Once again, we’re not living in boring times.

This time the Twitterverse and the media are up in arms over an Instagram post and comment from Scottish actress Louise Linton, who is married to Treasury Secretary Steven Mnuchin.

Posting on Instagram, a social media site that allows you to share photos online (and encourages glamorous shots by providing an array of filters and editing tools to help you polish your photos), Linton shared a photo of herself getting off a government plane, captioning it, according to screenshots circulating the internet, “Great #daytrip to #Kentucky!” and then mentioning some of the designer brands she was wearing, including Tom Ford, Valentino, and Hermes.

Linton was on the trip with her husband and Senate Majority Leader Mitch McConnell, who represents the Bluegrass State.

But one woman, identified by The New York Times as Oregon mom of three Jenni Miller, took issue with Linton’s Instagram post, writing, “Glad we could pay for your little getaway. #deplorable.”

Linton fired back.

“Adorable! Do you think the US govt paid for our honeymoon or personal travel?! Lololol. Have you given more to the economy than me and my husband? Either as an individual earner in taxes OR in self sacrifice to your country? I’m pretty sure we paid more taxes toward our day ‘trip’ than you did. Pretty sure the amount we sacrifice per year is a lot more than you’d be willing to sacrifice if the choice was yours.”

“You’re adorably out of touch … Thanks for the passive aggressive nasty comment. Your kids look very cute. Your life looks cute,” she continued.

Now, to be clear, Linton herself didn’t fly on the government’s dime. “A Treasury Department spokesman said Monday’s flight was cleared by appropriate government channels, and that the Mnuchins covered the cost of Linton’s travel,” reported The Washington Post. And on Tuesday, she apologized, saying in a statement obtained by CNN that “I apologize for my post on social media yesterday as well as my response. It was inappropriate and highly insensitive.”

However, Linton has a point about taxes.

Setting aside Linton’s bizarre assumptions (what if the woman commenting had been, say, a veteran?) and original lamentable tone (even if Linton was right that she and her husband have paid more in taxes, it’s a bit much to assume they have felt the pinch more), it’s true that rich Americans do pay a lot in taxes.

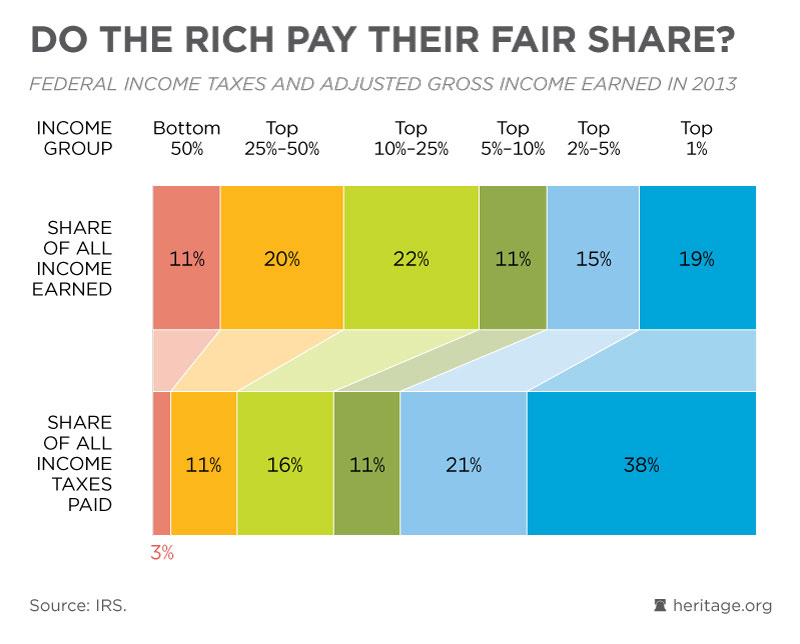

According to The Heritage Foundation’s research, the top 1 percent of Americans, based on annual income, earned 19 percent of all income, yet paid a whopping 38 percent of all income taxes in 2013. Look at the top 10 percent of earners, and they make 45 percent of all income—and pay 70 percent of all income taxes.

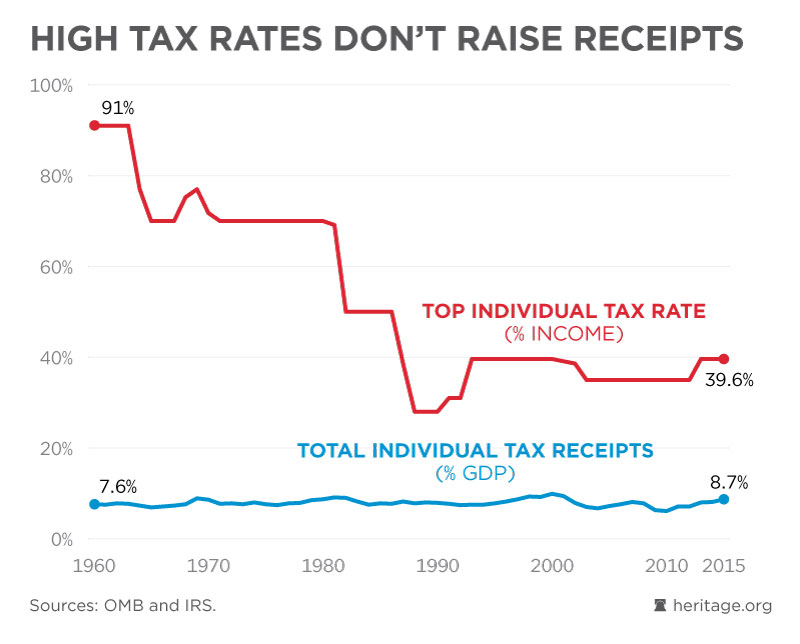

Nor is it clear that hiking taxes on the rich would necessarily lead to more revenue for the government, as this chart from Heritage’s “Federal Budget in Pictures” shows:

But all that being said, it’s unfortunate it takes a social media exchange to capture attention on the issue of taxes.

Too many Americans, likely including Miller, are being hurt by our current tax code. And Americans aren’t just hurt by the amount they have to fork over to Uncle Sam each year. They’re also hurt by the reduced opportunity that occurs because of the current tax code.

For instance, a 2016 Tax Foundation analysis found that a House Republican tax reform plan would lead to, if implemented, “7.7 percent higher wages, and an additional 1.7 million full-time equivalent jobs.”

In other words, the status quo is leading to fewer jobs and lower wages than we could have with tax reform.

“The current tax system is economically destructive, overly complex, and unfairly treats similar taxpayers differently,” write The Heritage Foundation’s Romina Boccia and Adam Michel in a May report.

“Responsible tax reform can increase economic prosperity and produce welfare gains for all Americans through increases in job creation, investment, output, and real wages.”

When it comes to matters that affect most Americans, it’s not one throwaway Instagram post that matters, but the broader issue of our broken tax code.