Less than three months after being denied access to a bank because he sells firearms, a North Carolina gun seller said the bank reversed its policy and offered him the financial products he needs to run his business.

Luke Lichterman, owner of Hunting and Defense in Tryon, North Carolina, told The Daily Signal, “I’m going to be able to continue doing business.”

After being initially denied from the bank, Lichterman blamed a little-known program called Operation Choke Point. Operation Choke Point was launched by the Department of Justice in 2013 to fight fraud by choking fraudsters’ access to the bank services.

Critics of the program believe Operation Choke Point didn’t just harm illegal businesses, but also legal industries such as gun sellers that the Obama administration doesn’t like.

Lichterman’s ordeal began on March 11, when HomeTrust Bank in Asheville, North Carolina, refused to open an automatic clearing house payment service for his online gun and tactical store.

Lichterman had maintained personal accounts at HomeTrust Bank since 2012. He said it wasn’t until a banker discovered that he sold guns that they refused to offer him the automatic clearing house payment service.

An automatic clearing house payment service makes it easier—and cheaper—for business owners to transfer and send money, allowing them to complete transactions electronically.

Without it, Lichterman said he would have been forced to process payments for guns and other accessories using a credit card processor, which costs 4.5 percent of every transaction.

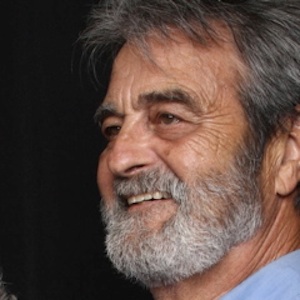

Luke Lichterman, co-owner of Hunting and Defense in Tryon, North Carolina, said he would like to see the banks “stop censoring” his business. (Photo courtesy Luke Lichterman)

“I would have been unable to continue doing business at credit card rates because the internet is the most competitive marketplace on earth and a dealer will buy a gun from one guy because it’s a dollar less than another,” he said. “Being able to do these transactions and save the 4.5 percent of every transaction, you do a $1,000 transaction, you’re looking at $40.”

The Daily Signal sought comment from HomeTrust Bank, but it has not yet responded.

Originally suspicious of a connection to Operation Choke Point, Lichterman asked the banker in March for another example of an industry that HomeTrust Bank wouldn’t do business with.

His immediate response: “Pornography.”

“I really had to stop from laughing,” Lichterman recalled in an earlier interview. “I said, I’m not a pornographer. I deal in constitutionally protected goods.”

>>> Read More: In Voicemail, Bank Tells Former Police Officer It ‘No Longer Lends to Firearms Dealers’

According to a 2014 congressional report investigating Operation Choke Point, federal agencies sent thousands of U.S. banks formal guidance identifying categories of merchants the agencies considered high risk. That list featured “firearms” and “ammunition” sales, along with “pornography.”

On April 15, two weeks after The Daily Signal shared Lichterman’s story, bankers at HomeTrust Bank walked back their refusal. A treasury management sales officer at HomeTrust Bank contacted Lichterman by email offering him two different payment service options—a third-party payment processor or the bank’s internal payment service program.

Lichterman said he decided to accept the olive branch and stay with HomeTrust Bank. On May 20, Lichterman said, he received his login credentials.

Lichterman said the bankers at HomeTrust Bank “didn’t admit” denying him service because of Operation Choke Point, “but it looked to me like they were under the impression that Operation Choke Point was in effect,” he said.

The Daily Signal sought comment from the Justice Department about the current status of Operation Choke Point. It has not yet responded, but back in April, it said the department “has not and will not target businesses operating within the bounds of the law.”

Republicans in both the House and the Senate have attempted to take down Operation Choke Point or similar initiatives for more than a year now. In February, the House of Representatives passed a bill that would prohibit the program with bipartisan support. In April, two weeks after The Daily Signal shared Lichterman’s story, Sens. Ted Cruz, R-Texas, and Mike Lee, R-Utah, introduced an identical bill in the Senate. That measure has not yet been scheduled for a vote.

In February, the White House publicly opposed that bill, called the Financial Institution Customer Protection Act. In a statement, the administration said, “Restricting the federal banking agencies in this way could unnecessarily and dangerously hinder or compromise important law enforcement and national security efforts.”

Lichterman said he doesn’t hold a grudge against HomeTrust Bank for its actions, but is pleased that they’ve “seen the light.”

“They discovered after being led to it that no, there’s no reason to deny an honest upstanding young fellow like myself this service,” Lichterman, who’s 75 years young, said.