Saying that something helps small businesses is a great way to gain public support for your cause. Except when it’s not true.

Take, for example, claims about the government-run Export-Import Bank, which subsidizes U.S. exports by providing discount loans to foreign governments and businesses to purchase American goods. According to bank Chairman Fred Hochberg: “Helping small businesses…grow and compete on the global stage is at the heart of the Bank’s mission.”

Boosting the fortunes of mom-and-pop businesses certainly sounds noble — and much more likely to win support from Congress. But the real beneficiaries aren’t exactly what most people would consider “small.”

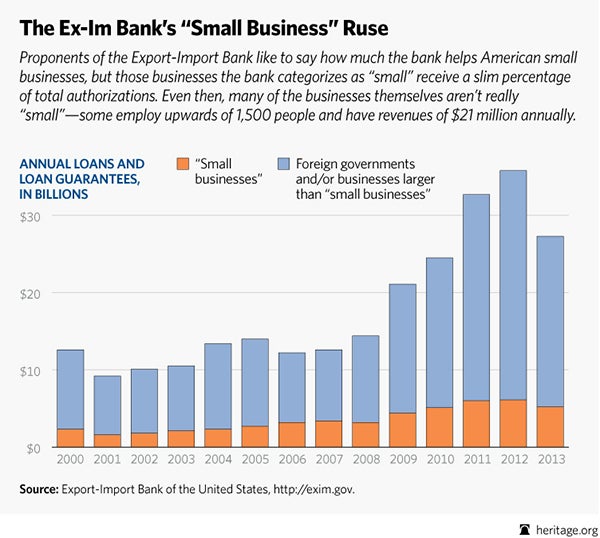

Under the bank definition, a small business can employ up to 1,500 people and pull in revenues of up to $21 million annually, depending on which sector of the economy it’s in. And even by that definition, the vast majority of subsidized financing goes to major corporations rather than “small” entities:

Who’s really getting the money? Heritage expert Diane Katz reveals:

Multinational corporations attract the largest proportion of Ex–Im financing, including the construction and engineering firm of Bechtel, ranked by Forbes as the fourth-largest privately held company by revenue, and Lockheed Martin, valued in excess of $50 billion. But the bank’s foremost beneficiary is Boeing, the world’s largest aerospace company (with a market capitalization exceeding $91 billion). In the past five years, the company has profited from 197 Ex–Im deals totaling $48 billion. Last year alone, Boeing-related financing comprised 30 percent of all Ex–Im activity.

The loan recipients who purchase exports from the titans of industry are mainly foreign governments and foreign businesses. Check out this map to see some of the unfriendly nations where U.S. taxpayer dollars are at risk.

Yet a coalition of business groups, including the U.S. Chamber of Commerce and the National Association of Manufacturers, claimed in recent years that “(S)mall businesses account for 87 percent of Ex-Im’s transactions.”

How is this possible? Katz explains: “‘Transactions’ actually means the number of applications they process, not the amount of financing provided.”

“It is an attempt to deceive Congress and the public,” Katz says. “Simply put, they have provided a small amount of financing to a lot of relatively smaller firms — but the lion’s share of the money goes to a few multinational entities.”

Read the Morning Bell and more en español every day at Heritage Libertad.

Quick Hits:

- What does an AT&T merger with DirecTV mean for consumers?

- Is the debate about Obamacare over? See if you agree with the majority of voters here.

- It looks like at least this push for amnesty in immigration policy won’t make it through the House.

- Here’s what Indiana Gov. Mike Pence has to say about expanding Medicaid in his state.

- The federal government hasn’t improved education – so maybe it’s time to try something else.

- President George W. Bush lost one of his beloved dogs who lived in the White House. See photos of Miss Beazley.