Senior officials at the Federal Deposit Insurance Corporation actively sought to crack down on legal businesses that the Obama administration – or the officials themselves – deemed morally objectionable, a new congressional report finds.

Released today by the House Oversight and Government Reform Committee, the 20-page investigative report details how the FDIC worked closely with the Justice Department to implement Operation Choke Point, a secretive program that seeks to cut off the financial lifeblood of payday lenders and other industries the administration doesn’t like.

>>> Congressman Seeks to End Program He Calls ‘More Dangerous’ Than IRS Scandal

The FDIC is the primary agency responsible for regulating and auditing more than 4,500 U.S. banks.

Emails unearthed by investigators show regulatory officials scheming to influence banks’ decisions on who to do business with by labeling certain industries “reputational risks,” ensuring banks “get the message” about the businesses the regulators don’t like, and pressuring banks to cut credit or close those accounts, effectively driving enterprises out of business.

>>> See the Revealing Emails Below

The House panel’s investigation, led by Rep. Darrell Issa, R-Calif., and Rep. Jim Jordan, R-Ohio, cites confidential briefing documents that show senior Justice Department officials informing Attorney General Eric Holder that, as a consequence of Operation Choke Point, banks are “exiting” lines of business deemed “high risk’” by regulators.

“It’s appalling that our government is working around the law to vindictively attack businesses they find objectionable,” Issa, chairman of the Oversight Committee, said in a press release. Issa added:

Internal FDIC documents confirm that Operation Choke Point is an extraordinary abuse of government power. In the most egregious cases, federal bureaucrats injected personal moral judgments into the regulatory process. Such practices are totally inconsistent with basic principles of good government, transparency and the rule of law.

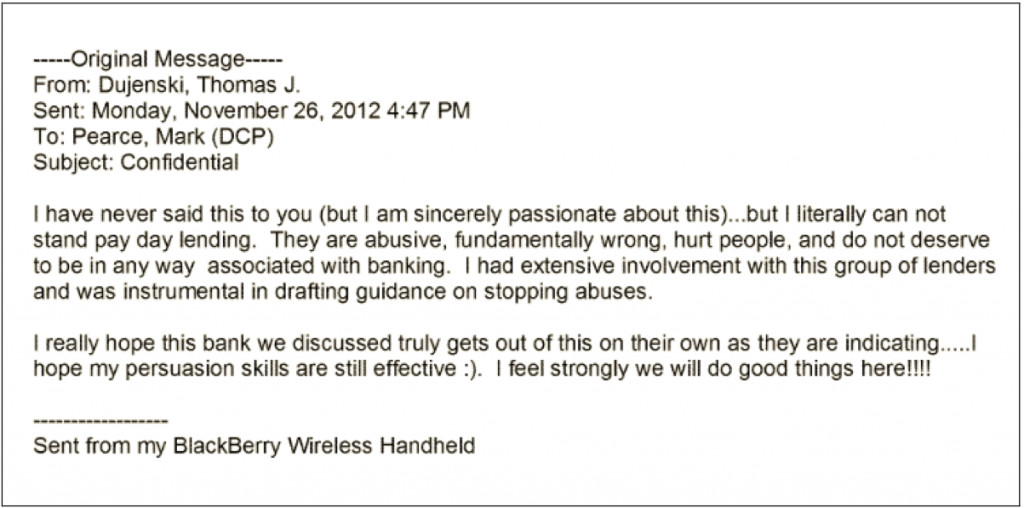

For example, email reveals FDIC employees opposing the payday lending industry on “personal grounds” and attempting to use their agency’s supervisory authority to drive the entire industry out of business.

>>> Related: Meet Four Business Owners Squeezed by Operation Choke Point

One email from Thomas Dujenski, FDIC’s Atlanta regional director, to Mark Pearce, director of the Division of Depositor and Consumer Protection, was particularly concerning to investigators.

In it, Dujenski writes:

I have never said this to you (but I am sincerely passionate about this) … but I literally cannot stand the pay day lending industry … I had extensive involvement with this group of lenders and was instrumental in drafting guidance on stopping abuses.

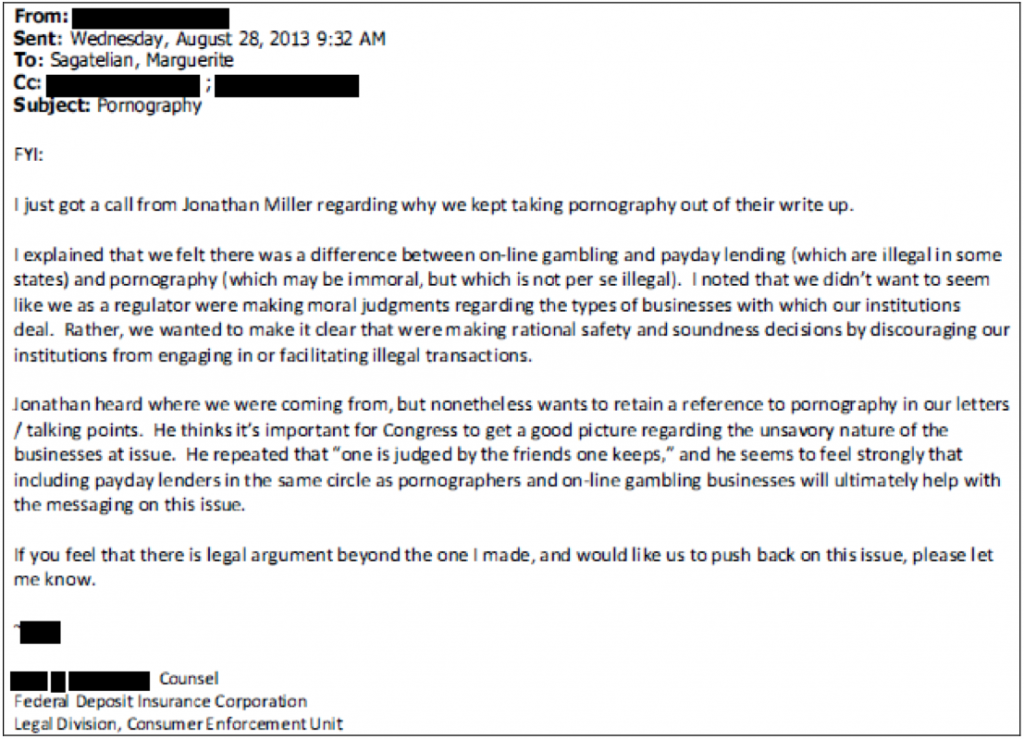

In another example, a senior official insisted that FDIC Chairman Martin Gruenberg’s letters to Congress and talking points always mention pornography when discussing payday lenders and other targeted industries, in an effort to convey a “good picture regarding the unsavory nature of the businesses at issue.”

Payday loans are small, short-term loans supposedly made to hold borrowers over until their next payday.

Norbert Michel, research fellow in financial regulations at The Heritage Foundation, said payday lenders, along with some other industries targeted by Choke Point, all have been criticized for taking advantage of the poor or financially strapped by charging exorbitant fees or leaving customers in more debt than they started with.

>>> Commentary: Forget Obamacare. Get Worried About ObamaLoans.

The Obama administration contends that Operation Choke Point combats unlawful, mass-market consumer fraud. However, an earlier report by the House Oversight Committee found that the Justice Department initiative’s targets included legal businesses such as short-term lenders, firearms and ammunition merchants, coin dealers, tobacco sellers and home-based charities.

Today’s report, investigators said, confirmed that the FDIC originated the controversial list of “high risk” industries that it posted on its website, as previously reported by The Daily Signal.

Critics of the program argue that equating legal industries such as ammunition and lottery sales with explicitly illegal or offensive activities such as pornography and racist materials transforms the FDIC into the moral police.

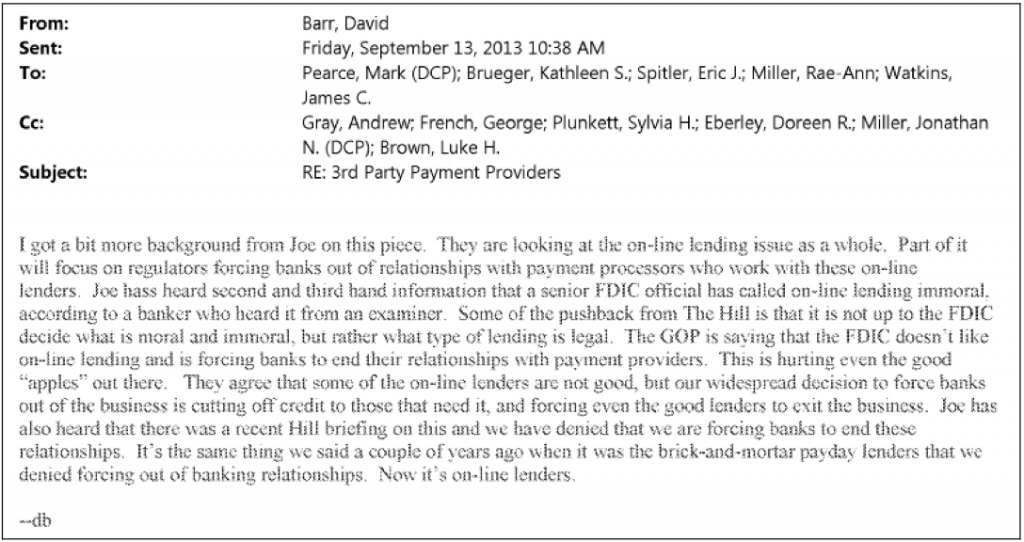

Apparently, FDIC officials were aware of the “inherent impropriety” of these policies, the report indicates. In another email, David Barr, assistant director of the FDIC’s public affairs office, wrote:

[S]ome of the pushback from the Hill is that it is not up to the FDIC to decide what is moral and immoral, but rather what type of lending is legal.

Read a sample of emails unearthed by investigators here:

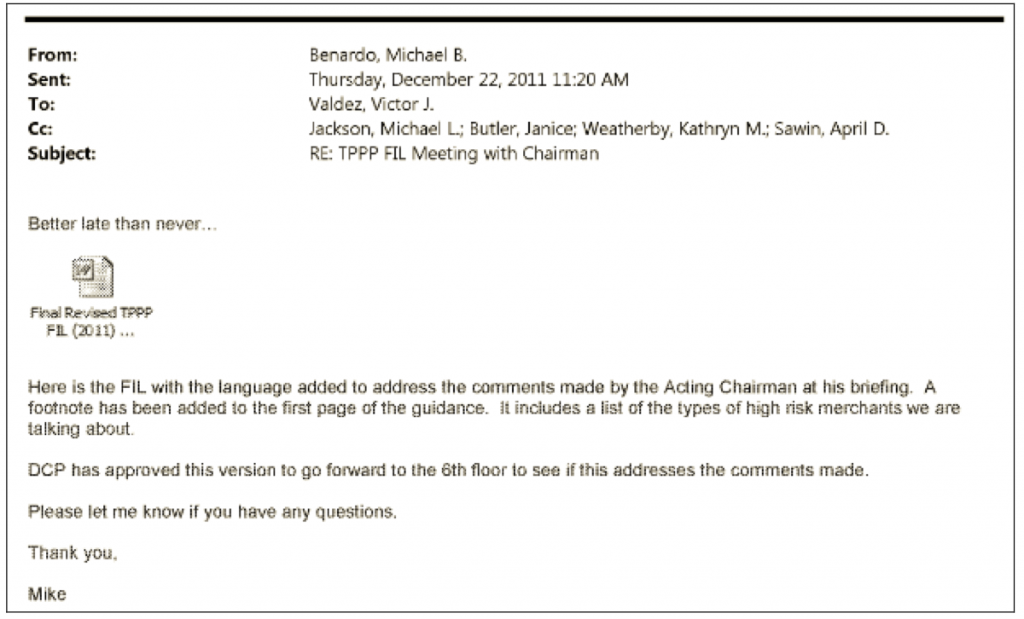

Correspondence between “Chief, Cyber-Fraud and Financial Crimes Section, Div. of Risk Management Supervision,” to the “Deputy Director, Div. of Risk Management Supervision, FDICHOGR00002183,” about the list of targeted “high risk” industries:

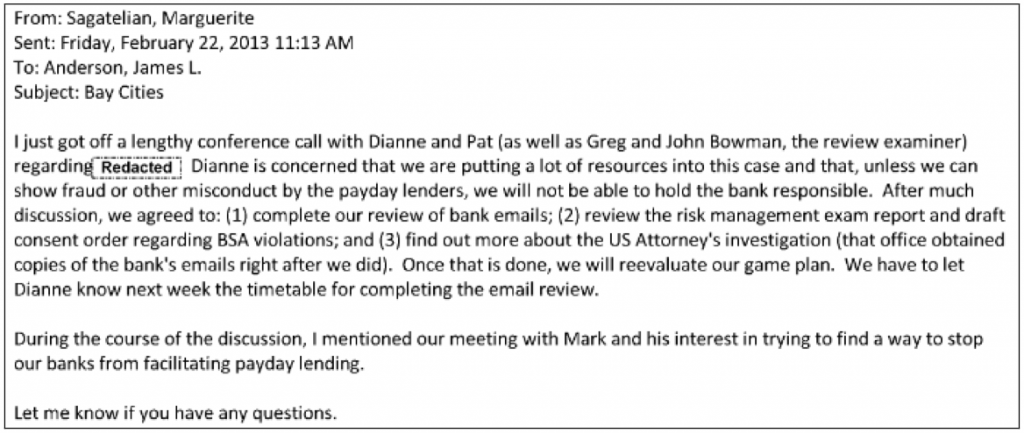

Email from Marguerite Sagatelian, senior counsel, Consumer Enforcement Unit, FDIC to James L. Anderson, assistant general counsel, Consumer Section, Consumer, Enforcement/Employment, Insurance & Legislation Branch, FDIC:

Email from David Barr, assistant director, Office of Public Affairs, FDIC to Mark Pearce, director, Division of Depositor and Consumer Protection, FDIC:

Emails between Thomas J. Dujenski, regional director, Atlanta, FDIC, and Mark Pearce, director, Division of Consumer Protection, FDIC:

One Reply to “These 7 Revealing Emails Show Federal Officials Scheming to Target Legal Businesses”