Instead of embracing the reality of modern-day agriculture, too many farm subsidy apologists want to perpetuate the myth of the struggling farmer to help make their case for subsidies.

The subsidies for the taxpayer-funded “safety net”—about $15 billion a year—are massive wealth transfers from taxpayers to agricultural producers, generally the largest producers.

Farm subsidies shouldn’t be based on a snapshot in time, but instead on what government intervention, if any, is appropriate to assist farmers in addressing risk.

Here are some important points to put the farm economy in perspective:

1. The rural economy isn’t the same thing as the farm economy.

Status quo proponents want to make it seem as if touching farm subsidies would be an attack on rural America. But rural America is far more diverse than merely farming. In fact, only 6 percent of rural jobs are in farming.

In a literature review on farm payments and rural America, agricultural researchers Joe Outlaw and Roland Fumasi correctly explain, “What most people fail to realize is that in many cases, production agriculture is no longer the economic engine in most rural U.S. counties.”

2. Net farm income is not at unusually low levels.

House Agriculture Committee Chairman Michael Conaway recently explained, “Farmers and ranchers have endured a 45 percent drop in net farm income over the last three years.”

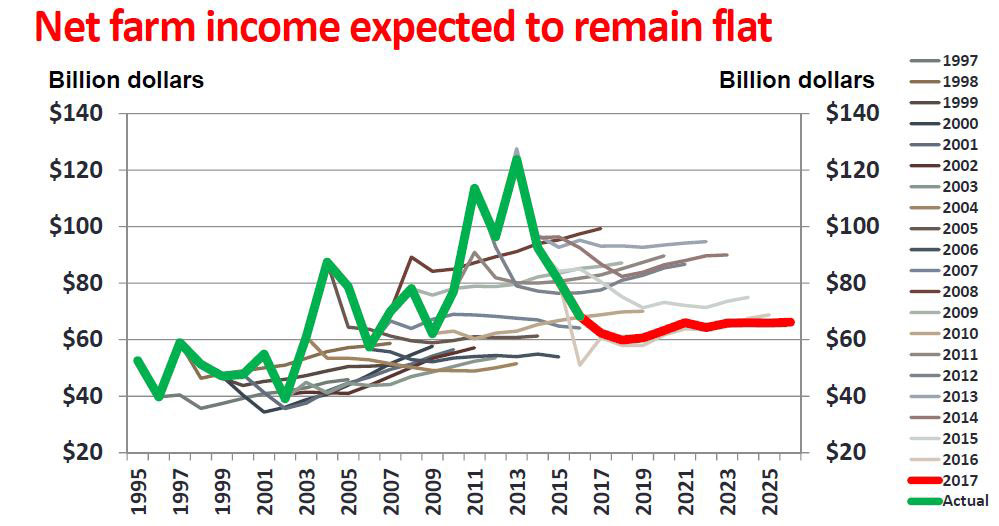

This is true, but it is also cherry-picking the data. Those who make this claim don’t mention that 2013 was a record high year for net farm income. Below is a recent U.S. Department of Agriculture chart showing the data that is used to make this claim. As can be seen, there’s nothing unusual about net farm income. There’s nothing unusual even when adjusted for inflation.

Source: U.S. Department of Agriculture.

3. Median farm household income and wealth is much higher than the median wealth of all U.S. households.

The median income of farm households was $77,000 in 2015, compared to $51,700 for all U.S. households. That’s an incredible 49 percent difference. Farm households have consistently had higher average and median income when compared to all U.S. households for decades.

The wealth numbers are even more staggering. The median wealth of farm households was $827,000 in 2015, compared to $82,600 for all U.S. households. That’s about 10 times greater than the median wealth of all U.S. households.

These wide discrepancies also exist when comparing farm households with self-employed heads to that of all U.S. households with self-employed heads.

4. Key financial indicators are very strong.

In August 2016, Department of Agriculture Secretary Tom Vilsack explained, “The estimates today also showed that debt-to-asset and debt-to-equity ratios—two key indicators of the farm economy’s health—continue to be near all-time lows.”

Debt-to-asset ratios and debt-to-equity ratios have been low for decades. The debt-to-asset ratio is projected to be 13.9 percent in 2017, far below the U.S. Department of Agriculture’s Economic Research Service’s favorable standard of 40 percent or less.

5. The largest farms receive most of the subsidies.

Commercial farms—that is, mid-size, large, and very large family farms as well as non-family farms—represent only about 10 percent of all farms in the U.S., but account for 76 percent of the value of production.

In terms of subsidies, commercial farms received 70 percent of government commodity payments in 2015 and 78 percent of federal crop insurance indemnities.

Farm Subsidies Need Reform

The taxpayer-funded “safety net” should, at most, concentrate on helping farmers when they experience major crop losses due to weather or other unforeseeable catastrophes.

Farm subsidies have become about ensuring farmers do well financially. Farmers now get subsidies just because they didn’t get as much revenue as they expected, and can even get crop insurance checks when they have bumper crops.

Simply put, maintaining subsidies merely to help the financial bottom line of agricultural producers is not the role of the federal government.

As Congress considers the next farm bill, it should ignore all of the scare tactics and instead determine what role, if any, is appropriate and necessary for the federal government when it comes to shouldering the risks of agricultural producers.