The House Budget Committee will deliver its budget resolution—which would eliminate the deficit within 10 years—ahead of Congress’s statutory deadline of April 15. The Senate, on the other hand, has already announced that it would not bother producing a budget this year, relying instead on the Ryan–Murray budget deal struck in December.

This seals the deal that 2014 will be a year of inaction on reforming the entitlements and putting the budget on a path to balance. The problem is that, the longer lawmakers wait, the more difficult the necessary policy changes will become.

If the Senate’s budget from last year is any indication, imposing a higher tax burden on Americans is acceptable to some in Congress. Congress should instead prevent the federal debt from growing further out of control and harming economic growth in the long term by putting the budget on a path to balance without raising taxes further. Here is a five-point checklist on how to get there:

- Do not raise taxes. Washington does not have a revenue problem; it has a spending problem. The Congressional Budget Office estimates that revenues will be at or above the historical average for the next decade. Focusing on raising taxes again—President Obama has done so several times, including in Obamacare and the fiscal cliff deal—only serves to distract from the real problem of overspending. The top 10 percent of income earners already pay 71 percent of all federal income taxes. More tax hikes would only hurt the economy and American workers by dampening investment and job creation. Only significant reductions in spending will effectively curb debt and deficits.

- Reform entitlement programs. Congress should make much-needed reforms to entitlement programs to provide an affordable safety net. Congress should first repeal Obamacare and replace it with patient-centered, market-based health care. Social Security and Medicare should become true safety net programs and focus assistance on seniors in need. The eligibility age for both programs should match and reflect increases in longevity. Social Security’s cost-of-living adjustment should be based on a more accurate measure of inflation.

- Reduce discretionary spending. Congress can stay below the budget caps agreed to in 2011 by stopping inappropriate and wasteful spending. Subsidies that benefit only a few—such as farm subsidies, energy handouts, and distortive ethanol policies—should cease immediately. The federal government should focus on a limited number of appropriate national duties. States and local governments are better able to meet the needs of local populations in areas such as transportation, education, job training, economic development, and environmental conservation.

- Do not use budget gimmicks. Congress should abstain from abusing disasters, such as Hurricane Sandy, to push through excessive spending. Neither should Congress enact laws that explode in spending outside the 10-year budget window, as Obamacare does.

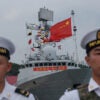

- Do not sacrifice the nation’s security. Defense spending should be based on the nation’s national security strategy and the corresponding military capability requirements. Allowing myopic cuts to reduce military capabilities today risks incurring higher rebuilding costs tomorrow. Congress should responsibly fund defense at adequate levels.

Congress can prudently put the budget on a path to balance without burdening Americans with higher taxes or compromising the nation’s national security. But the window of opportunity is closing quickly.