While the budget has received relatively little attention since February, one misleading headline has made the rounds: “US on Track for Narrowest Budget Gap Since 2008.”

The deeply troubling reality is that current levels of deficits and debt tell us only so much about the U.S. budget situation. The real fiscal gap is getting bigger each and every year that lawmakers fail to enact structural budget reforms.

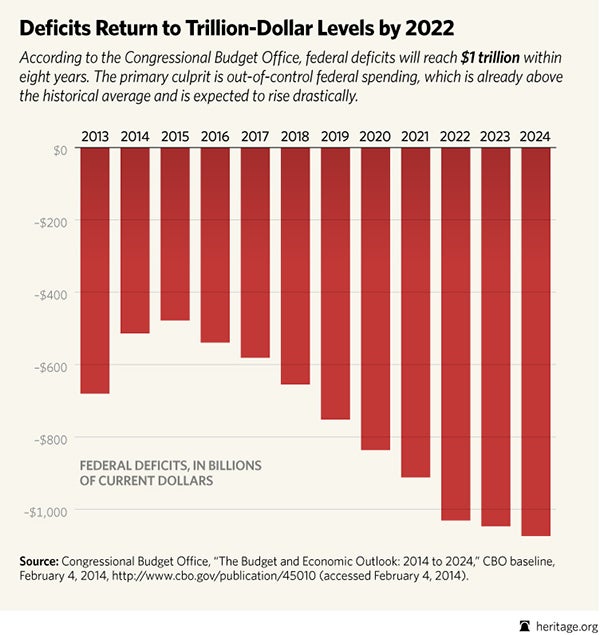

The Congressional Budget Office (CBO) projects the deficit to reach its lowest point since before the U.S. recession at $492 billion—or slightly less than half-a-trillion dollars—in 2014. But the annual deficit figure only tells us about the cash-flow shortfall in the U.S. budget in one year. Each year’s deficit adds to the mountain of current debt, which, according to the Treasury Department, is nearing $17.5 trillion.

This debt measure consists of $12.5 trillion in publicly held debt (borrowed from credit markets) and $5 trillion in intragovernmental holdings—borrowing from other federal agencies such as Social Security.

Suddenly, a half-trillion dollar deficit in 2014 looks a lot worse. This is also the last year in which the CBO projects deficits will decline. It’s all downhill from here.

The drivers of growing deficits and debt in the future are unfunded entitlement programs that transfer—by design—resources from younger, working generations to older, retired generations. Economist Philip Booth describes this problem as “arguably one of the most important issues of our time”:

In modern democracies people of voting age have voted themselves benefits to be paid for, not by sacrifices that they make through funded provision, but by sacrifices that will be made by the next generation of tax payers, who may not have even been born when the benefits were promised.

Economist Jagadeesh Gokhale in a report for the Institute of Economic Affairs lays out a detailed account of the pension and health care commitments the U.S. government has made but are missing from official government budget figures. Gokhale argues that once these commitments are accounted for, the total national debt held by the public is nearly $95 trillion—more than seven times the published figure.

When the debt limit suspension expires in March, lawmakers should not sign another blank check but enact responsible structural reforms to the budget. Prudent lawmakers would begin to educate the public about the choices the nation faces now. The future depends on it.