India has emerged as the most favored destination for foreign direct investment (FDI) in 2015, outpacing China (for the first time) and even the U.S.

India’s Recent Successes

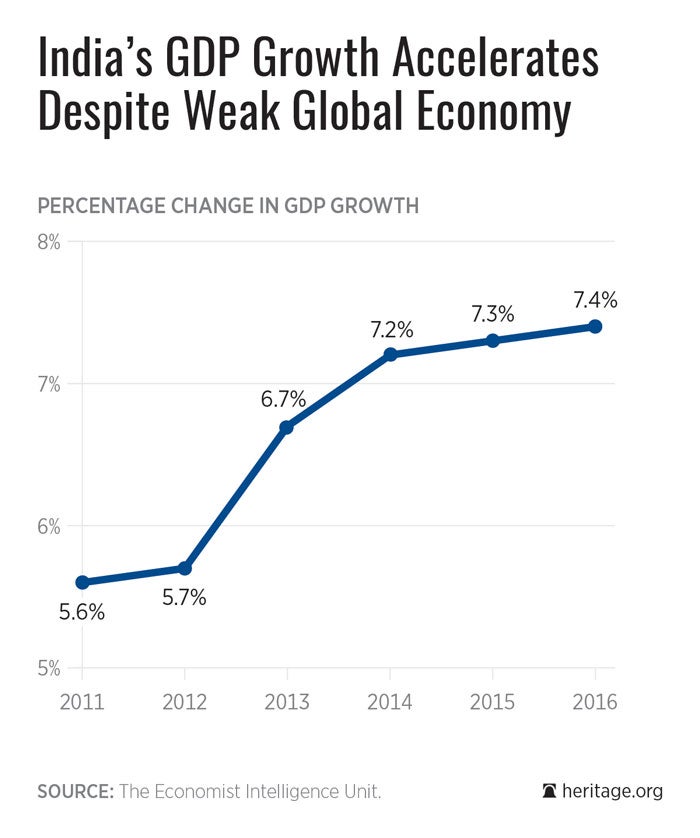

Recent economic events confirm India’s success. FDI inflows into India during January–June stood at $31 billion, ahead of China’s $28 billion and the U.S.’s $27 billion. While questions remain about the macro-statistics of the Chinese and Indian economies, India does appear to have eclipsed China as the world’s fastest largest growing economy.

India also jumped 16 notches to sit at 55th among the 140 countries in the World Economic Forum’s Global Competitiveness Index. The Index ranks countries on the basis of parameters such as institutions, macroeconomic environment, education, market size and infrastructure, among others.

Not the Complete Story

However, by other measures, India is hardly the most open economy for FDI. In The Heritage Foundation’s 2015 Index of Economic Freedom, India was ranked an uninspiring 150th and 144th in trade and financial freedom, respectively.

The most recent disturbing signal regarding India’s commitment to sound economics involve the politics of monetary policy.

Raghuram Rajan, the governor of the Reserve Bank of India (the equivalent of the U.S. Federal Reserve), is one of the most respected central bank chiefs in the world. A former professor at the University of Chicago, he was firmly committed to the efficacy of free markets and liberalizing India’s economy.

However, Rajan is not seeking a second term as governor. The incumbent party, Bharatiya Janata Party (BJP), does not favor Rajan because of his concern over inflation and its slowing effect on economic growth, and has effectively ousted him from his position.

The Need for Vigilance

So, yes, apparently, India is rising. And this is a great thing. But reformers in New Delhi and global investors should remain vigilant. There are always forces waiting to bring it back down.