America is facing a looming budget crisis, but you wouldn’t know it from the way Congress keeps spending.

By 2027, net interest on the national debt will cost the American people $768 billion, Social Security and health care spending will consume 59 percent of the entire budget, and Obamacare will have cost taxpayers nearly $1 trillion.

No, these aren’t doomsday prophecies. These are actual projections from the Congressional Budget Office’s latest 10-year budget projection.

Twice a year, the Congressional Budget Office updates its annual “Budget and Economic Outlook.” This report projects the nation’s fiscal conditions for the next 10 years based on current laws.

January’s update painted a grim picture of out-of-control spending, growing debt, and irresponsible budgeting. Here are eight charts using data from the report that illustrate the nation’s current fiscal path.

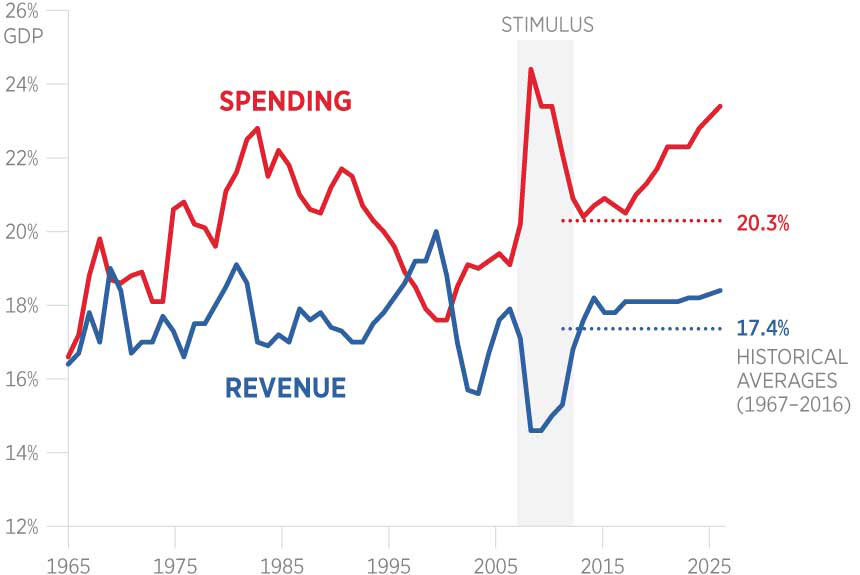

1. Out-of-control spending.

Massive government spending drives budget deficits and the national debt. In 2016, federal spending reached 20.9 percent of the economy and is projected to grow even larger in 2017. By 2027, federal spending will be nearly 23.5 percent of gross domestic product. At the same time, revenues remain above historic averages. Clearly, Congress has a spending, not a revenue, problem.

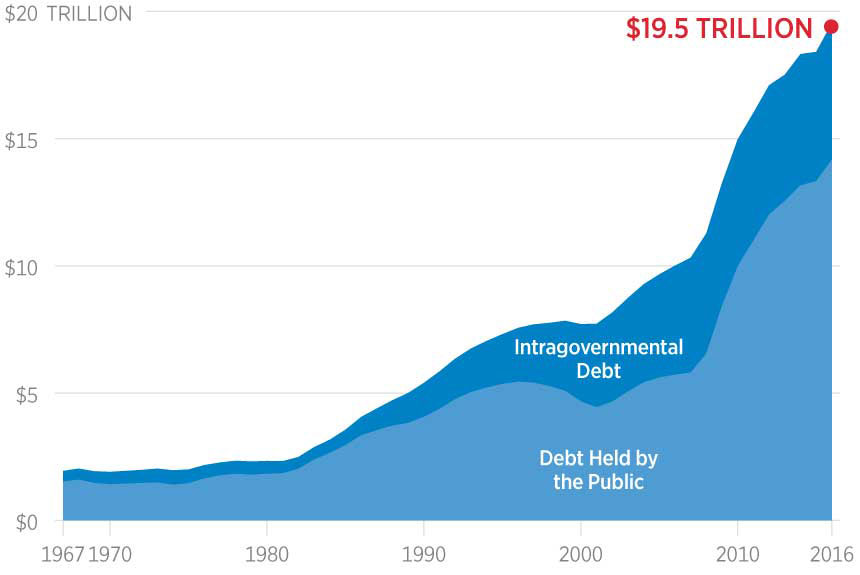

2. A mountain of debt.

The U.S. debt is steadily approaching $20 trillion. In the next few weeks, our debt will exceed the combined 2016 economic output of India, the United Kingdom, Japan, Germany, Canada, Brazil, Australia, Taiwan, and Thailand. Of this debt, a staggering $14.1 trillion was held by the public in 2016.

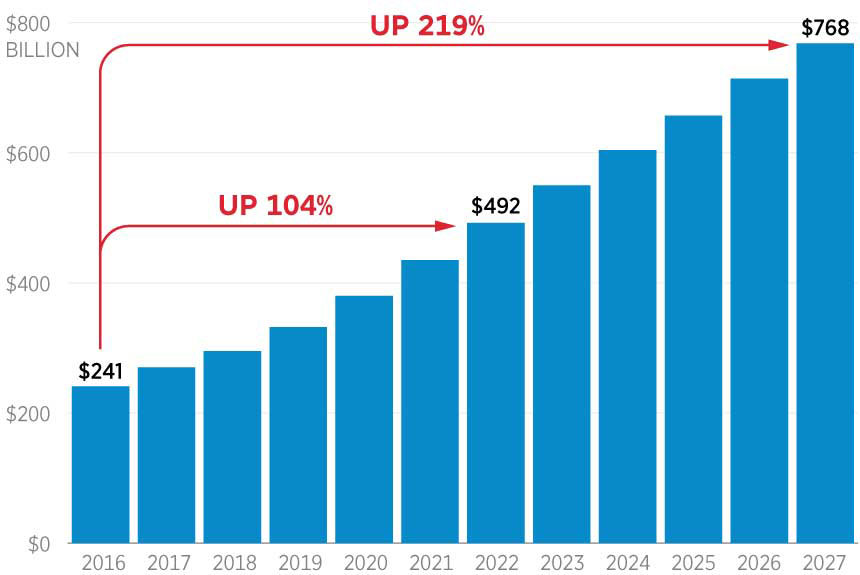

3. The interest on the debt.

With every additional dollar of debt the government takes on, taxpayers pay more money in debt-servicing costs. In 2016, net interest payments on the national debt cost $241 billion. By 2027, this cost will triple and American taxpayers will be on the hook for $768 billion in net interest payments.

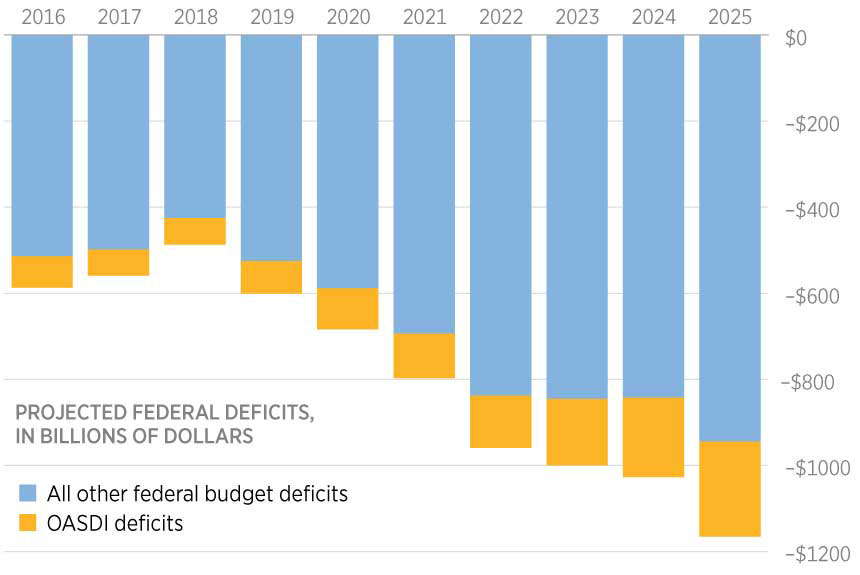

4. Social Security ‘s unsustainable path.

Social Security’s programs are running persistent deficits. Revenues from the payroll tax and taxing workers’ benefits simply aren’t enough to cover the cost of Social Security Old-Age, Survivors, and Disability Insurance payouts. By 2025, Social Security’s deficits will account for 19 percent of all federal budget deficits.

>>>Social Security Needs Real Reform, Not Just a New Commission

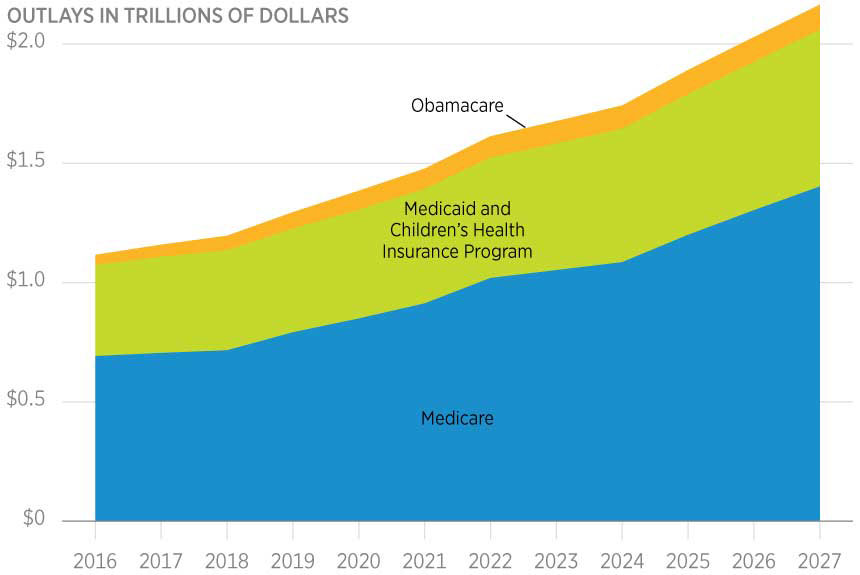

5. Higher government expenses on health care.

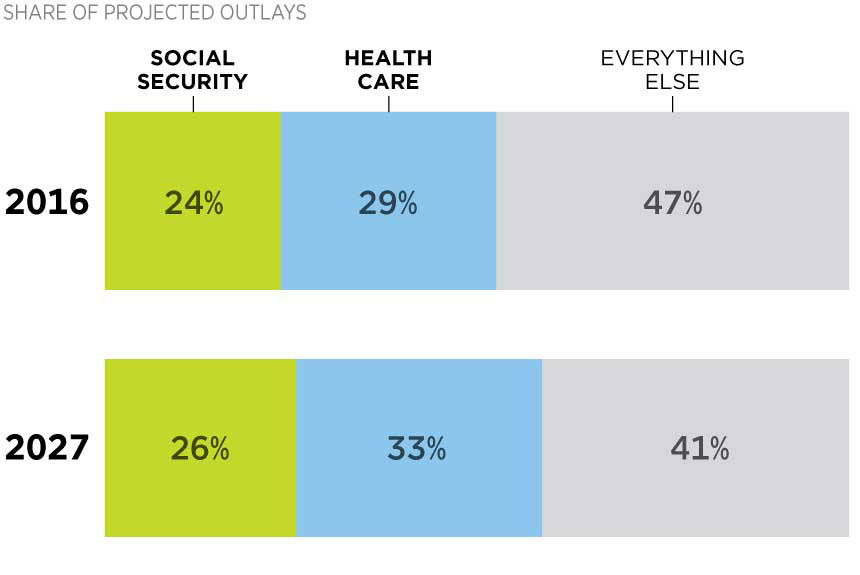

Health care spending is the largest portion of the federal budget. Programs like Medicare, Medicaid, Obamacare subsidies, and the Children’s Health Insurance Program consumed 29 percent of the federal budget in 2016.

By 2027, these programs will consume $2.2 trillion. Over the next 10 years, Obamacare will be responsible for nearly $1 trillion in additional health care spending.

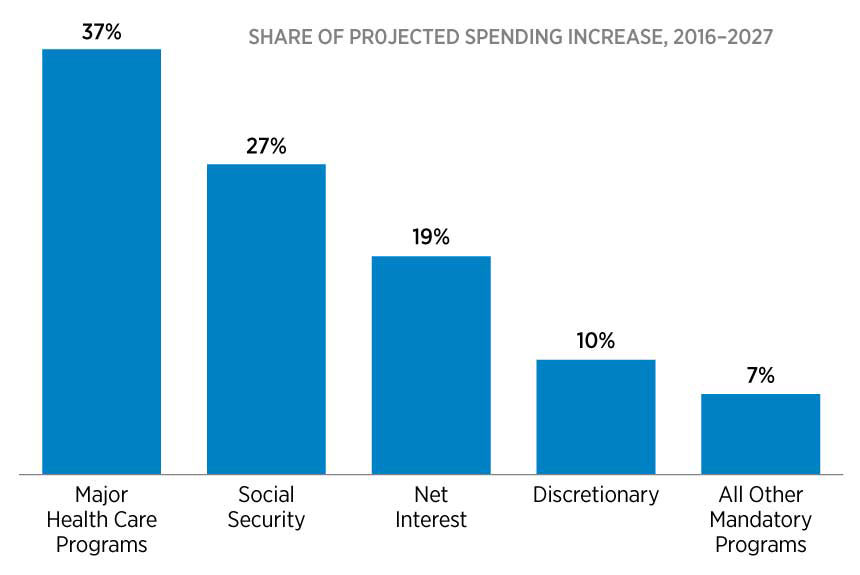

6. Structural problems in the federal budget.

Between 2016 and 2027, the Congressional Budget Office projects that federal spending as a whole will increase by $2.8 trillion. Just three major budget categories—health care, Social Security, and interest on the national debt—will be responsible for 83 percent of this spending growth.

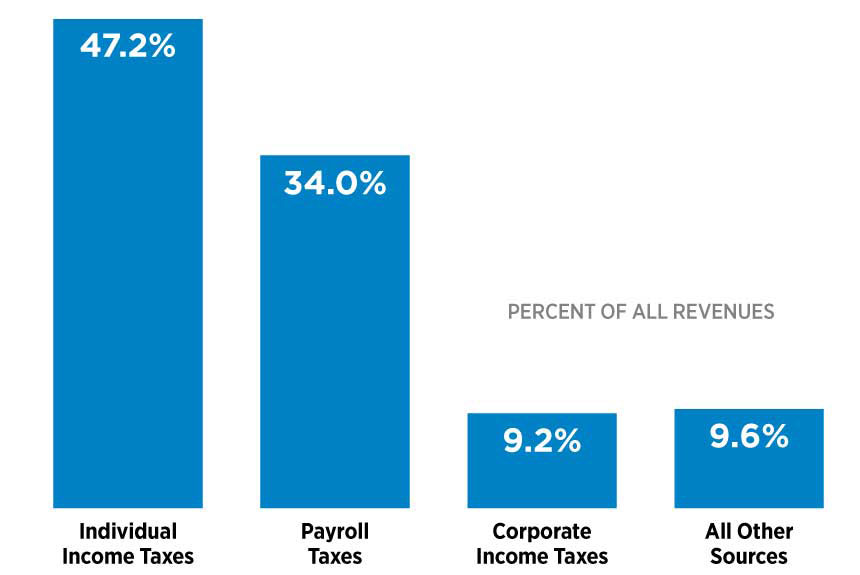

7. Who’s paying.

Ever wonder where the government gets all of its money? In 2016, American taxpayers funded nearly 50 percent of federal revenues through the individual income tax. Payroll taxes covered another 34 percent of government revenues, while corporate income taxes and other revenues brought in 19 percent of all revenues.

8. Health care in the federal budget.

In 2016, federal health care (Medicare, Medicaid, Obamacare, and Social Security) consumed 53 percent of the entire federal budget. By 2027, these programs will consume 59 percent of the entire federal budget, without reform.

Without structural reform, these drivers of debt will continue to spiral out of control and eventually lead the U.S. to a budget crisis. To prevent that scenario, Congress should take preemptive measures now while it has the opportunity to do so.