When President Franklin D. Roosevelt signed Social Security into law on August 14, 1935, he referred to it as “a law which will give some measure of protection to the average citizen and to his family against the loss of a job and against poverty-ridden old age.” But today’s Social Security is an entirely different thing.

It fails to protect too many seniors from poverty, while threatening younger generations with punitive tax rates or massive cuts to promised benefits—hurting their opportunities and means of building financial security. The program needs a major overhaul. (continues below chart)

Here are three problems with Social Security:

1. The trust fund is a liability.

The $2.7 trillion in IOUs counted in the Social Security trust fund are part of the $16.7 trillion national debt. Congress immediately spent the surpluses Social Security collected from workers and counted on taxpayers to pay off this debt in the future. Even though Social Security is considered solvent through 2033, it is only so on paper.

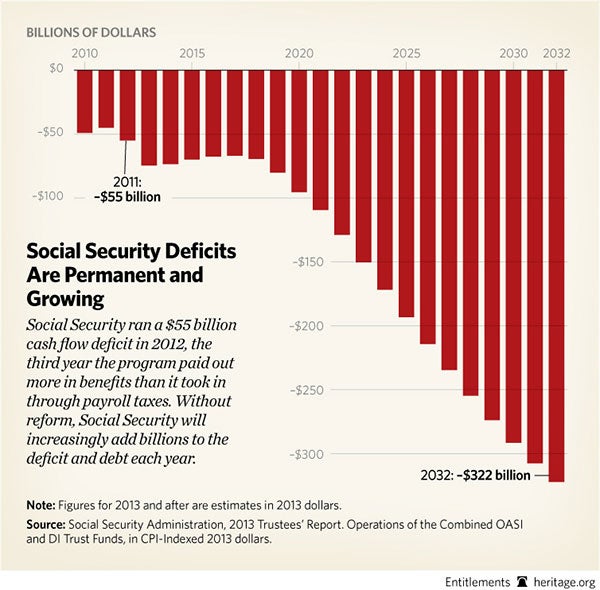

2. The program is already running chronic and growing deficits.

Social Security has been running cash flow deficits since 2010, and the gap between what Social Security pays out in benefits and what it collects through its 12.4 percent payroll tax is only growing. The difference is paid for by general revenues or borrowing, imposing a large and growing burden on the federal budget.

3. Seniors remain in poverty while the wealthy get benefits.

There are about 9 million seniors left in poverty despite the program, while more than 47,000 millionaires get Social Security benefits, regardless of need. A flat benefit that focuses benefits to eligible seniors who need them most and phases them out for wealthier retirees would return Social Security to its original purpose of providing protection “against poverty-ridden old age.”

To reform the program, lawmakers should immediately: 1) Replace the current COLA adjustment with the more accurate chained CPI; 2) Raise the early and full-retirement ages gradually and predictably and index both to longevity; and 3) Focus Social Security benefits on those who need them most and alleviate poverty in old age with a minimum flat benefit.