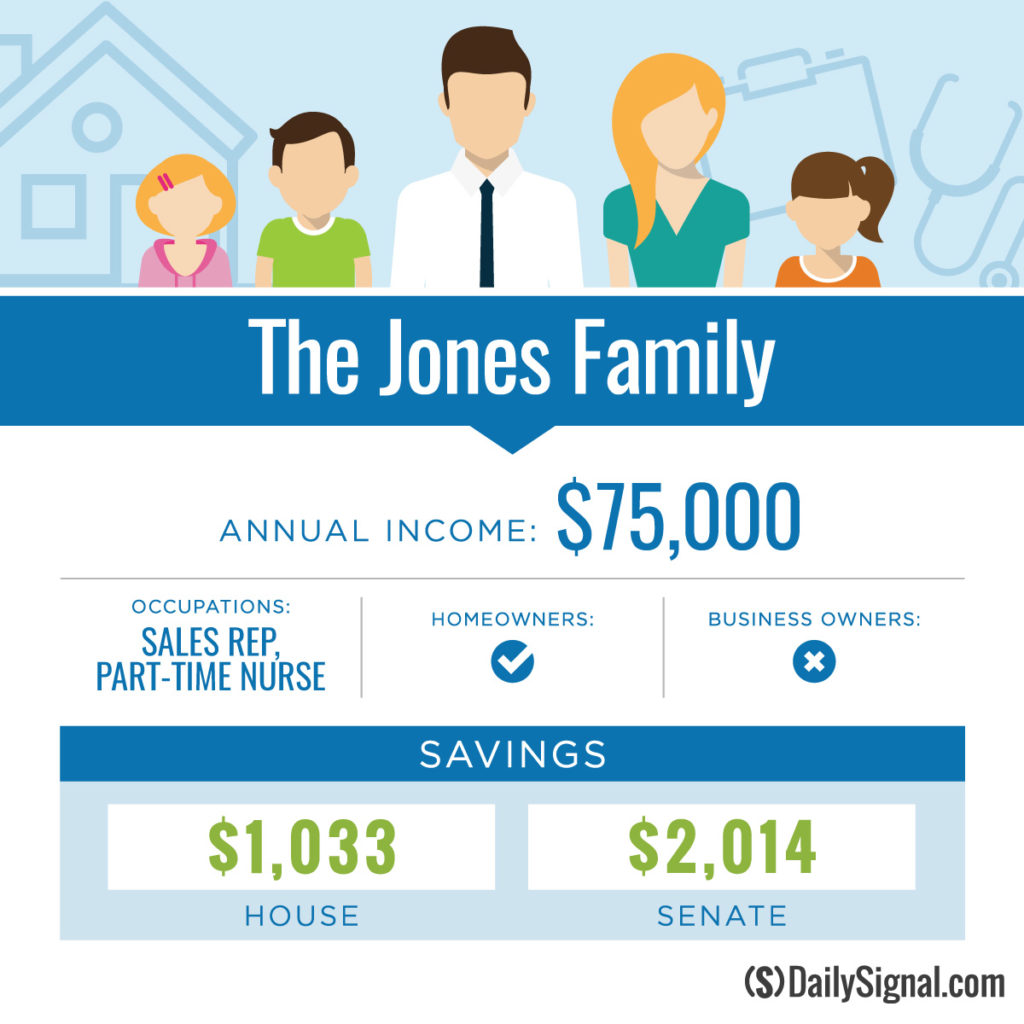

John and Sarah Jones: Married couple with three children, homeowners, and $75,000 in annual income. John is a sales representative and earns an average of $55,000 a year. Sarah is a registered nurse. After having children, Sarah cut back to part-time work and she earns $20,000 a year. Under the current tax code, John and Sarah pay $1,753 each year in federal income taxes.

But under the House’s tax plan, their tax bill would decline by $1,033, or 59 percent, (to $720). Under the Senate’s plan, their bill would be reduced by $2,014, or 115 percent, (to $0, plus a refundable credit of $261).

Even though John and Sarah would have more taxable income under the proposed plans (as a result of not being able to deduct all of their state and local taxes and not being able to claim personal exemptions), they would still receive a tax cut because they would face lower marginal tax rates and receive larger child tax credits.

Their current marginal tax rate would decline from 15 percent to 12 percent under both the House and Senate plans. Their current child tax credits of $1,000 each would increase to $1,600 each under the House plan and $2,000 each under the Senate plan. The House plan would also provide $600 in family credits to John and Sarah.

The numbers listed in the above example for John and Sarah’s current tax payments assumes John and Sarah own a home and live in a state with average tax levels. Under the current tax code, if they did not own a home but instead rented, their federal tax bill would be higher ($2,375 instead of their current $1,753 tax bill).

This would mean that their subsequent tax cuts—as renters—would be larger: $1,655, or 70 percent, under the House plan and $2,636, or 111 percent, under the Senate plan. The House plan would partially eliminate and the Senate plan would fully eliminate an inequity in the current tax code that provides bigger tax breaks to homeowners, wealthy individuals, and people who live in high-tax states.

If the John and Sarah rent, their new tax bills would remain the same under both the House and Senate plans (because the larger standard deduction would mean they would not itemize regardless of whether they owned a home or rented).

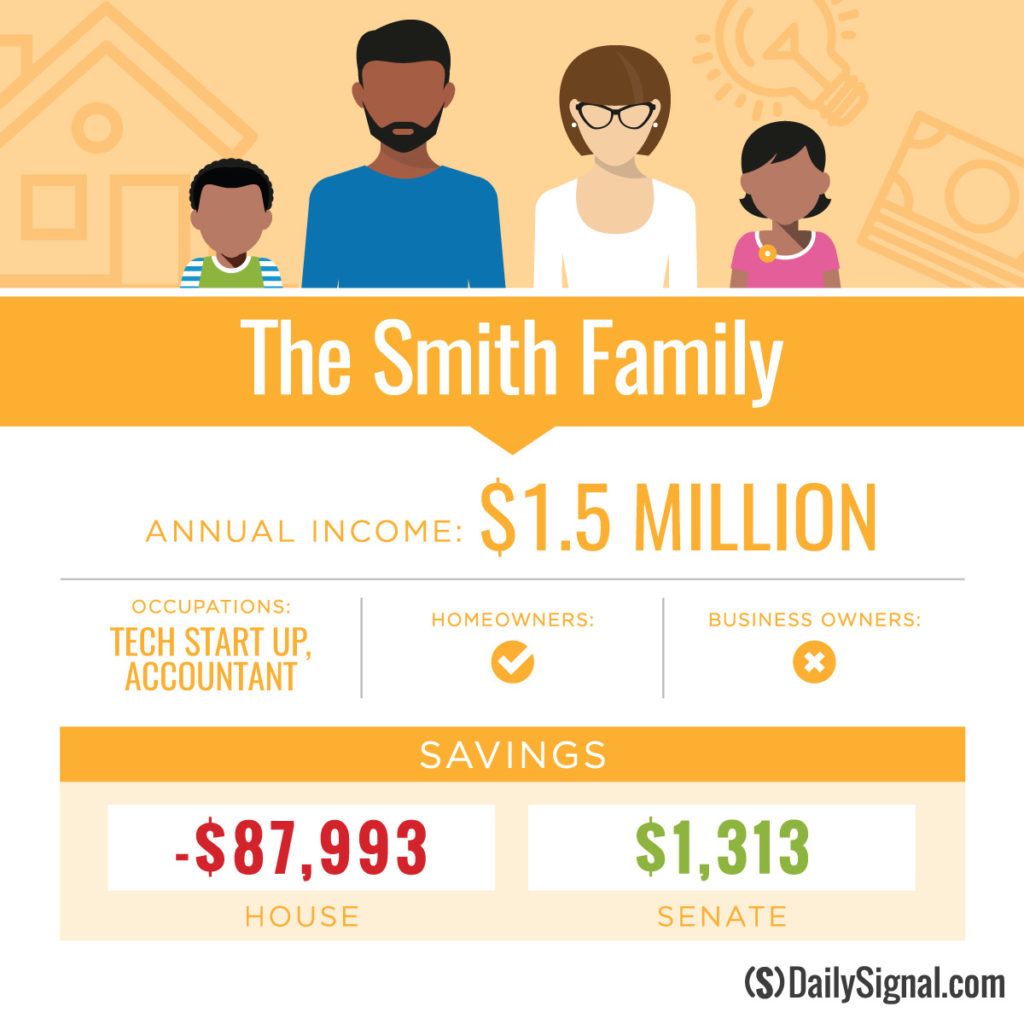

Peter and Paige Smith: Married couple with two children, homeowners, $1.5 million annual income. Peter works for a technology startup company and Paige is an accountant. Although Peter’s income fluctuates significantly from year-to-year, this was a big year for his company and he received a very large bonus, bringing his total earnings to $1.4 million. Paige’s stable income of $100,000 provided their family the financial stability they needed for Peter to take a risk and follow his dreams.

Under the current tax code, Pater and Paige pay $439,275 in federal income taxes. Their tax bill would increase by $87,993, or 20 percent, (to $527,268) under the House plan and would remain relatively the same, decreasing by just $1,313, or 0.3 percent, (to $437,962) under the Senate plan.

Peter and Paige’s taxable income would increase under both the House and Senate plans because they would lose some or all of their state and local tax deductions. Their total exemptions and child tax credits would remain the same—at zero—as their income is too high to claim any exemptions or credits under the current code or the proposed plans.

Under the current tax code, Peter and Paige face a top marginal tax rate of 42.5 percent (39.6 percent, plus the 2.9 percent Obamacare surtax). Under the House plan, their top rate would rise to 48.5 percent (39.6 percent, plus the 6 percent “bubble” tax, plus the 2.9 percent Obamacare tax), and under the Senate plan, it would fall to 41.4 percent (38.5 percent, plus the 2.9 percent Obamacare tax).

Those marginal tax rates do not include Social Security’s 12.4 percent payroll tax, which can lead to extremely high combined marginal tax rates for second earners that are part of a high-income family like Peter and Paige. Because Paige makes less than Social Security current taxable maximum income of $127,200, her combined federal income and payroll tax rate is 54.9 percent under current law and would be 60.8 percent under the House plan and 53.8 percent under the Senate plan.

Although Peter and Paige would have the most taxable income under the Senate plan, the Senate plan’s lower top marginal tax rate does the most to remove the tax penalty on work and investment. The more Peter and Paige work and invest, the more jobs and income growth they help create across all income groups. Peter and Paige would also benefit under the Senate plan’s lower marginal tax rates in the bottom brackets.

The above example assumes Peter and Paige live in a state with average taxes. Currently, however, their federal tax bill could be tens of thousands of dollars higher or lower, depending on whether they live in a state with higher- or lower-than-average taxes for them to write off. This is not the case under the proposed House and Senate tax plans, because the Senate plan fully eliminates the state and local tax deduction and the House plan eliminates all but a $10,000 property tax deduction (and at their income level, they would likely claim that full amount in any state).

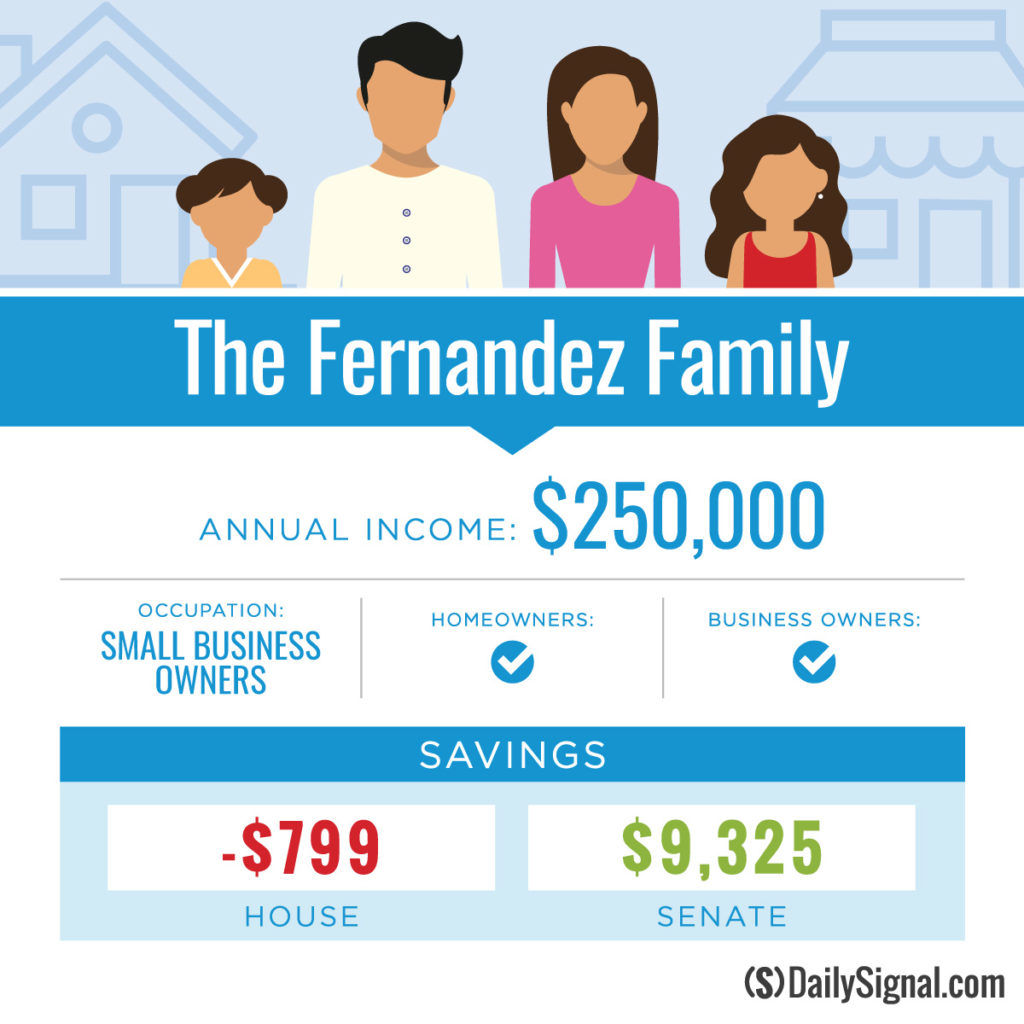

Jose and Marie Fernandez: Married couple with two children, owners of JM Blinds and Shades LLC, homeowners, $250,000 annual income. Jose owns and manages JM Blinds and Shades manufacturing company. Marie primarily stays home with their young children, but she also helps out significantly with the business when needed. Under the current tax code, Jose and Marie pay $35,588, which is their alternative minimum tax (AMT) amount.

The AMT is a separate tax system, created back in 1982 to make sure that millionaires paid their “fair share” in taxes. However, because the AMT was not indexed for inflation until 30 years after it was enacted, it now hits a significant number of middle- to upper-income Americans with a higher tax bill than they would otherwise pay. That’s because under the current tax code, taxpayers pay the larger of what they owe under the regular income tax system and the AMT.

Both the House and Senate plans eliminate the AMT. Under the House plan, Jose and Marie’s federal tax bill would increase by $799, or 2.3 percent, (to $36,387) and under the Senate plan, their federal tax bill would decrease by $9,325, or 26 percent, (to $26,263).

Jose and Marie’s marginal income tax rates would vary significantly under the different tax plans. Their current marginal tax rate of 35 percent would decline to 30 percent under the House plan and 19.8 percent under the Senate plan.

Under the House tax plan, Jose and Marie would face a good deal more complexity. As a small business, they would face the top rate of 25 percent, but only on 30 percent of their income. The other 70 percent (counted as wages) would be taxed at the regular income tax rates (which range from 12 percent to 46.5 percent). At their current income level, that top rate would also be 25 percent. However, on top of that, Jose and Marie would face an additional 5 percent tax due to the phaseout of their child tax credits.

Under current law, Jose and Marie make too much to claim the $1,000 per child tax credits. Under the House plan, they would be able to claim $1,100 of each $1,600 child tax credit, and under the Senate plan, they would receive the full $2,000 credit per child.

Also, because Jose and Marie make $250,000, their next dollar of income would be subject to the 2.9 percent Obamacare tax under both the current and proposed tax plans. That would bring their marginal tax rate on any additional income to 37.9 percent under the current tax code, 32.9 percent under the House plan, and 22.7 percent under the Senate plan.

The above examples seek to show how some common taxpayers—including some wealthy individuals who are less common—would fare under the proposed tax reforms. Actual individuals’, families’, and businesses’ tax bills could vary significantly.

On net, however, most taxpayers—particularly lower- and middle-income taxpayers and businesses—will pay less in total taxes. Even more important than total taxes paid, however, is marginal tax rates. That’s because a lot of decisions are made at the margin.

For example, a worker is far more likely to work an additional hour if it counts as overtime and provides the equivalent of 1.5 hours’ worth of pay. And an individual is more likely to make a $1,000 contribution to his retirement savings account if that savings goes tax-free and means he can put all $1,000 away, instead of first having to pay between $100 and $400 in taxes on the savings.

Lower marginal tax rates are a big driver of economic growth, and the lower the rates, the higher the growth. Under the House bill, lower- and middle-income earners and businesses face lower marginal tax rates, but some high-income earners face higher marginal tax rates. The Senate proposal reduces the top marginal tax rate for an overwhelming majority of taxpayers, with the largest reductions occurring for businesses and for lower- and middle-income Americans.

While the proposed tax reforms do not achieve 100 percent of the potential pro-growth impacts that they could, they go a long way in helping to jump-start America’s struggling economy and put it on a pathway toward higher long-term growth.