It is budget season in Washington and the debate is focused on who wants to increase spending and by how much.

But the debate should be focused on how to reduce the size and scope of government. Across the country, Americans remain deeply concerned about growing deficits and debt. Washington’s obsession with increasing the size and scope of government shows just how out of touch this city can be.

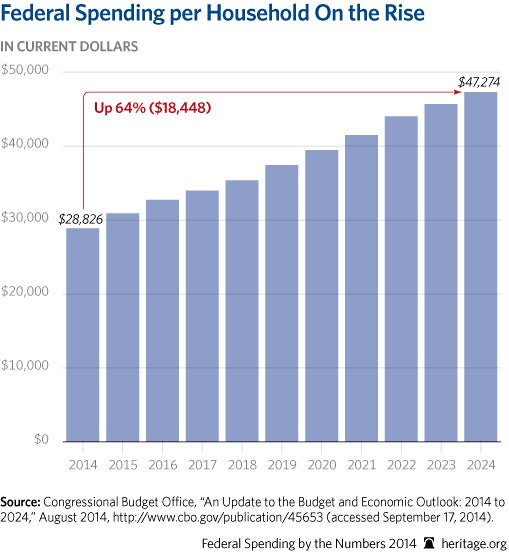

Within mere days of the Congressional Budget Office’s warnings that spending is going up by three-quarters—from $3.5 trillion to $6 trillion—before the end of the decade, the president’s budget laid out an agenda for more spending on programs that fall far outside the federal government’s constitutional scope.

The Budget Book, released by The Heritage Foundation today, stands in direct contrast to President Obama’s agenda of bigger government.

We believe that no spending cut and no attempt to right-size government is too small. When lawmakers stand up against entrenched special interests and eliminate bad government programs, even less expensive ones, this sends a powerful message to the people in this country that lawmakers are working for them in the best interests of the nation.

The Budget Book offers members of Congress who pledged to get government spending under control 106 ways to put that promise into action.

It’s time for Congress to prove to the American people it is serious about fixing the Washington spending and debt crisis. Congress can make that case by cutting federal programs that benefit the few well-connected at the cost of the many families struggling to pay their bills. And by doing so, it can earn the moral authority to tackle the massive spending challenges posed by Medicare, Medicaid and Social Security.

106 Ways to Cut the Budget

(All savings are for 2016.)

National Defense

1. Reduce Civilian Overhead in Department of Defense: $1.2 billion

2. Cut Funding for Non-Combat Related Research $135 million

3. Cut Commissary Subsidies: $500 million

4. Close Domestic Dependent Elementary and Secondary Schools (DDESS): $583 million

5. Reform Military Compensation: $2.1 billion

6. Increase Use of Performance-Based Logistics: $9 billion

7. Focus the Department of Energy’s National Nuclear Security Administration Spending on Weapons Programs: $529 million

International Affairs

8. End Funding for the United Nations Development Program (UNDP): $81 million

9. End Funding for the U.N Intergovernmental Panel on Climate Change (IPCC): $10 million

10. Eliminate the U.S. Trade and Development Agency (USTDA): $56 million

11. Reform Food Aid Programs: $168 million

12. Eliminate the Export-Import Bank: $200 million

13. Eliminate the Overseas Private Investment Corporation (OPIC): –$213 million

14. Eliminate Funding for the United Nations Population Fund (UNFPA): $36 million

General Science, Space and Technology

15. Return Funding for the Office of Nuclear Physics to Fiscal Year 2008 Levels: $95 million

16. Return Advanced Scientific Computing Research to Fiscal Year 2008 Levels: $85 million

17. Eliminate the Advanced Research Projects Agency-Energy (ARPA-E): $284 million

18. Eliminate the Biological and Environmental Research (BER) Program: $619 million

19. Reduce Basic Energy Sciences (BES) Funding: $301 million

20. Eliminate Energy Information Hubs: $24 million

21. Reduce Fusion Energy Sciences (FES) Spending to Fiscal Year 2008 Levels: $178 million

22. Reduce High-Energy Physics (HEP) Program Funding: $10 million

Energy

23. Eliminate the Advanced Manufacturing Partnership: $183 million

24 & 25. Eliminate Department of Energy Loans and Loan Guarantees

26. Eliminate the Office of Electricity Deliverability and Energy Reliability (OE): $150 million

27. Eliminate the Office of Energy Efficiency and Renewable Energy (EERE): $1.93 billion

28. Reduce Office of Fossil Energy (FE) Funding: $341 million

29. Reduce Funding for the Office of Nuclear Energy: $293 million

30. Eliminate Subsidies for Power Marketing Administrations (PMAs): $86 million

31 & 32. Eliminate SBIR and STTR Programs: $2.746 billion

33. Auction of Assets of the Tennessee Valley Authority (TVA): -$5 million ($500 million savings in 2025)

Natural Resources and Environment

34. Eliminate Funding for Development and Implementation of New Ozone Standards

35. Eliminate the Renewable Fuel Standard (RFS): $5 million

36. Eliminate Environmental Protection Agency Grant Programs and Information Exchange/ Outreach: $131 million

37 – 45. Eliminate Nine Climate Programs: $106 million

46. Eliminate Regional EPA Programs: $422 million

47. Lease or Sell Underused EPA Space: $22 million

48. Eliminate the National Clean Diesel Campaign (NCDC): $20 million

49. Eliminate Environmental Justice Programs: $7 million

Agriculture

50. Eliminate the Market Access Program (MAP): $186 million

51. Repeal the USDA Catfish Inspection Program: $14 million

52. Eliminate the Conservation Reserve Program: $2.005 billion

53. Eliminate the Conservation Technical Assistance Program: $725 million

54. Eliminate the Rural Business- Cooperative Service (RBCS): $258 million

55 & 56. Eliminate the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) Programs: $4.748 billion

Commerce and Housing Credit

57. Let the Postal Service (USPS) Eliminate Saturday Mail Delivery: $1.285 billion

58. Cut Universal Service Subsidies

59 – 63: Eliminate Five Corporate Welfare Programs in Commerce Department: $892 million

64. Repeal the Corporation for Travel Promotion: – $38 million

65. Reform the Securities and Exchange Commission (SEC): $321 million

Transportation

66. Limit Highway Trust Fund (HTF) Spending to Revenues: $17 billion

67. Phase Out the Federal Transit Administration (FTA): $2.33 billion

68. Eliminate Grants to the National Rail Passenger Service Corporation (Amtrak): $608 million

69. Close Down the Maritime Administration (MARAD) and Repeal the Jones Act: $150 million

70. Eliminate the New Starts Transit Program: $1.972 billion

71. Privatize the Saint Lawrence Seaway Development Corporation (SLSDC): $32 million

72. Eliminate the TIGER Grant Program: $609 million

Community and Regional Development

73. Eliminate Fire Grants: $591 million

74. Eliminate the Small Business Administration Disaster Loans Program (DLP): $33 million

Education, Training, Employment and Social Services

75. Sunset Head Start to Make Way for Better State and Local Alternative: $887 million

76 & 77. Eliminate Competitive/Project Grant Programs & Reduce Spending on Formula Grants: $3.702 billion

78- 80. Eliminate Titles II, VI, VIII of the Higher Education Act (HEA): $2.374 billion

81. Decouple Federal Financing from Accreditation

82. Expand the D.C. Opportunity Scholarship Program (OSP)

83. Eliminate the PLUS Loan Program: -$3 million

84. Privatize the Corporation for Public Broadcasting (CPB): $445 million

85 & 86. Eliminate the National Endowment for the Arts (NEA) and the National Endowment for the Humanities (NEH): $296 million

87. Eliminate Job Corps: $1.721 billion

88. Eliminate Workforce Innovation and Opportunity Act (WIOA) Job-Training Programs: $3.366 billion

Income Security

89. Let Trade Adjustment Assistance (TAA) Expire: $823 million

90. Cap Total Means-Tested Welfare Spending: $100 billion

91. Set a Work Requirement for Able-Bodied Adult Food Stamp Recipients: $5.4 billion

92. Return Supplemental Security Income (SSI) to Serve Its Originally Intended Population: $12 billion

93. Reduce fraud in the Earned Income Tax Credit (EITC): $8 billion

94. Reduce Anti-Marriage Penalties in the Earned Income Tax Credit (EITC): $6 billion

Administration of Justice

95. Eliminate the Office of Community Oriented Policing Services (COPS): $248 million

96. Eliminate Grants within the Office of Justice Programs (OJP): $1.358 billion

97. Eliminate Violence Against Women Act (VAWA) Grants: $428 million

98– 102. Reduce Finding for Five Programs in the Department of Justice: $787 million

General Government

103. Eliminate the Presidential Election Campaign Fund: $2 million

Allowances

104. Repeal the Davis-Bacon Act: $8.112 billion

105. Open Access to Drilling and Conduct Lease Sales

106. Empower States to Control Energy Production on Federal Lands