Which taxpayers experience the greatest tax burden—and who pays the most in taxes?

As Americans navigated the labyrinthine tax code ahead of tax day, many felt the sting of the President’s myriad tax increases.

As Americans navigated the labyrinthine tax code ahead of tax day, many felt the sting of the President’s myriad tax increases.

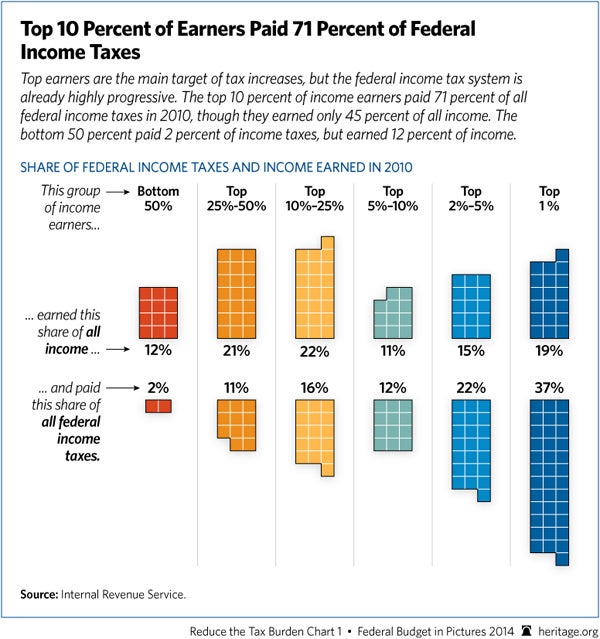

Despite calls for more taxes on the rich, the Heritage chart shown above reveals that the recent tax increases disproportionately affect the working wealthy. The top 10 percent of all income earners paid 71 percent of federal income taxes in 2010, yet they earned 45 percent of all federal income. Compare that to the bottom 50 percent of earners, who earn 12 percent of income yet pay only 2 percent of federal income taxes.

So when Obama and advocates of higher federal taxes opine that the rich do not pay their “fair share,” they are correct—affluent income-earners pay a whole lot more than they would pay if we had a proportional tax code instead of the highly progressive one we have today.

While taxes have increased for most taxpayers, the wealthy are—relative to the rest of the population—increasingly shouldering the federal tax burden. The Wall Street Journal’s John McKinnon notes that this burden has shifted largely as a result of the tax changes passed at the start of 2013 during the fiscal cliff debates. These changes include a “bump in the top ordinary income rate to 39.6% from 35%, a limit on itemized deductions and an increase in the top rate on investment income.”

But the tax misery is not limited only to the well-to-do. All taxpayers faced an average tax increase of 1.8 percent in 2013. Indeed, Heritage tax expert Curtis Dubay uncovered no less than 13 tax increases that kicked in at the beginning of the year, six of which came on the coattails of Obamacare. Taxpayers also face state and local tax burdens that remain high in much of the country, as well as the prospect of rising payroll taxes in the future.

In addition to stifling economic growth, many of these new taxes—especially those on income—penalize success and discourage work. As Dubay has written, it is imperative to reform the tax code because families would be able to earn more, “but would not pay higher marginal tax rates on their higher earnings. The tax code would not punish families as it does today for being more successful and for earning higher compensation because they are more productive.”

Reform represents a pro-growth agenda that would encourage work and savings to a far greater extent than the current system, which rewards those who can best exploit the arbitrary breaks in the tax code. If President Obama and Congress were serious about creating a more just and efficient tax code—in which everyone paid his “fair share”—they would reform the tax code, rather than levying more taxes on Americans and further complicating the system with additional rules.