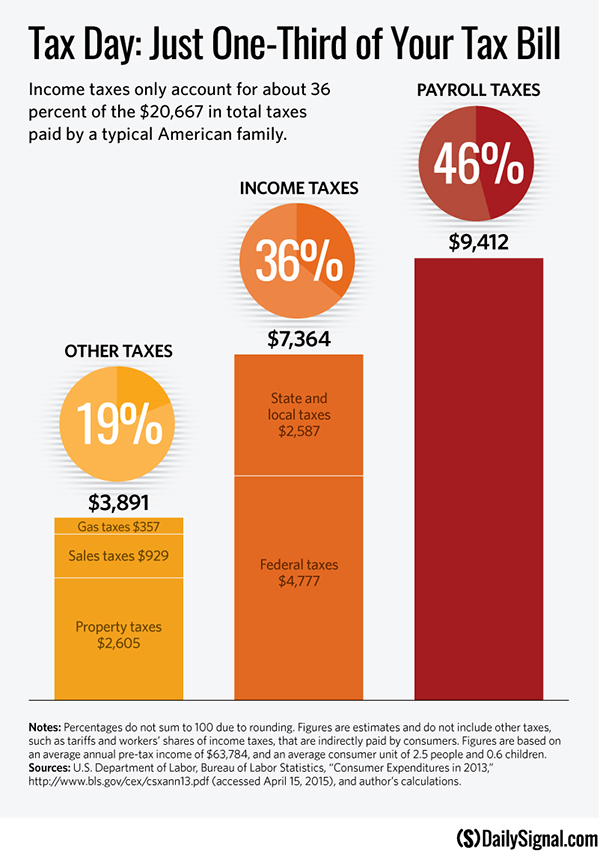

It’s tax day—time to send those income tax payments to your federal and state governments. While tax withholding throughout the year means that many individuals actually receive tax refunds when they file, most people cringe at the total amount of state and local income taxes they pay each year. As burdensome as income taxes are, however, they represent only about a third of the average family’s direct tax payments (families also pay indirect taxes such as tariffs and consumers’ share of corporate taxes).

FICA taxes, which fund Social Security and Medicare, account for close to half of the typical American family’s tax bill. Workers’ paychecks only report half of total FICA taxes; employers pay the other half, without which workers’ wages would be that much higher.

On top of income and FICA taxes, individuals and families shell out thousands of dollars in taxes on the goods and services they purchase, the property they own, and the gas they put in their cars. A dollar here and a couple of dollars there in sales taxes may not seem like much, but the average family pays nearly $1,000 in sales taxes each year. Gasoline taxes often go unnoticed because retailers are forced to display the tax-inclusive cost.

When it’s all said and done, these taxes (over $20,000 on average) consume almost a third of a typical family’s income in the U.S.

*The above estimates are based primarily on 2013 data from the most recent Bureau of Labor Statistics Consumer Expenditure Survey.