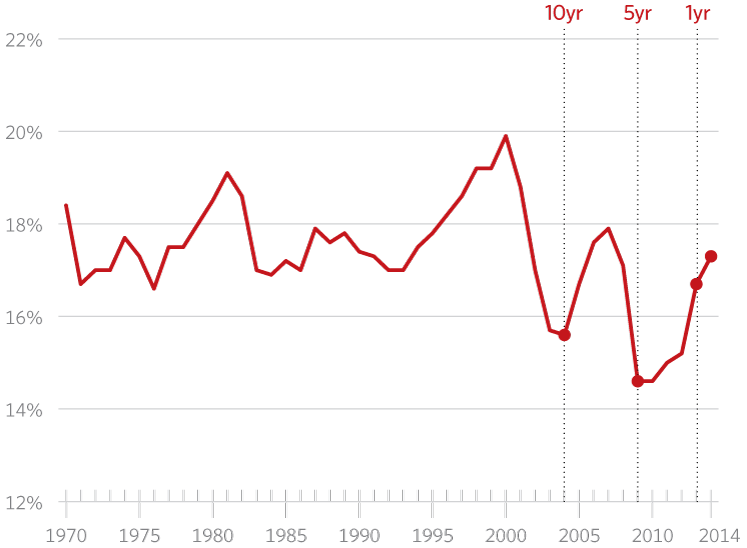

We talk about taxes as a “burden” because they reduce the take-home pay of American workers, the profits of American businesses, and the purchasing power of American consumers. Over the past century, the overall federal tax burden steadily grew from about 5 percent of national income to almost 20 percent. Over the last decade, tax receipts declined due to the recession and fiscal policy, but taxes have increased over the last five years. This trend roughly corresponds with the growth in government spending.

>>> For more articles like this, check out 2014 Index of Culture and Opportunity.

Americans effectively work one day a week to pay federal taxes and the other four days to pay their bills and take care of their families. Taking into account state and local taxes, almost one in three dollars of a worker’s earnings go to the tax collector. Taxes are, for many households, the single largest expenditure item in the family budget.

Nor is the federal tax burden evenly spread. The wealthy pay the largest share of their income in taxes, while the bottom 20 percent of earners pay very little federal tax. You would not know it from media reporting, but the U.S. has one of the world’s most progressive income tax structures—the richest 1 percent pay almost 40 percent of federal income taxes.

The income tax burden is also borne in the invisible tax of lost productivity and output. When you tax something, you get less of it, and the federal tax code punishes saving, investment and business creation. Our byzantine income tax code has not been modernized since the mid-1980s. Pursuing economic success is like trying to win the Indianapolis 500 in a Pinto. Tax rates are too high and confiscatory, tax loopholes are too plentiful, and complexity makes the tax code an economic drain.

Tax burdens are likely to continue climbing if we do not rein in our rapidly growing debt. Without government spending reductions, taxes will likely rise. Some experts believe rates could rise to 50 percent or more on “the rich.” Such crushing taxes will indebt future generations—hardly the financial legacy Americans want to leave their children and grandchildren.