A longtime head of the Federal Reserve and prominent voice in economics has come out in opposition to a much more controversial government bank that is locked in a reauthorization fight.

Alan Greenspan, who served as Federal Reserve chairman under four presidents, told The Hill that “as an economist” he doesn’t support reauthorization of the Export-Import Bank, an 80-year-old federal agency.

However, Greenspan added, if he were a politician up for re-election this year, “I might.”

“The Export-Import Bank is fundamentally a subsidy for American exporters,” he said, adding:

But the other question you have to ask is, ‘Does international competition and global economic activity do better if no country subsidizes its exports?’ My answer is yes.

The Ex-Im Bank bank provides taxpayer-backed loans and loan guarantees to foreign countries and companies to purchase U.S. exports.

Lawmakers in the House made Ex-Im the center of debate over the last several months, as its charter was set to expire Sept. 30. However, the House passed a continuing resolution to fund the government yesterday that included a reauthorization of the bank until June 30.

The Senate could vote on the measure as early as this afternoon, but it is unknown whether the Democrat-controlled chamber will pass the continuing resolution with Ex-Im’s short-term reauthorization or attempt to extend the bank’s life beyond next summer.

>>> Politically Connected: Ties Link Embattled Government Bank, Well-Heeled Consultants

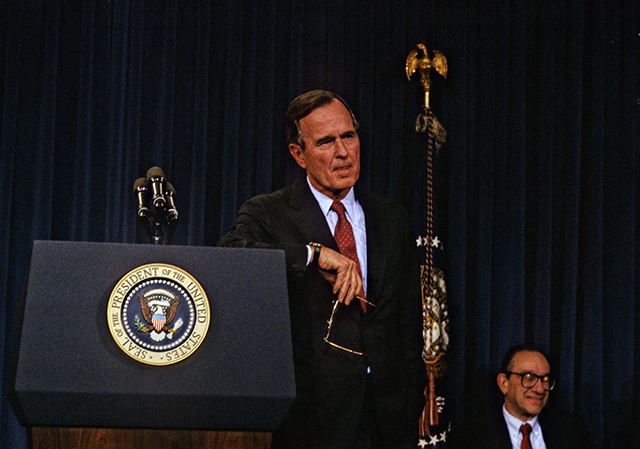

Alan Greenspan (in background) served as Federal Reserve chairman under four presidents, including George H.W. Bush. (Photo: Ron Sachs/Newscom)

Greenspan joins a list of Ex-Im opponents who range from self-described progressives such as pioneering consumer advocate Ralph Nader and Rep. Alan Grayson, D-Fla., to House conservatives such as Financial Services Chairman Jeb Hensarling, R-Texas, and Budget Chairman Paul Ryan, R-Wis.

President Obama opposed the bank as a senator in 2008, calling it “a fund for corporate welfare,” but supported the agency’s reauthorization two years ago and came out in support of it again this year.

Advocates argue that the New Deal-era agency helps small businesses compete in the global market and creates jobs at home. Obama and other proponents such as Sen. Lindsey Graham, R-S.C., contend that because other nations operate government-run export credit agencies, the United States would be at a competitive disadvantage if Ex-Im were to be shuttered.

However, the agency’s foes, led by Hensarling, argue that it is an engine for corporate welfare and cronyism, helping politically connected corporations such as Boeing, Caterpillar and General Electric.

>>> Main House Foe of Export-Import Bank ‘Swallows Hard’ at 9-Month Reprieve

Greenspan, first appointed to head the Federal Reserve by President Ronald Reagan, said that eliminating export subsidies would boost the global economy, but noted that politics often trump good policy. He told The Hill:

There is just no doubt that, from a political perspective, all that is visible is the immediate subsidy advantage. Foreign competition’s response is never considered. In politics, it’s the short term that regrettably sets policy, and that is what accounts for an overwhelming backing of the Export-Import Bank.