Out of every dollar you earn, 15 cents goes directly to payroll taxes.

Your payroll taxes fund Social Security and Medicare (both “pay-as-you-go” programs) benefits for current retirees. However, even those payroll taxes are no longer sufficient to cover the cost of those benefits. Social Security is already running massive cash-flow deficits to the tune of $70 billion in 2013.

In other words, the federal government is currently issuing more debt to make monthly payments to beneficiaries.

Without reforms that modernize these outdated entitlement programs to enable people to exercise more choice with their own health care dollars and retirement savings, workers are at risk of seeing their tax burden going up.

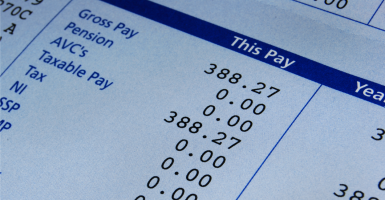

Payroll taxes are line items that you will find on both your paycheck and W-2. Payroll taxes, also known as Federal Insurance Contributions Act (FICA) taxes, are used to fund Social Security programs, both Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI), and the Medicare hospital insurance program (Part A).

The Federal Budget in Pictures 2015 illustrates how the cumulative payroll tax rate has grown since the establishment of Social Security in the thirties, particularly with the enactment of the disability insurance program in 1956 and the enactment of Medicare in 1965.

Over the last 50 years, since Medicare was enacted, the payroll tax rate has more than doubled. The current cumulative payroll tax rate, including taxes levied on the employer and employee, is 15.3 percent, with the largest portion being used to finance the rapidly growing Old-Age and Survivors Insurance program. Economists broadly agree that both the employee and employers’ share of the payroll tax are fully borne by the worker.

Both the disability program and the retirement program face insolvency. The disability program will be unable to pay full benefits before the end of 2016, without reforms. The retirement program is expected to face the same prospect by 2034—less than 20 years from now.

The Medicare program also faces an unsustainable financial future. Unless the program is reformed, it will impose a huge financial burden on American taxpayers as it jeopardizes access to care for seniors. Medicare’s hospital insurance trust fund will be depleted by 2030.

At the core of Social Security’s and Medicare’s financing challenge are demographics and growing health care costs. Every day 10,000 more baby boomers are hitting the retirement age, while fewer people are working and paying taxes to support each retiree.

Furthermore, a smaller percentage of people are in the workforce now than at any time since 1978 as many people are dropping out of the labor market altogether. Payroll taxes are already high—increasing them further could discourage work even further and hinder economic growth.

Instead, Congress should reevaluate entitlement programs and make common-sense reforms that modernize Social Security and Medicare so they are more affordable and enable Americans to exercise more control over their own health care and retirement decisions.