The Daily Signal has obtained a draft letter from two Democrat senators urging the Consumer Financial Protection Bureau to continue addressing what they call “discriminatory and unfair lending practices” in the auto industry.

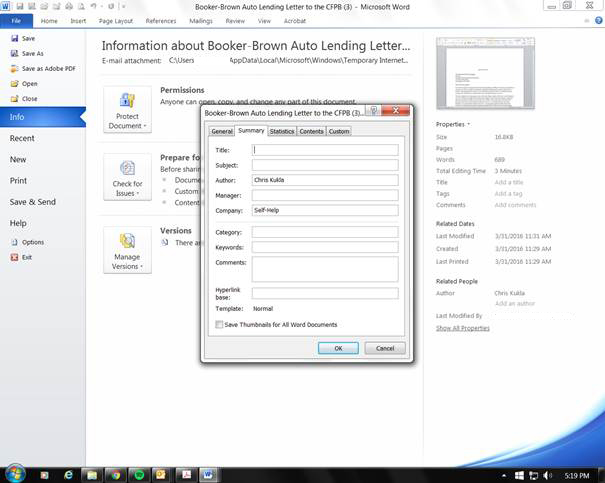

But, according to metadata found in the document’s properties, it appears the letter may not have been written by the two senators or any of their staffers but instead by a top adviser to the agency.

“We write to urge the Consumer Financial Protection Bureau (CFPB), in the face of opposition, to continue its work to combat discriminatory and unfair lending practices, particularly in auto finance,” the letter from Sens. Cory Booker, D-N.J., and Sherrod Brown, D-Ohio, states. “Discrimination has no place in our financial system. We believe it is appropriate and necessary for the bureau to continue this work, and urge the bureau to do so.”

The letter, a copy of which is below, was provided to The Daily Signal by a Republican staffer. According to the document’s metadata, the author is Chris Kukla from Self-Help Credit Union. The Daily Signal has not been able to independently verify that the Microsoft Word document received was the original document.

Booker’s office says the letter “remains a draft.” Brown’s office referred The Daily Signal to the Senate Banking Committee, which did not respond to a request for comment.

Kukla is a member of the CFPB’s Consumer Advisory Board and also serves as a senior vice president at the Center for Responsible Lending. North Carolina-based Self-Help Credit Union created the Center for Responsible Lending in 2002 to fight “abusive financial practices.”

According to Kukla’s bio, he leads the Center for Responsible Lending’s work on auto lending issues. The group has been accused in the past by Politico of having “cozy ties” with the CFPB.

Sam Gifford, a CFPB spokesman, told The Daily Signal: “Members of the CFPB’s advisory boards and councils are not CFPB employees, and do not represent the views of the bureau.”

The Daily Signal reached out to Kukla to confirm that he authored the letter, but Kukla did not respond to the request for comment.

The Republican staffer, who spoke on the condition of anonymity, said the situation raises alarming concerns. “CRL must really stand for the Center for Rented Letterwriters,” he said, adding:

Senators should probably know before they sign on that this letter was written by someone whose organization played a big role in the subprime mortgage crisis, which makes its cozy relationship with the CFPB all the more troubling. The CFPB’s deputy director was even caught saying he was having ‘withdrawal pains’ from not meeting with CRL often enough. All of this raises even more questions about the CFPB’s attack on auto lending, which has already been exposed as being based on nothing more than junk science.

In 2015, the CFPB came under fire for publishing just such “junk science.”

A report by the House Financial Services Committee, “Unsafe at Any Bureaucracy: CFPB Junk Science and Indirect Auto Lending,” found internal documents showing CFPB employees discussing the statistical methods used to allege racial discrimination in the auto lending industry. Those employees said the methods were “prone to significant error.”

Critics of the CFPB believe the letter in question was an attempt to change the narrative after the House committee spotlighted the flawed evidence.

“This whole episode underscores the blatant political nature of the CFPB,” said Norbert Michel, an expert in financial regulation at The Heritage Foundation. “The House Financial Services Committee exposed the bureau for basing its claims regarding auto lending discrimination on little more than guesswork, so they run to their friends in the Senate for political cover.”

Monique Waters, spokeswoman for Booker, said the letter was only a “draft” and its content comes from “a variety” of sources.

“Many people share a commitment to eliminating discrimination wherever it occurs,” Waters said. “The draft letter that was circulated supporting action to crack down on discriminatory auto lending practices is the product of input from a variety of organizations, stakeholders, and Senate offices. The letter also remains a draft, and the current version differs from the version that was circulated in the Senate last week.”

This story was updated with additional information about the letter’s origins. The screenshot has been altered to remove the identities of congressional staffers.