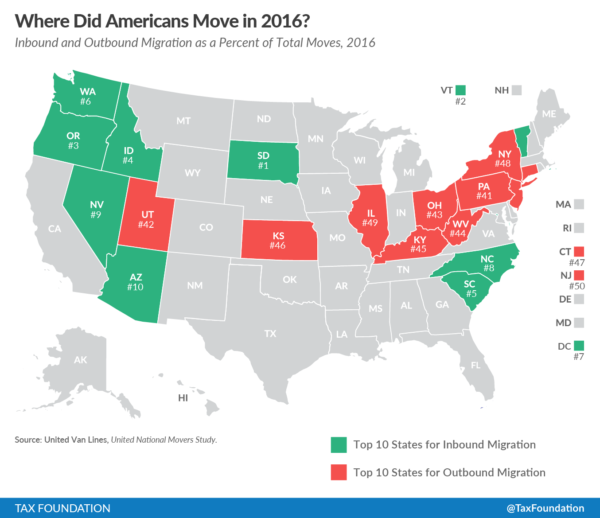

Migration patterns for 2016 show that Americans tended to move away from high-tax states and into states where residents keep more of what they earn.

United Van Lines, the nation’s largest moving company, recently released its annual movers study report showing that South Dakota overtook Oregon as the top inbound destination. Generally, more people moved toward the West, and states in the Northeast saw the largest exodus of residents. The top four outbound states in 2016, in order, were New Jersey, Illinois, New York, and Connecticut.

The Tax Foundation pointed out in a recent blog post that those results are similar to the organization’s annual state business tax climate index.

In fact, New Jersey, which saw an outbound rate of 63 percent—meaning nearly two people moved out of the Garden State for every person who moved in, also finished last in that index. New York had the second-worst business tax climate, according to the Tax Foundation. Connecticut was eighth-worst while Illinois was more middle of the pack.

The Tax Foundation said the absence of a major tax such as the corporate income tax, individual income tax, or sales tax is a common factor among most of the states that rank in the top 10 on the business climate tax index.

Nicole Kaeding, author of the migration post, noted that taxes are sometimes overcited as a primary reason why people move out of states, but they certainly can play a significant role, as is evidenced by the similar results in the Tax Foundation and United Van Lines studies.

“Tax rates and structure affect a state’s economy,” she wrote. “States with less burdensome tax structures and lower rates tend to have better economic growth. Increased job opportunities can result from the better economic growth.”

She noted, for example, a person moving to Chicago for a job might decide to commute from nearby Indiana where the individual income tax rate is 3.3 percent, rather than live in Illinois, where the same rate is 3.75 percent.